VA sales slump to lowest level in 25+ years, Wink Inc. reports

Wink Inc. reported deferred annuity sales in both the fourth quarter, and in all of 2022, were the greatest they have been since Wink began tracking sales of the product in 2015. It is likely the greatest sales have ever been for deferred annuities.

Total fourth quarter sales for all deferred annuities were $79.3 billion; sales were up 9.4% when compared to the previous quarter and increased 30.1% when compared to the same period last year, according to Wink's Sales and Market Report.

However, the news was not so good for variable annuities.

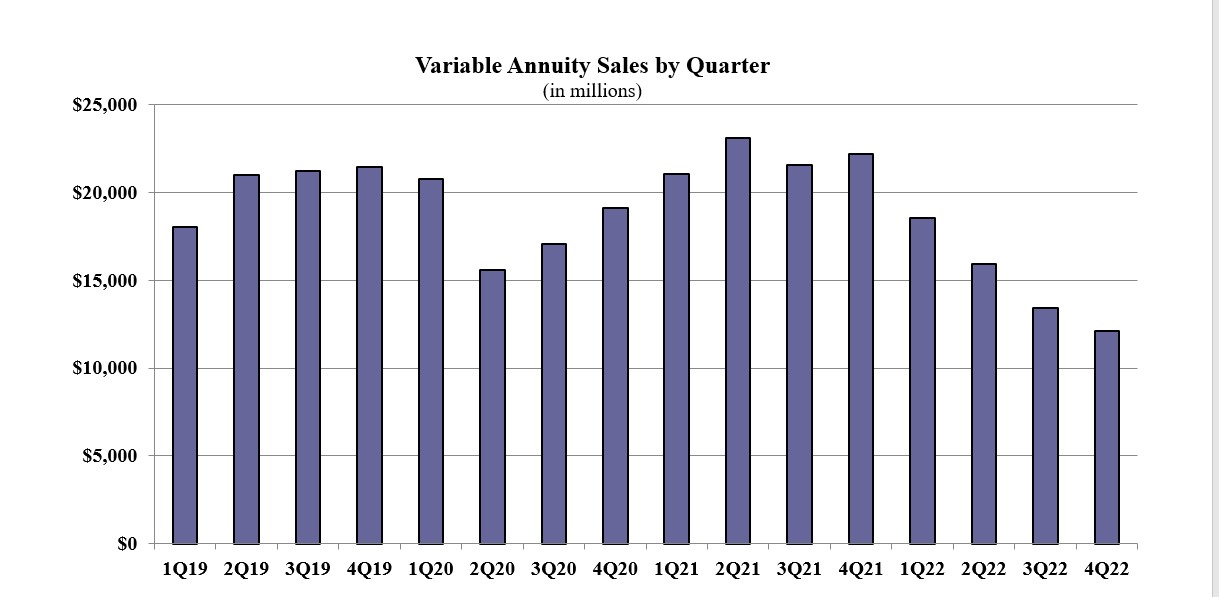

Variable annuity sales in the fourth quarter were $12.0 billion; down 9.7% as compared to the previous quarter, and down 45.4% as compared to the same period last year. Variable annuities have no floor, and the potential for gains/losses is determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments. Total 2022 variable annuity sales were $59.9 billion, down 31.7% from the previous year.

“Variable annuity sales have fallen to the lowest level in two-and-a-half decades because consumers don’t like to lose money. The market fell 9% in 2022, and the ensuing flight to safety hurt VAs," said Sheryl Moore, CEO of both Wink, Inc. and Moore Market Intelligence. “The 9% decline in the market, in 2022, hurt sales of the once-flagship product dramatically.”

Noteworthy highlights for variable annuities in the fourth quarter include Jackson National Life ranking as the #1 carrier in variable annuities, with a market share of 20.6%. Equitable Financial ranked second, while New York Life, Nationwide, and Lincoln National Life finished out as the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the #1 selling variable annuity for the sixteenth consecutive quarter, for all channels combined.

All deferred annuities

All deferred annuities include the variable annuity, structured annuity, indexed annuity, traditional fixed annuity, and MYGA product lines. Total 2022 sales for all deferred annuities were $284.1 billion, an increase of 16.2% from the previous year.

Noteworthy highlights for all deferred annuity sales in the fourth quarter include Athene USA ranking as the #1 carrier overall for deferred annuity sales, with a market share of 9.7%. Massachusetts Mutual Life Companies moved into second place, while New York Life, Corebridge Financial, and Equitable Financial rounded-out the top five carriers in the market, respectively. Massachusetts Mutual Life’s Stable Voyage 3-Year product, a MYGA, was the #1 selling deferred annuity, for all channels combined in overall sales.

