What If The Market Goes Up? Why An FIA Is Better Than Stocks

By Sean A. Ruggiero

What if the market rebounds in 2019? Let’s say that the S&P 500 rebounds and gains 10 percent back in 2019. Would that make stocks a better retirement income vehicle than a fixed indexed annuity for your clients? Let’s take a look.

Imagine your client had $200,000 to invest in an FIA with a guarantee of zero percent, but with 3.25 percent dedicated toward the purchase of call options on an index such as the S&P 500. How would that stack up against your client investing that same $200,000 in the S&P 500 at the start of 2018?

If your client had invested $200,000 in the S&P 500 at the start of 2018, by the end of the year, their investment would have decreased to $186,000. Assuming a 10-percent gain in the S&P 500 in 2019, your client’s principal balance of $186,600 that carried over from 2018 would gain 10 percent, or $18,600, and would finish 2019 with a balance of $204,600.

Now, the FIA, which never lost principal from negative market returns in 2018, would still be at $200,000 going into 2019. If we assume applying a 60 percent participation rate of the S&P 500 with its hypothetical 10 percent return in 2019, then the FIA would receive a 6 percent interest credit, or $12,000 to its principal balance, raising it to $212,000. This $12,000 interest credit would be a realized gain added to your client’s FIA account value, and would be achieved without having to sell any stocks, bonds or mutual funds and without ever risking any of your principal.

Which is better - having $204,000 or $212,000? Having to time the market right or not having to worry about that? Risking principal to achieve gains or achieving gains without risking principal? Having to worry about which stocks, bonds or funds to sell, or not having to worry about that? For many, the advantages of an FIA become overtly attractive.

FIAs guarantee that the principal will never receive negative interest crediting due to market decline. What do mutual funds guarantee? Many mutual funds only guarantee fees, such as annual expense ratios and 12b-1 fees, but I’ve never seen a mutual fund guarantee that it won’t lose value in a down market.

I’ve personally seen FIAs with annual returns in the 10 to 20 percent range. Although those are not typical, they can happen because of the more exotic indices that are being used for the call options and when the markets are rising, such as what happened in 2017. Furthermore, FIAs can thrive with volatility. If the market is continually going up and down, the FIA has the potential to capture the upside swings without being exposed to the downside losses.

In addition, many of today’s FIAs offer something called “volatility-controlled indexes,” which can do a great job of capturing these swings and smoothing out returns. These proprietary index options can be purchased over the counter, not through the Chicago Board Options Exchange, so they avoid commissions and gain even higher participation for the consumer.

Purchasing an FIA because a client want to see 20 percent gains is folly, and I want to be clear in stating that. But knowing that your client can potentially earn significant interest credits when the market climbs, and not have to worry about when to sell or about risking principal, makes the FIA an extremely valuable financial tool.

Need more good news? Many FIAs will offer something called a premium bonus upon transfer. This is a percentage amount that is credited to the accumulation value when the annuity is funded. I’ve seen crediting bonuses greater than 10 percent, and many in the range of 5 percent. The bonus is credited to the accumulation value upon funding the annuity and it will earn interest starting day one. This bonus can create an excellent opportunity to gain back recent losses in the market.

There are drawbacks to an FIA. The major drawback, as it is with all annuities, is liquidity. Understanding the liquidity restrictions for FIAs is very critical for evaluating if an FIA is right for a particular client.

All annuities require the ability for the annuity company to invest the client’s money for known periods of time. The concept that annuity companies make money with you, not off you, is very true, but in order to do that, they need to know that they can keep the client’s money for a certain period of time. This is accomplished through a surrender charge schedule.

