Young, Wealthy Hybrid Investors Are Coming, McKinsey Report Says

High-net-worth investors are increasingly digital, already doing it themselves on digital platforms and increasingly looking at advisors to catch up, according to a recent McKinsey report.

“To thrive in this dynamic environment, firms must prioritize growth, adopt an innovation mindset, and be prepared to reallocate resources rapidly in response to the changing context,” according to McKinsey’s “U.S. Wealth Management: A growth agenda for the coming decade.”

The report’s authors suggested that firms might be complacent in innovation because last year looked good on the surface, but perilous conditions are streaming underneath.

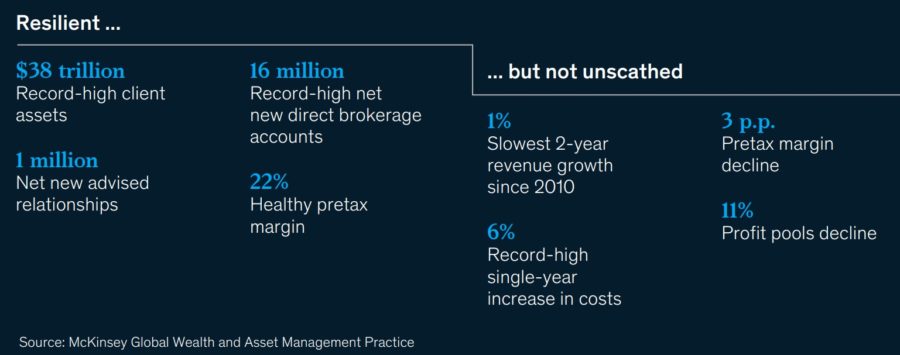

“At face value, the US wealth management industry entered 2021 from a position of strength — record-high client assets, record growth in the number of self-directed and advised clients, and healthy pretax margins,” the report said. “However, beneath these strong headline numbers, the story was mixed, with the worst two-year revenue growth since 2010, as well as negative operating leverage.”

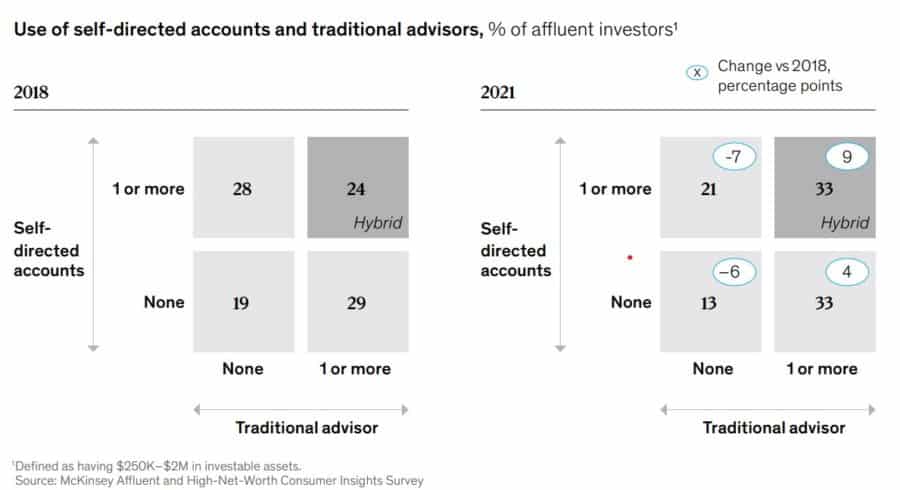

Another important factor is the source of growth in young, wealthier investors who represent the future for financial advisors. More often, those investors tend to want actual humans advising them but they are also already dabbling in their own investing on digital platforms.

Since the start of 2020, more than 25 million new direct brokerage accounts have been opened, a 40% increase. Advisors might write off hybrid investors as first-timers with low assets, but that group includes some big accounts. In 2021, hybrid investors accounted for a third of affluent investor households with more than $250,000 and less than $2 million in investable assets, an increase of nine percentage points in three years.

The report cited two trends propelling wealthy hybrid investors, the ease of direct investing and the desire for human advice. They winners in the advising world will be those that incorporate the two.

“To foster deep relationships with affluent clients and prevent them from investing with competitors, wealth managers of all types need to have both direct brokerage and advisor-led offerings with a seamlessly integrated experience across the two,” the report showed. “Achieving this will not be easy; it will require careful management of channel conflicts and potential revenue cannibalization.”

