Wedding Events Bring Increased Risk For Agribusinesses

On-the-farm weddings have grown in popularity in recent years as couples seek rustic, unique places to tie the knot. Recognizing an opportunity to add a dependable secondary revenue stream in what can be a volatile industry, many farm, ranch and winery owners are hoping to cash in on the trend.

According to wedding website The Knot, barns and farms were the second most popular wedding venue in 2021, behind banquet halls. For owners of such venues, that can mean between $6,000 and $12,000 on average per wedding in rental fees alone.

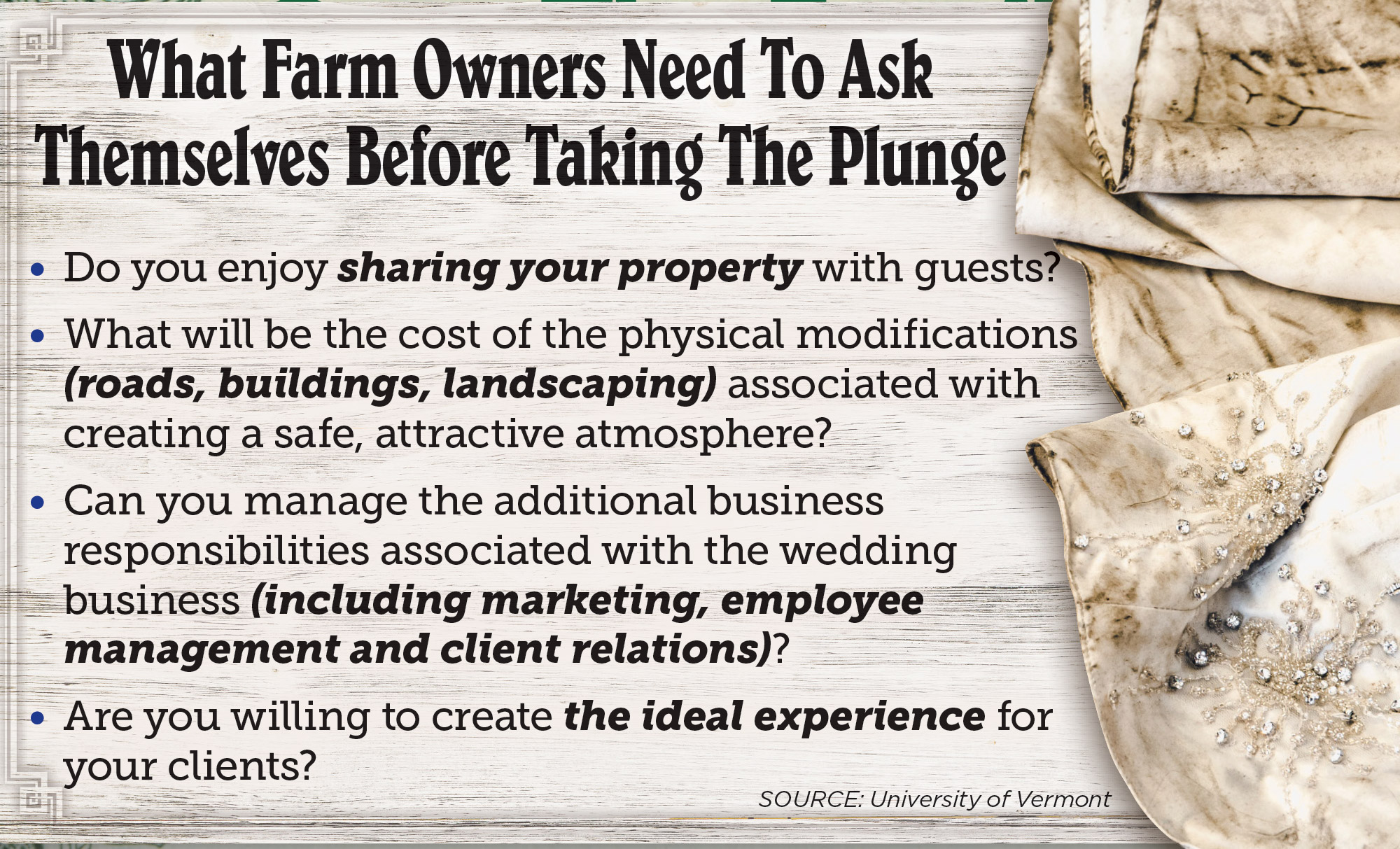

Yet there are unique considerations owners must take into account before opening the barn doors to a wedding.

In addition to costly upgrades to property — guests typically expect modern restrooms, for example — getting the proper permits and ensuring everything is up to code takes time and money. Hosting special events also requires insurance coverage that isn’t included in most agribusiness policies.

The current hard market for property/casualty insurance makes it even more critical to think through these considerations before launching into a new business venture.

Wedding Receptions And Live Events Pose Additional Risks

When deciding whether to host special events, property owners must first assess the potential impact on their primary business — whether it is farming, ranching or winemaking. Is the space where the event will take place located far enough from crops to prevent damage? Can guests be kept away from animals and farming equipment, or is access to livestock and tractors part of the attraction? Will hosting special events inhibit primary revenue streams, such as wine tastings or harvesting?

