Vanishing retirement with more workers pushing past 65, survey shows

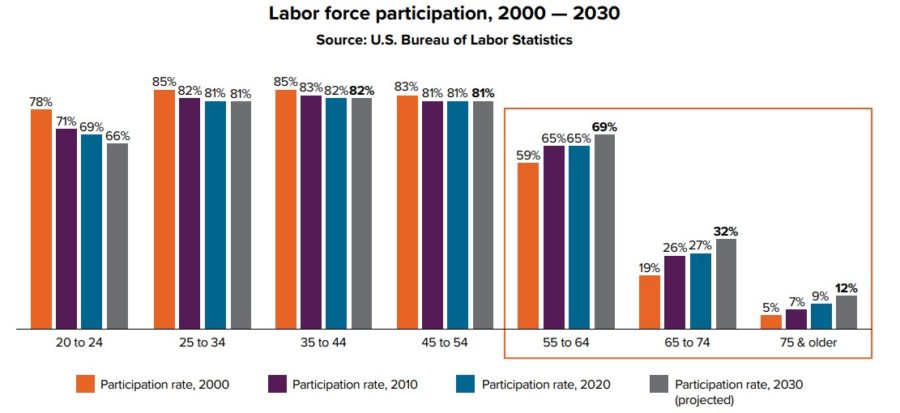

Although early retirees have been grabbing headlines, it appears that the trend of older workers is where the growth is, with a third of people between 65 and 74, and 12% of people over 74 expected to still be working by 2030, according to a study.

More workers are expecting to extend their work lives and they might be tricking themselves into believing that they want to do it rather than having to do it, according to findings from the survey report “Employment Extenders: A (labor) force to be reckoned with” from Voya Cares and Easterseals.

More are remaining at work

Whatever the reasoning, it is clear that more older people are remaining at work or returning, with the greatest growth coming those 55 and older. In 2000, only 19% of those between 65 and 74 were working, a percent expected to grow to 32% by 2030.

Most “employment extenders” said they want to work longer but most of them also say they have not saved enough for retirement, with a majority having less than $500,000 in savings. The survey polled 1,062 of what the researchers called employment extenders – half 50 and older who previously retired but are currently working, the other at least 65 and planning to work past retirement age.

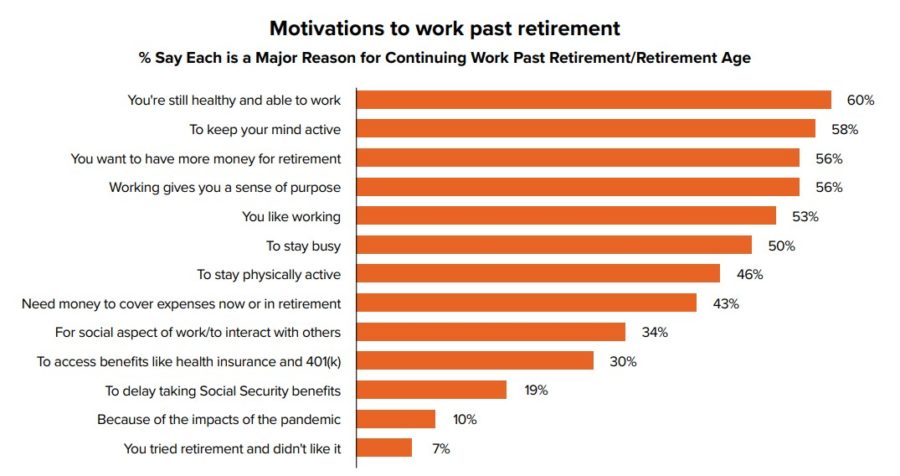

Only 43% said they were working to cover current or future expenses, but nearly all (92%) of older workers said they needed or wanted more money for retirement. Needing the money was No. 8 of the reasons most cited for working past retirement age. Simply being able to work was No. 1.

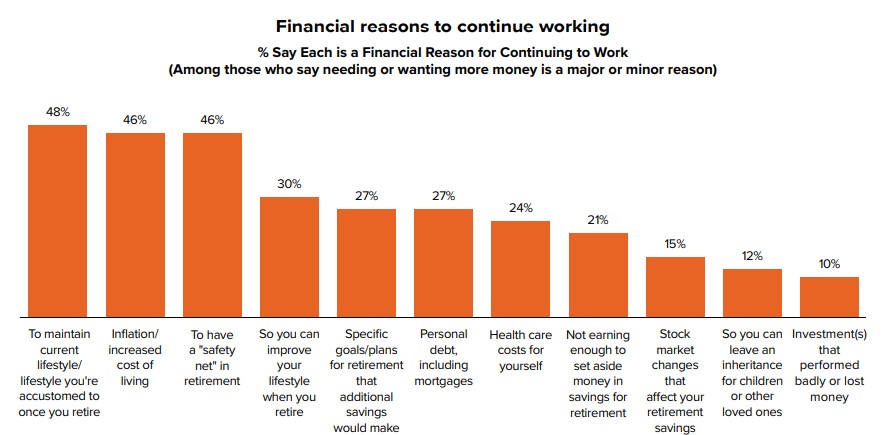

Perhaps reflecting events in August when the poll was taken, inflation was the No. 2 financial reason for continuing to work. The top one was to maintain lifestyle and No. 3 was to have a safety net.

Few of the respondents were concerned about the most likely factors to affect their later years, such as health care costs.

