Young, brash and wrong: FINRA study profiles investing risks

Fun and trendy is in with investors as they skew younger – and stodgy is dodgy, according to the latest FINRA investor study.

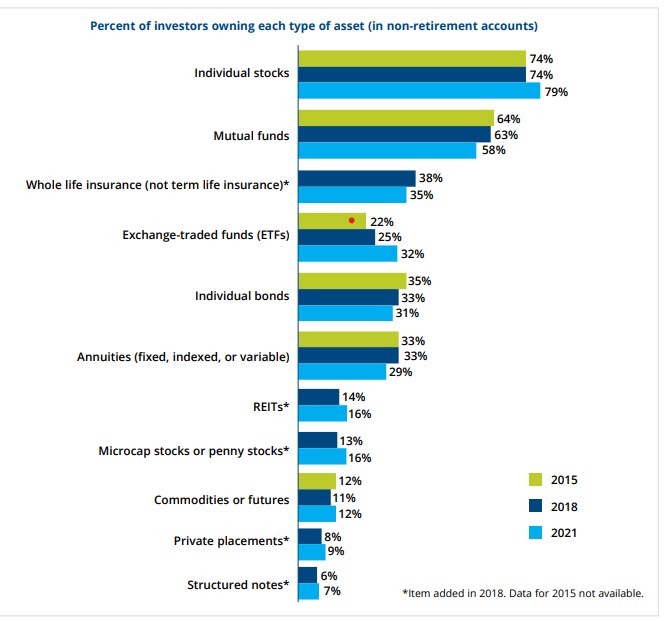

In a survey taken last year, investors were putting more of their money into individual stocks and ETFs and less into insurance products.

Besides stocks and ETFs, investors were moving money into REITs, penny stocks and other riskier bets. Whole life dropped from 38% in 2018 to 35% in 2021 (only two years available). Annuities dropped from 33% in 2015 and 2018 to 29% in 2021. Another safer investment, individual bonds slipped from 35% in 2015, 22% in 2018 to 29% in 2021.

Maybe whole life needs a meme? The goofy cartoons were a minor feature of the investment world last year as moribund companies such as AMC and GameStop took off out of Reddit investment groups. The FINRA National Financial Capability Study surveyed 27,118 people state by state and then the Investor Survey focused in 2021 on 2,824 people with investments outside retirement accounts.

Back then, 18% of investors said they bought GameStop, AMC or Blackberry. Those purchases came from younger investors, who were also more likely to make risky investments, buy on margin, trade on mobile apps and look to social media for guidance. Basically, they were having fun with it. And, of course, they showed little investor knowledge. More than half (56%) of people who recently opened an investment account had less than two years of investment experience.

“Findings reveal a new generation of younger and less experienced investors that is vastly different from older generations in their investment behaviors and attitudes,” according to the report. “Younger investors are more likely than older investors to be investing for reasons other than long-term gains, such as social responsibility, entertainment, or social activity.”

The authors pointed out that the new investors might be less equipped to handle a shock. And a shock is indeed what happened this year with the bear market, but indicators show that younger people are still getting into the game. For example, even though Fidelity Investments’ asset levels fell in its third quarter report, young investors opened almost half of the firm’s new accounts, according to Barron’s.

“Retail accounts increased 11% to 35.6 million, thanks in part to young investors opening new accounts and growth among registered investment advisory and other firms who use Fidelity’s clearing and custody services,” Barron’s reported.

Who they are

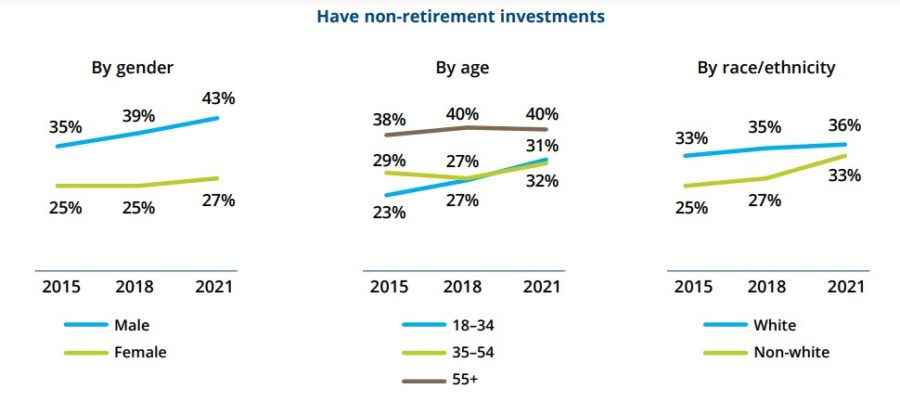

The FINRA survey showed a substantial number of investors jumped in recently, with 21% starting in the previous two years and 25% the previous eight. Of the general investor population, a growing number had non-retirement investments, increasing to 35% in 2021, up from 30% in 2015 and 32% in 2018.

Younger, non-white and mostly male investors were key in that increase.