Non-variable deferred annuities

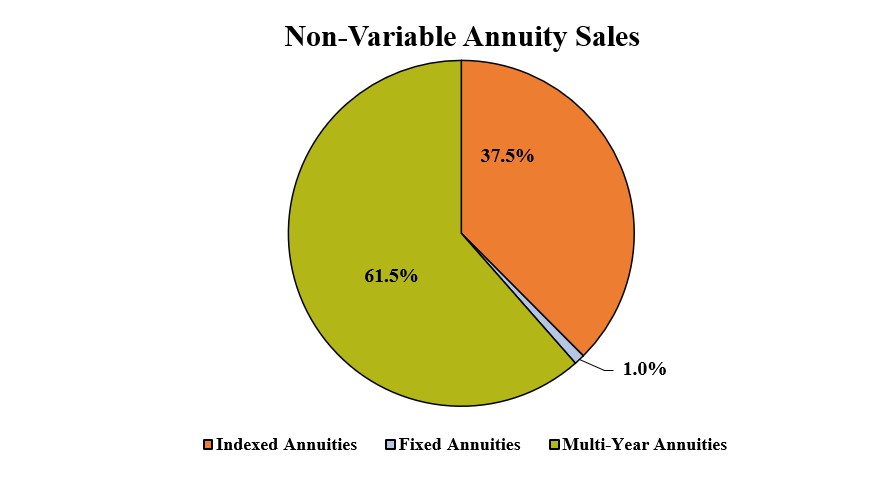

Total fourth quarter non-variable deferred annuity sales were $57.8 billion; sales were up 18.3% when compared to the previous quarter and increased 101.8% when compared to the same period last year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines. Total 2022 non-variable deferred annuity sales were $184.6 billion, an increase of over 56.8% from the previous year.

Noteworthy highlights for non-variable deferred annuity sales in the fourth quarter include Athene USA ranking as the #1 carrier overall for non-variable deferred annuity sales, with a market share of 13.0%. Massachusetts Mutual Life Companies held onto second place while New York Life, Corebridge Financial, and Sammons Financial Companies completed the top five carriers in the market, respectively. Massachusetts Mutual Life’s Stable Voyage 3-Year product, a MYGA, was the #1 selling non-variable deferred annuity, for all channels combined for the quarter.

Variable deferred annuities

Total fourth quarter variable deferred annuity sales were $21.4 billion; sales were down 8.9% when compared to the previous quarter and down 33.4% when compared to the same period last year. Variable deferred annuities include structured annuity and variable annuity product lines. Total 2022 variable deferred annuity sales were $99.5 billion, a decline of 20.9% from the previous year.

Noteworthy highlights for variable deferred annuity sales in the fourth quarter include Equitable Financial ranking as the #1 carrier overall for variable deferred annuity sales, with a market share of 16.6%. Jackson National Life continued in the second-place position, as Lincoln National Life, Brighthouse Financial, and Allianz Life concluded the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the #1 selling variable deferred annuity, for all channels combined in overall sales for the fifteenth consecutive quarter.

Indexed annuities

Indexed annuity sales for the fourth quarter were $21.7 billion; sales were up 3.4% when compared to the previous quarter, and up 28.1% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500®. Total 2022 indexed annuity sales were $78.9 billion, an increase of 20.5% from the previous year. This was a record-setting quarter for indexed annuity sales, topping the prior 3rd quarter 2021 record by 3.47%. This was also a record-setting year for indexed annuity sales, topping the prior 2019 record by 7.74%.

Noteworthy highlights for indexed annuities in the fourth quarter include Athene USA ranking as the #1 seller of indexed annuities, with a market share of 13.7%. Allianz Life maintained their second-ranked position, while Corebridge Financial, Sammons Financial Companies, and Nationwide rounded-out the top five carriers in the market, respectively. Allianz Life’s Allianz Benefit Control Annuity was the #1 selling indexed annuity, for all channels combined for the second consecutive quarter.

Traditional fixed annuities

Traditional fixed annuity sales in the fourth quarter were $575.3 million; sales were up 27.4% when compared to the previous quarter, and up 18.1% when compared with the same period last year. Traditional fixed annuities have a fixed rate that guaranteed for one year only. Total 2022 traditional fixed annuity sales were $1.9 billion, an increase of 10.5% from the previous year.

Noteworthy highlights for traditional fixed annuities in the fourth quarter include Modern Woodmen of America ranking as the #1 carrier in fixed annuities, with a market share of 13.3%. National Life Group ranked second, while EquiTrust, Global Atlantic Financial Group, and Western-Southern Life Assurance Company rounded-out the top five carriers in the market, respectively. Forethought Life’s ForeCare Fixed Annuity was the #1 selling fixed annuity, for all channels combined, for the tenth consecutive quarter.

Multi-year guaranteed annuities

Multi-year guaranteed annuity (MYGA) sales in the fourth quarter were $35.5 billion; sales were up 29.6% when compared to the previous quarter, and up 216.8% when compared to the same period, last year. MYGAs have a fixed rate guaranteed for more than one year. Total 2022 MYGA sales were $103.7 billion, an increase of 105.5% from the previous year. This quarter and this year are the greatest MYGA sales have been since Wink began tracking sales of the products in 2015.