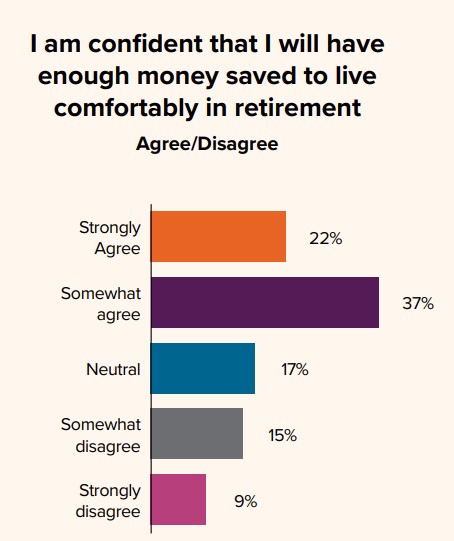

Peeling it back a little further, the respondents were also not incredibly confident in their financial robustness, with only 22% strongly agreeing that they had saved enough to live comfortably in retirement.

“Of no surprise, this lack of confidence correlates to the amount Employment Extenders have in retirement savings,” according to the repot. “As many as 60% say they have less than $500,000 in savings, including all investments, savings accounts, pension plan/defined benefit plans, employer-sponsored retirement plans (e.g., 401(k), 403(b), 457), and IRAs or Roth IRAs. And three-in-10 admit to less than $100,000 in savings.”

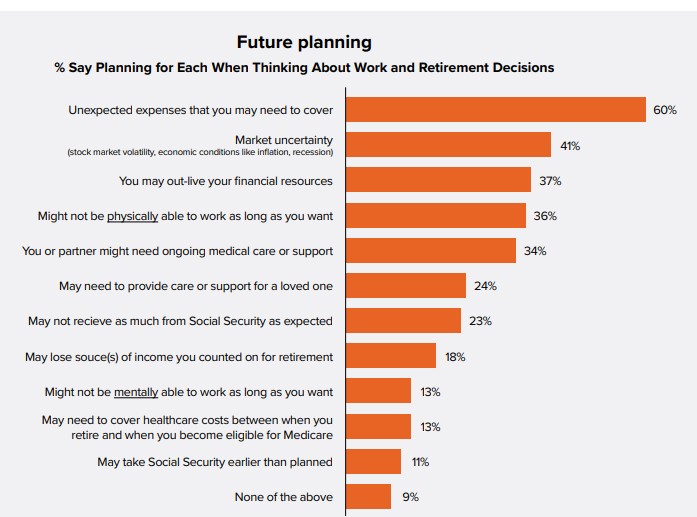

Perhaps the most concerning theme in the survey results was how few are preparing for the likely financial or physical challenges ahead of them.

Most are 'not planning'

“What is particularly alarming is that most are not planning for the possibility that they may be physically unable to work or have a loved one who needs ongoing medical care, even though both these circumstances have high probabilities,” according to the report. “Despite the fact that 40% of adults aged 65 years and older are living with a disability today, just a third (36%) are planning that they might not be physically able to work as long as they want, and only 13% are thinking about not being mentally able to work as long as they want.”

A significant impact is the cost of assistance in the later years. A home health aide costs more than $5,000 on average, adult day care about $1,700, assisted living apartment $4,500 and skilled nursing room $9,000. It is no wonder that 20% of Americans provide regular care or assistance for someone else, according to Centers for Disease Control data.

“Having enough income to cover their needs if they become disabled will be difficult for many,” according to the report. “Nearly 90% expect to use Social Security as a source of income, which in most cases will not be enough to cover the expenses of living with a disability or caring for someone with a disability. Just over half have retirement accounts to supplement their Social Security.”

The report’s authors said interviews with respondents suggested they were too scared to look at the long-term concerns and instead focused on what they can control now.

Help sought

The respondents also discussed what they would like help with, which would be of interest to financial advisors and insurance professionals. According to the report, they were:

- Transitioning to retirement (i.e., understanding Social Security benefits, health care costs, Medicare, etc.).

- Providing predictable, non-guaranteed streams of income in retirement, including withdrawal strategies.

- Maximizing benefit dollars across retirement savings, Health Savings Accounts (HSAs), healthcare insurance coverage, and voluntary benefits.

- Estimating income needs in retirement, including future health-care costs.

- Keeping saving for retirement on track, even in times of financial difficulties (so called Workplace Emergency Plans).

- Providing online or digital personal financial tools that allow employees to see ALL their financial and employer benefits information in a single place.

This was particularly true of segments the researchers called “worriers” and the “need to work” groups. They wanted to know if they had enough money to retire and what to do with their retirement accounts, along with knowing when to take Social Security and how Medicare works.

Some of the gaps are basic, such as knowing that waiting to 70 provides the largest Social Security benefit or that Medicare does not cover long-term care. But this is about more than just dollars.

“Not all the information they are seeking is financial in nature,” the researchers wrote. “They are also interested in how to deal with the emotional and mental challenges they will encounter when they stop working.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

FINEOS and Empathy partner to support life insurance beneficiaries

The role of life insurance in an ESG-focused future

Advisor News

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

More Advisor NewsAnnuity News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

More Annuity NewsHealth/Employee Benefits News

- Blue Cross Blue Shield of Wyoming CEO Gore announces retirement; Urbanek to take lead

- Wellpoint taps Rachel Chinetti as president

- Proposed changes to MA and Part D would harm seniors’ coverage in 2027

- Pan-American Life Insurance Group Reports Record 2025 Results; Premiums Reached $1.86 Billion and Net Income Totaled $110 Million as Company Enters Its 115th Year

- LightSpun and Smile America Partners Announce Partnership to Accelerate Dental Provider Enrollment to Expand Treatment for 500K Underserved Kids

More Health/Employee Benefits NewsLife Insurance News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

- How AI can drive and bridge the insurance skills gap

- Symetra Partners With Empathy to Offer Bereavement Support to Group Life Insurance Beneficiaries

- National Life Group Ranked Second by The Wall Street Journal in Best Whole Life Insurance Companies of 2026

More Life Insurance News