“The proportion of investors increased by nine percentage points among those under 35, and eight percentage points among respondents who do not identify as white, while remaining fairly steady among those 35 and older and among white respondents,” according to the report.

The new investors were far more likely to own individual stocks, with 84% of those with fewer than two years’ experience saying they owned stocks vs. 35% owning mutual funds. The other groups had much closer percentages.

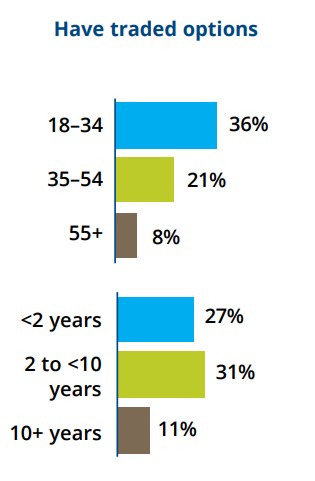

Even though the younger investors tended to know less about investing, they were far more likely to have traded in the risky game of options.

Before the crypto winter set in, younger investors were also far more likely to put money in digital currencies. Almost all investors knew of crypto, with 88% professing awareness, and 27% were in the game, with another 33% thinking about it. That of course skews younger too, as 53% of 18-34 year-olds had crypto, while 33% of the 25-54 and 7% of the 55+ groups held some. The percentages were similar for length of experience, 54% for under two years, 38% for 2-10 and 12% for more than 10. Younger investors also saw crypto as less risky.

The profile also held for meme stocks, the ones promoted in Reddit and other social media in pump-up campaigns – 39% of those 18-34 years old said they bought AMC, GameStop or Blackberry, vs. 19% 35-54 and 4% 55+.

Young, brash – and wrong

Just before stocks slumped, people were feeling bullish, with 29% expecting that the market would average at least 10% annually over the next 10 years, up from 24% in 2018, while 36% expected a more reasonable 5-9.9%, down from 36% in 2018.

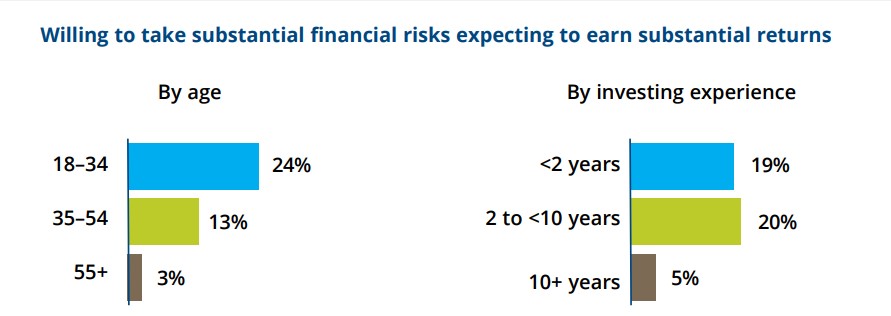

Unsurprisingly, younger men tended to think their portfolio would outperform the market. Also younger, inexperienced investors were far more willing to take risks.

Almost all investors said they were investing to make money in the long term, but younger ones also wanting short-term gains. Of the 18-34 year-olds, 94% said they wanted long-term money and 83% said they wanted short-term gains, a departure from the other age groups. More than half (58%) said they were investing because their peers were doing it or to socialize, another departure.

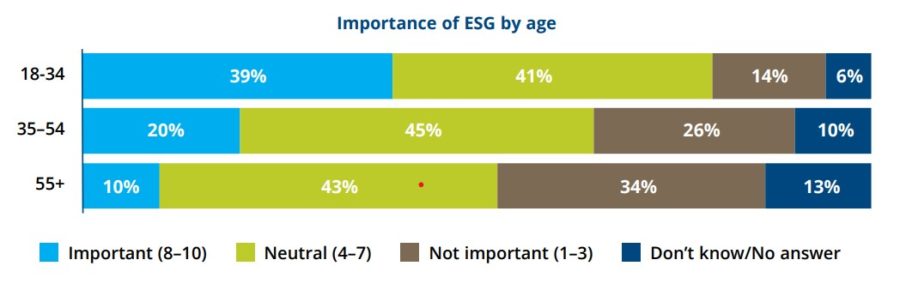

Environmental, social and governance investing exposed another dramatic division in the age groups.

“The perceived importance of ESG was negatively correlated with age,” according to the report. “Roughly two in five investors under 35 considered ESG important in investment decisions, compared to one in five investors ages 35 to 54, and one in 10 investors 55 and older.”

Given the emphasis on social connection, it might not be surprising that the youngest cohort trusts social media as much as financial professionals and sought information from a variety of sources. And although Reddit grabbed much of the headlines last year during the meme stock run-up, YouTube was actually the No. 1 source as 28% used it, with Reddit a distant second at 17%.

