Will lower interest rates cut into fixed deferred annuity sales?

Although annuity sales are still seeing record highs, investor interest may eventually shift away from fixed-rate deferred annuities and towards other annuities products that have more growth potential if the Federal Reserve cuts interest rates as expected, according to industry experts such as LIMRA.

Fixed-rate deferred annuity products sales are strongly leading the pack and experts expect that trend will likely continue for some time. However, Bryan Hodges, LIMRA head of research, said lower interest rates also mean lower interest rates on products like fixed deferred annuities. This may make them “a little bit less attractive” to investors, he said.

“I think what you'll see is still a strong fixed-rate deferred annuity year of sales, but you'll see a pivot into some of the other annuity products that are designed for a little bit more growth,” Hodges said. “They have a little bit more market participation, opportunities for more growth on the upside, and you may see a shift there as a result.”

Record-high annuity sales

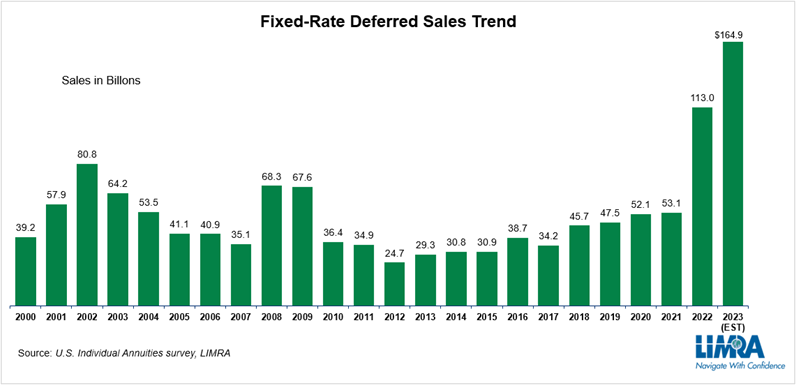

According to LIMRA’s data, annuity sales have skyrocketed over the last two years. FRD annuity sales in particular have tripled during that time, reaching their highest figure ever.

Preliminary results of LIMRA’s 2023 U.S. Individual Annuity Sales Survey indicate total sales reached $385 billion. This is more than 20% higher than the $313 billion in sales in 2022, which was already a record-high at the time.

Of that amount, $286.2 billion were from fixed annuities products, which is 36% higher than 2022’s sales figures.

On the other hand, variable annuities products hit an all-time low record of $51.4 billion, marking a 17% decrease year-over-year. However, these figures were the exception rather than the norm.

“These last two years, we have seen a tremendous run-up in annuity business,” Hodges said. “You've seen record sales numbers achieved in multiple products, but one in particular is driving a lot of the overall sales, and that has been the fixed-rate deferred annuities.”

Unprecedented FRD annuities growth

FRD annuities sales accounted for around $165 billion of the $385 billion total in 2023, according to LIMRA’s preliminary records.

Hodges said this marks “unprecedented growth” in FRD annuities, where their sales figures don’t usually exceed $50 billion.

“So, you go from $35 to $50 billion year after year, kind of that range for a decade,” he said. “We have a record year in 2022 of $113 billion, only to have interest rates continue to stay high in 2023 and fixed rate deferred annuities continue to drive even higher with $165 billion in sales in 2023. That is a sort of unprecedented growth during that time.”

Interest rates, inflation, market drove activity

High interest rates, volatile markets, inflation and recession fears have been the primary drivers for unusually high annuities sales.

“Equity markets, in general, were having a lot of volatility over the last several years,” Hodges said. “Now, overlap that with interest rates. Interest rates started to really take off in 2022, and we hadn't seen rates this high in over 15 years.”

At the same time, research from the Insured Retirement Institute found that more investors sought to prioritize asset protection over maximizing growth, finding a possible solution in annuities products.

LIMRA’s data seems to support those findings. Hodges stated that market conditions led investors to seek products that could provide some measure of protection.

“You have consumers that are looking at it and saying, ‘I sort of want protection. I want to take a look at where I can invest some of my money into products that are not going to be affected by this volatility, and I can take advantage of these really rising interest rates,’” he said. “And so, we saw this big surge in fixed rate deferred annuities as a result.”

Future trends: Shifting interest, sustained growth

While shifting economic conditions will likely shift consumer interest in annuities in the months ahead, sales are still expected to continue trending upwards for the next few years.

LIMRA has forecasted, “with fixed rate deferred annuities in particular [or] any of the annuity products that are really tied to those interest rates directly,” sales might decrease — but only slightly.

“I still think, overall, annuity sales will continue to be strong in the years to come because of the demographics, the need for guaranteed income and so forth,” Hodges said.

Demographics in particular have played a major role in annuities sales. LIMRA research found the average age of an FRD annuity buyer is 62, and annuities products are particularly popular among American seniors.

“You can just overlay the aging population,” Hodges said. “With people living longer, retiring sometimes earlier than the traditional age of 65, this all matches up to say that it will play out with annuities. I think these sales numbers will be sustained in the years to come.”

The role of financial professionals

Hodges suggested that financial advisors, and especially those who offer retirement planning or similar services to seniors, should keep an eye on changing trends as economic conditions begin to stabilize.

For the time being, many consumers are still looking to “de-risk some of their portfolio, particularly as they’re heading into retirement,” he noted.

“As people are approaching retirement, advisors are often looking to help them secure a portion of their assets with a little bit more conservative investment in their portfolio,” Hodges said. “When they have an opportunity to lock in at these high interest rates, it's obviously advantageous for them to do that.”

At the same time, he noted that the number of Americans heading into retirement with pension plans has been declining over the years.

“Research shows that many of this next wave of retirees, over the next 10 years or so, are coming into retirement without a pension plan,” Hodges said. “There's an opportunity for advisors to be positioning annuities as a pension replacement, as a guaranteed income source.”

Overall, he suggested “economic conditions out there today are very favorable” not only for FRD annuities, but for other annuity product lines as well.

LIMRA is one of the largest American trade associations, representing more than 700 members. The final figures of its U.S. Individual Annuity Sales Survey are expected to be published in the coming weeks.

Rayne Morgan is a Content Marketing Manager with PolicyAdvisor.com and a freelance journalist and copywriter.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Rayne Morgan is a journalist, copywriter, and editor with over 10 years' combined experience in digital content and print media. You can reach her at [email protected].

Life insurers report improved mortality; actuaries say nothing’s changed

Financial services careers can take many paths

Advisor News

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

- Does a $1M make you rich? Many millionaires today don’t think so

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- To attract Gen Z, insurance must rewrite its story

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

More Life Insurance News