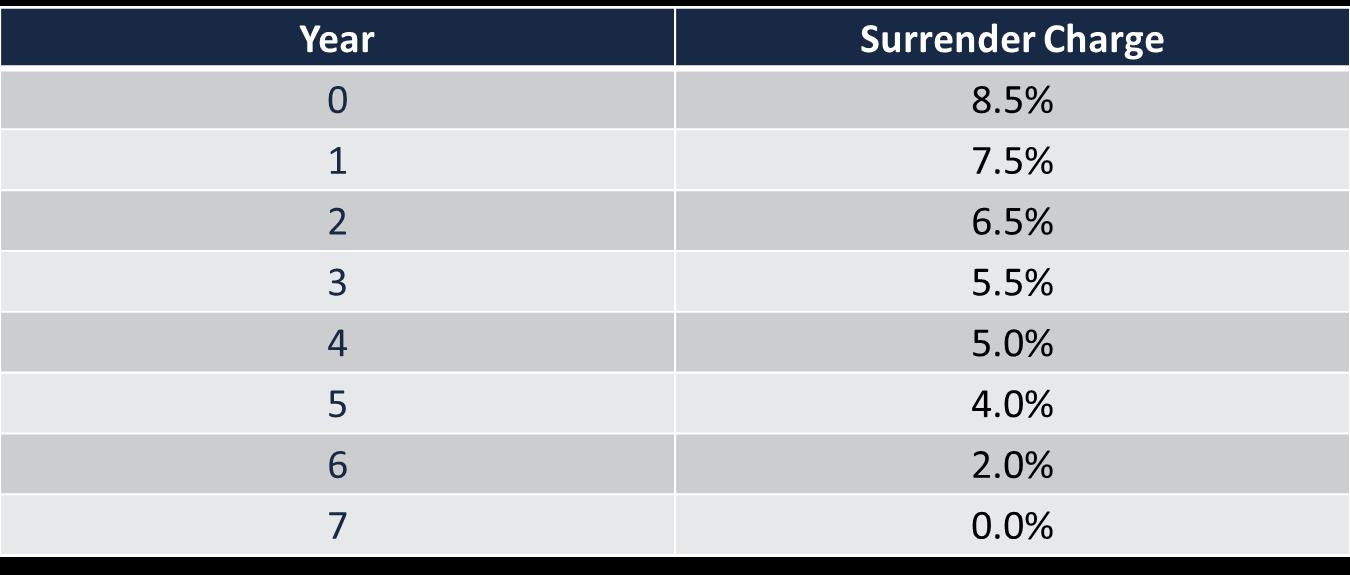

A surrender charge is an amount of penalty, usually a percentage, that will be assessed to the annuity owner if they withdraw more than the allowed amount in any one year. The surrender charge will typically decline from the start of the annuity to the end of the contract, and the length of the period can vary.

Almost all FIAs are named with a number at the end, like “FIA 7” or “FIA 10.” That number usually indicates the length of the contract and the corresponding surrender charge period. Many annuities allow for the annuity owner to withdraw up to 10 percent of the annuity every year, and they will not have any surrender charge on that amount. However, if the annuity owner takes out more than the amount allowed under the annuity contract, the surrender charge will apply.

For example, if your client purchased a 7-year FIA for $100,000 and they were allowed to withdraw 10 percent per year, then they could take out 10 percent of the annuity value every year and have no penalty. In this example, if they had an account value of $100,000 and took out $11,000 ($1,000 over the allowed 10 percent amount), then the last $1,000 would be subjected to the surrender charge.

If this excess was taken out the first year when the surrender charge was 8.5 percent in our example here, then the client would be penalized $85 or 8.5 percent of the last $1,000. If this same scenario was played out in Year 5, when the surrender charge was reduced to 4 percent, they would be penalized $40, not $85.

Keep in mind that most likely, the annuity value will grow over the years, so a 10 percent maximum withdrawal amount in Year 5 would probably be higher than a 10 percent maximum withdrawal amount in Year 1 (assuming they have not been taking out additional amounts throughout the years). This is important when evaluating an FIA for your client’s financial plan.

Does anyone know what 2019 and beyond will bring from the stock market? I certainly don’t, but it’s fair to assume that one of three things will happen. Either the market will continue to go down, stay the same, or maybe go up. Wouldn’t it be nice to remove the foremost of these from the equation? This holds especially true for those who are nearing or are in retirement.

If your client purchases an FIA now, they can receive a premium bonus regardless of what the market does. If the market goes down, your client will lose nothing and will have earned interest with the bonus. With volatility controlled indexes now available in many FIAs, your client could also see gains in a market that goes up and down but doesn’t gain any ground.

If the market goes up, your client’s FIA will capture those gains too, not as sales of shares, but as tax-deferred interest credits to their annuity value. How much better will they sleep knowing that you will be exposed to only one of these three outcomes? When we take that into account, you can see why I say now is the time for your client to buy an FIA.

Sean A. Ruggiero is president and founder of SafeMoneySmart.org, a nonprofit that advocates for alternatives to the stock market in retirement. Sean may be contacted at [email protected].

© Entire contents copyright 2019 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Partners Advantage Acquired By Arthur Gallagher

Customers Are Taking Control Of Financial Services

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Higher premiums, Medicare updates: Healthcare changes to expect in 2026

- Wellmark still worries over lowered projections of Iowa tax hike

- Trump’s Medicaid work mandate could kick thousands of homeless Californians off coverage

- CONSUMER ALERT: TDCI, AG'S OFFICE WARN CONSUMERS ABOUT PURCHASING INSURANCE POLICIES FROM LIFEX RESEARCH CORPORATION

- REP. LAUREN BOEBERT INTRODUCES THE NO FEDERAL TAXPAYER DOLLARS FOR ILLEGAL ALIENS HEALTH INSURANCE ACT

More Health/Employee Benefits NewsLife Insurance News

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

- NAIFA and Brokers Ireland launch global partnership

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- Reimagining life insurance to close the coverage gap

More Life Insurance News