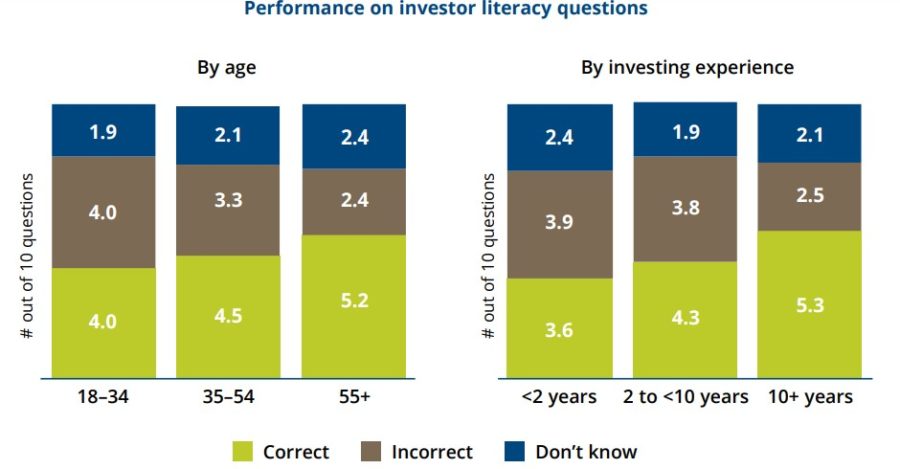

When it came to the investor quiz, the younger folks lived up to adage of knowing just enough to be dangerous.

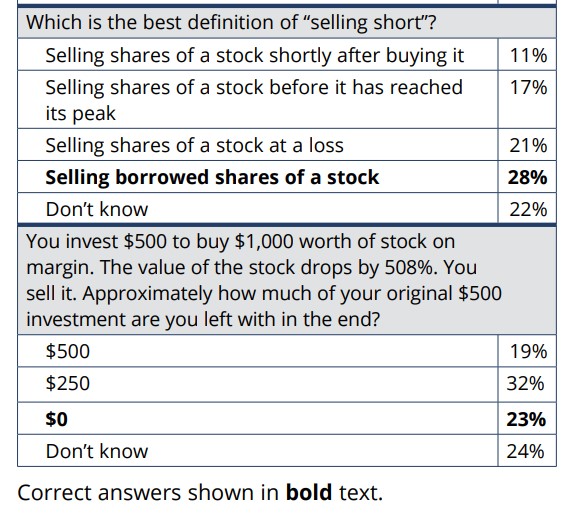

The 10-question quiz had two questions on short selling and buying on margin, both of which had the most incorrect answers.

Not only did the margin question receive the largest percentage of incorrect answers, but a lot of people who bought on margin got it wrong. Of those who have bought on margin, 76% answered the margin question incorrectly.

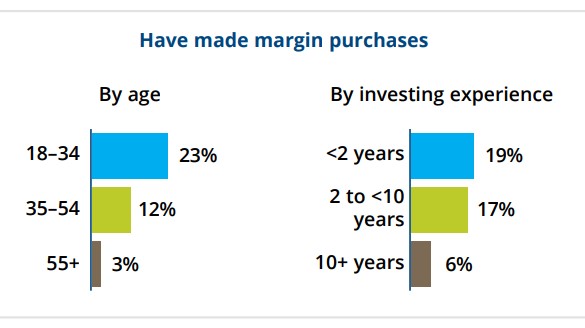

Astute readers might have already guessed who tended to buy on margin – by a good stretch it was the young ones.

The quiz included a bonus question on call options, with similar results. Investors who have traded options were much more likely to answer incorrectly, 62% vs. 39% of all investors.

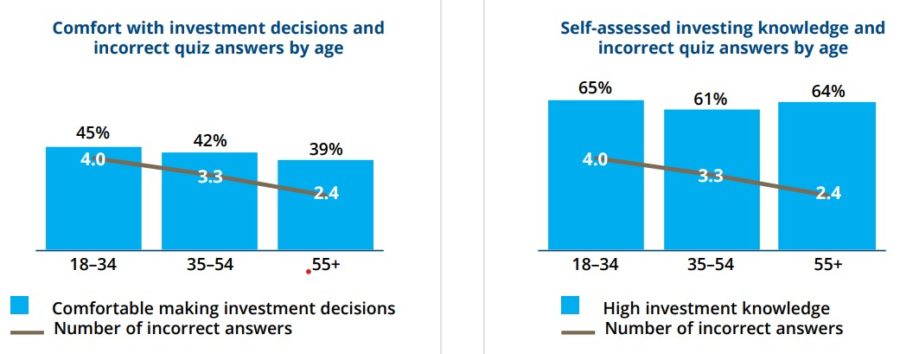

The number of wrong answers correlated with age and experience.

And in another example of the Dunning-Kruger effect of being arrogant about ignorance, confidence and ineptitude seemed to go hand in hand.

“As the markets evolve,” the authors wrote, “it will be imperative for policy makers, regulators and educators to rethink the tools and channels they use to educate and protect both long-time investors and the rising generation of new investors.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

How to talk to teens and adult children about life insurance

Growing storm intensity, EV insurance top 2022’s P&C reporting

Advisor News

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

- How OBBBA is a once-in-a-career window

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

- How the life insurance industry can reach the social media generations

- Judge rules against loosening receivership over Greg Lindberg finances

More Life Insurance News