Noteworthy highlights for MYGAs in the fourth quarter include Massachusetts Mutual Life Companies ranking as the #1 carrier, with a market share of 16.0%. Athene USA moved into the second-ranked position, while New York Life, Corebridge Financial, and Brighthouse Financial rounded-out the top five carriers in the market, respectively. Massachusetts Mutual Life’s Stable Voyage 3-Year product was the #1 selling multi-year guaranteed annuity for all channels, combined.

Sheryl Moore, CEO of both Wink, Inc. and Moore Market Intelligence commented, “Margins may be down, but rates and sales are up! You know that annuity sales are going to be unbelievable when insurance companies are taking three weeks to get a case issued!”

Structured annuities

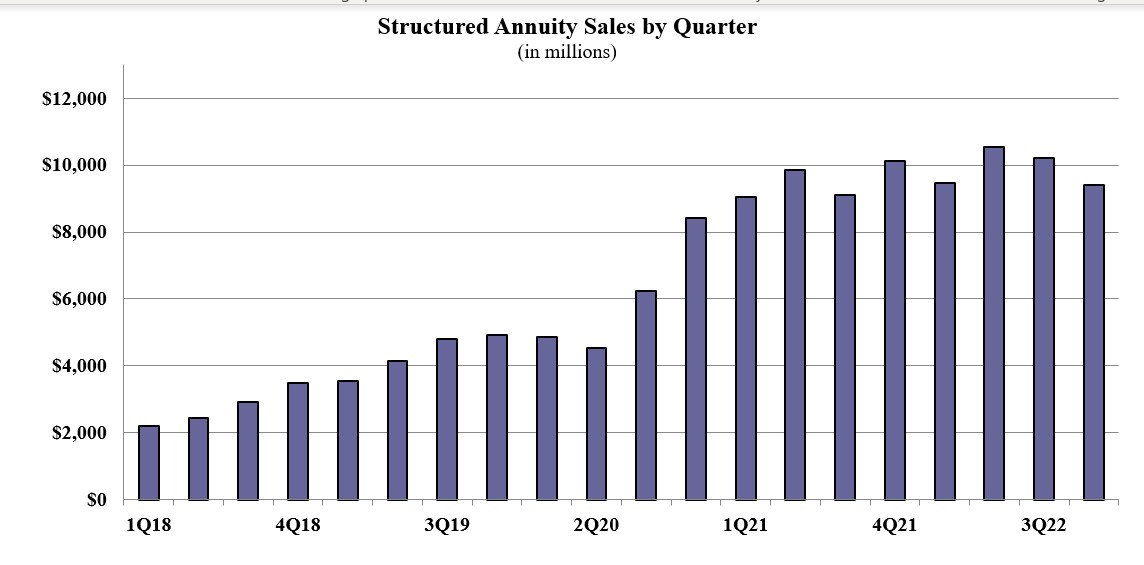

Structured annuity sales in the fourth quarter were $9.3 billion; down 7.9% as compared to the previous quarter, and down 7.1% as compared to the same period, the previous year. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts. Total 2022 structured annuity sales were $39.5 billion, an increase of 3.7% from the prior year.

Noteworthy highlights for structured annuities in the fourth quarter include Equitable Financial ranking as the #1 carrier in structured annuity sales, with a market share of 21.2%. Brighthouse Financial ranked second, while Allianz Life, Lincoln National Life, and Prudential completed the top five carriers in the market, respectively. Equitable Financial’s Structured Capital Strategies Plus 21 was the #1 selling structured annuity, for all channels combined, for the third consecutive quarter.

‘Financial wellness’ a challenge for many Americans, study finds

B/Ds must respond to shifting advisor preferences

Advisor News

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

- Amazon Go validates a warning to advisors

- Principal builds momentum for 2026 after a strong Q4

- Planning for a retirement that could last to age 100

More Advisor NewsAnnuity News

- Corebridge Financial powers through executive shakeup with big sales

- Half of retirees fear running out of money, MetLife finds

- Planning for a retirement that could last to age 100

- Annuity check fraud: What advisors should tell clients

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

More Annuity NewsHealth/Employee Benefits News

- New Findings from University of Southern California Keck School of Medicine in the Area of Military Medicine Reported (Health insurance status and hearing aid utilization in U.S. older adults: A population-based cross-sectional study): Military Medicine

- Research Data from University of Pennsylvania Update Understanding of Computer Science (The Health-Wealth Gradient in Labor Markets: Integrating Health, Insurance, and Social Metrics to Predict Employment Density): Computers – Computer Science

- Will people keep their Obamacare coverage after costs increase?

- Companies take greater interest in employee financial wellness

- DRUGMAKERS SIMPLY WANT A BLANK CHECK TO KEEP OVERCHARGING AMERICANS

More Health/Employee Benefits NewsLife Insurance News