Venue owners also must evaluate the potential impact on the community. How will hosting events affect neighbors’ access to their own property? Traffic, parking and noise are important issues that must be addressed up front.

Finally, owners must decide whether they can handle the new line of business. How will they staff events? Who will run the day-to-day operations?

Answering these questions will help determine the viability of expanding into the special-event space, and will help address some of the unique liability issues that farmers and other landowners face when hosting special events.

The rise in the number of agribusinesses hosting weddings and other special events has brought about a commensurate increase in the number of lawsuits against property owners hosting such events. At the very least, agribusiness owners must expand their P/C policies to include special-events coverage, including general liability, commercial umbrella, property, equipment and workers’ compensation.

This will protect owners in case a guest or employee is injured in a fall, suffers food poisoning or causes damage to property. If alcohol is served, liquor liability coverage is a must to protect the business in the event of a lawsuit arising from bodily injury or property damage caused by an intoxicated guest.

In addition to obtaining insurance coverage, owners must make every effort to ensure safe conditions to keep guests in specified areas and eliminate potential risks. Insurance is only part of the solution to protect business owners from claims. Risk mitigation is a vital component of any business strategy; policyholders with multiple exposures, poor risk management and significant losses will face higher costs and deductibles along with coverage restrictions.

Risk Management Measures And Methods Include:

» Installing adequate lighting and signage.

» Securing animals and equipment.

» Using liability waivers.

» Keeping a clean environment.

As noted in the University of Vermont white paper “How to Host Weddings on Your Farm,” venue owners should require clients and vendors to have $1 million in liability insurance coverage, which can cost as little as $150 for a one-day event.

Agribusiness P/C Outlook

Another white paper, Alera Group’s “Property and Casualty 2022 Market Outlook,” highlights the challenges agribusiness faces in the P/C market after being hit hard by the COVID-19 pandemic and a significant number of natural disasters in recent years. Property insurance pricing and availability depend in part on geography, with moderate rate increases for clients with minimal catastrophe exposures.

More buyers are being forced into the nonstandard market, particularly in catastrophe-prone areas such as California and Florida. Agribusiness owners with minimal catastrophe exposure, as well as those in states where multiple insurers want to write business, should see moderate improvement in pricing in the coming year.

Top concerns for the P/C market highlighted in the report include cybersecurity, labor shortages and employee lawsuits. Cyberthreats are a growing risk and something all businesses must consider. Advances in agriculture-related technology have increased the industry’s vulnerabilities, bringing a rise in cyberthreats.

While labor shortages are affecting virtually every industry, agribusinesses continue to be especially hard hit, with many younger American workers reluctant to perform manual labor and access to migrant workers limited by immigration restrictions. This has significant implications for insurance coverage, since labor shortages tend to decrease worker safety and increase employer liability.

In many instances, agribusiness owners are being forced to increase wages, enhance benefits and rely on inexperienced workers to maintain operations. Not all owners have the resources to increase wages and benefits, however, and that raises concerns over the potential for lawsuits from employment practices claims such as:

» Wage and hour violations.

» Wrongful terminations or furloughs.

» Discrimination.

» Harassment.

The Agribusiness-Insurance Partnership

It’s important for agribusinesses to keep their insurance agent or broker apprised of any changes to property or business operations and work together to keep underwriters up to date about conditions that could lead to more favorable coverage. Having a solid risk management plan in place and thorough documentation, including claims history, will help inform and influence underwriters during the review process. Almost no detail is too small.

For farms, ranches and wineries that expand into special events, it’s important to inform their agent or broker about venue details such as where on the property events will take place, how many people will attend, whether alcohol will be served, whether outside vendors will be used and, if so, what services they will provide.

Hosting special events can be a lucrative source of supplementary income. It’s guaranteed to add a significant amount of work — on the host business’s insurance coverage, as well as on the events themselves.

A Path To Better Agent Retention

Insurance Industry Facing Massive Talent Shortage

Advisor News

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

- Political turmoil outstrips inflation as Americans’ top financial worry

- What is the average 55-year-old prospect worth to an advisor?

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Findings on Managed Care Reported by Investigators at University of Pennsylvania (Awaiting Insurance Coverage: Medicaid Enrollment and Post-acute Care Use After Traumatic Injury): Managed Care

- New Findings on CDC and FDA from Department of Emergency Medicine Summarized (The Long-term Trend of the Affordable Care Act On Health Insurance Marketplace Enrollment): CDC and FDA

- Proxy Statement (Form DEF 14A)

- More than 5M could lose Medicaid coverage if feds impose work requirements

- States try to rein in health insurers’ claim denials, with mixed results

More Health/Employee Benefits NewsLife Insurance News

- SC regulators ‘reviewing’ rehab strategy for Atlantic Coast

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- 2025 Proxy Statement

- New York Life Appoints Christopher D. Kastner to Board of Directors

More Life Insurance News