It is critical across the board, not just with younger investors: “Omnichannel access is no longer just ‘nice to have.’ One of the clearest disruptions triggered by the pandemic has been the sharp acceleration of digital adoption across consumer segments — including wealthier and older clients who were previously less digitally inclined with respect to financial advice.”

Along with incumbent and new direct brokerages, some traditional wealth managers with sizable direct brokerage platforms have been leading the way.

In annual growth:

20% Digital advice models (robo, hybrid)

10% Registered investment advisors

6% National/regional broker-dealers

5% direct brokerages

2% wirehouses and other B-Ds

1% private banks

In a bright aside for a few of the entities at the bottom of the list, they stand to benefit if interest rates return to prepandemic levels: “Wirehouses and direct brokerages will disproportionately benefit, given their reliance on interest income from cash for profitability, with the overall growth rate for the industry reaching about 7 percent a year — similar to the growth that occurred between 2015 and 2018.”

4 R’s For The Future

The report’s writers offered a four-part agenda for navigating change, reposition, redesign, reimagine and reallocate.

REPOSITION: Wealth managers need to understand their own strengths and weaknesses to concentrate on growth areas, such as improving digital platforms. But lacking the resources, M&A is a growing opportunity. “The last 24 months have seen numerous high-profile transactions as firms seek scale and/or the acquisition of new capabilities to accelerate their strategy,” according to the report. “We expect M&A to be a particularly important theme over the next 24 months as wealth managers reposition themselves for the postpandemic ‘next normal.’”

REDESIGN: Firms also should survey their clients to understand their needs, and redesign their offerings to anticipate evolving client needs. “Examples could include new value propositions (for instance, around tax efficiency, integration of wealth and banking, or specific high-growth segments), privileged access to new products (such as digital assets or private markets), or completely new business models (for example, light-guidance digital offerings).”

REIMAGINE: Client expectations have changed, especially around digital access, and will likely accelerate, so a rethink of the client experience is in order. “Every wealth manager needs to ask, ‘What is the blueprint for a client experience model in a digital-first world?’ and ‘How can such a model simultaneously deepen our relationships and broaden our reach?’”

REALLOCATE: As indicated in the first “R,” resources will be important in this next phase, and wealth managers suld not be afraid to spend where its needed. Regularly reallocating resources is often neglected, but necessary. “Successful wealth management firms make a bold commitment to putting the money where the strategy is, and they make multiyear resource-reallocation decisions, including where firm’s top talent spends time, in favor of growth. “

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Pandemic Has Consumers Looking For LTCi Policies, Exec Says

3 Tips To Refine Your Client Base For Deeper Relationships

Advisor News

- Nationwide Financial Services President John Carter to retire at year end

- FINRA, FBI warn about generative AI and finances

- Prudential study: Babies born today will likely need nearly $2M to retire

- Economy performing better than expected, Morningstar says

- Advisors have more optimism post-election

More Advisor NewsAnnuity News

- Prudential Financial to Reinsure $7B Japanese Whole Life Block with Prismic Life

- Nationwide Financial Services President John Carter to retire at year end

- Pension Rights Center: PRT deals could lead to ‘nationwide catastrophe’ regulated

- Allianz Life Retirement Solutions Now Available Through Morgan Stanley

- Midland Advisory Focused on Growing Registered Investment Advisor Channel Presence

More Annuity NewsHealth/Employee Benefits News

- 'We Have No Intention to Increase Premiums'

- UnitedHealth gave hackers easy access to Change data, new lawsuit claims

- Demand for ACA health insurance plans soars to record high in WA

- Colorado plans to limit coverage of weight-loss drugs like Wegovy for state employees to save $17M

- Insider named as new CEO for UnitedHealthcare insurance business

More Health/Employee Benefits NewsLife Insurance News

- Prudential Financial and Dai-ichi Life to Pursue Strategic Partnership

- AM Best Removes From Under Review With Positive Implications and Upgrades Credit Ratings of ShelterPoint Insurance Company and ShelterPoint Life Insurance Company

- Prudential inks $7 billion reinsurance deal with Bermuda-based reinsurer

- Securian Financial Announces Chief Financial Officer Transition

- Voya launches innovative new permanent life insurance offering through the workplace

More Life Insurance News