Universal Life Sales Hit ‘All-Time Low’ In 1st Quarter, Wink Reports

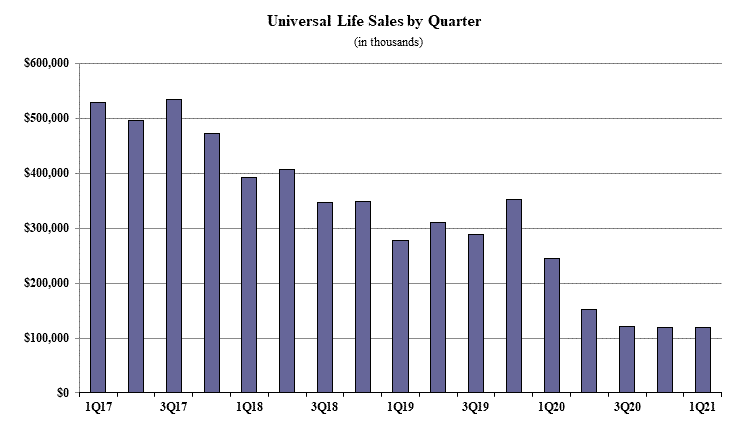

First-quarter non-variable universal life insurance sales were down double digits, according to Wink’s Sales & Market Report.

Non-variable UL sales were $649.8 million, down 12.1% when compared to the previous quarter and down 15.6% as compared to the same period last year. Non-variable universal life sales include both indexed UL and fixed UL products.

Noteworthy highlights for total non-variable universal life sales in the first quarter included National Life Group gaining the No. 1 overall sales ranking with a market share of 11.9%. Allianz Life’s Allianz Life Pro+ Advantage IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined.

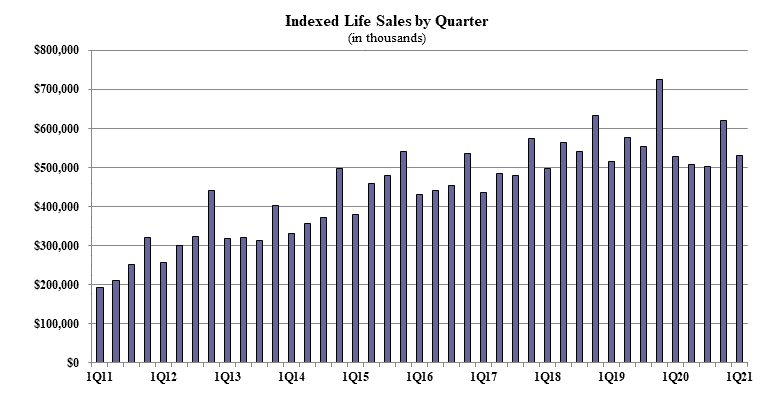

Indexed life sales for the first quarter were $530.6 million, down 14.6% when compared with the previous quarter, and down 0.7% as compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

“This was obviously going to be a tough quarter for life insurance sales. No sooner than we have products repriced for 2017 CSO, we have to reprice for AG49. And now that AG49 is under our belts, everyone is looking at the prospects of repricing for 7702. When product development is active, sales suffer,” explained Sheryl J. Moore, chairwoman & CEO of Wink, Inc. and president & CEO of Moore Market Intelligence.

Items of interest in the indexed life market included National Life Group gaining the No. 1 ranking in indexed life sales, with a 14.4% market share. Pacific Life Companies, Transamerica, Nationwide, and Allianz Life rounded out the top five, respectively.

Allianz Life’s Allianz Life Pro+ Advantage IUL was the No. 1 selling indexed life insurance product, for all channels combined. The top pricing objective for sales this quarter was Cash Accumulation, capturing 74.1% of sales. The average indexed life target premium for the quarter was $ 12,279, a decline of more than 2.0% from the prior quarter.

Fixed UL first-quarter sales were $119.7 million, up 0.6% when compared to the previous quarter and down 50.9% as compared to the same period last year. Noteworthy highlights for fixed universal life in the first quarter included the top pricing objective of No Lapse Guarantee capturing 41.6% of sales.

The average UL target premium for the quarter $5,021, a decline of more than 6% from the prior quarter.

“Seeing universal life hit rock bottom is a personal low for me," Moore said. "I remember developing the most competitive GUL in the life insurance industry 17 years ago; back then, I never would have foreseen that sales would get this bad.”

Whole life first-quarter sales were $1 billion, up 4.5% when compared with the previous quarter, and up 4% as compared to the same period last year. Items of interest in the whole life market included the top pricing objective of Final Expense capturing 54.9% of sales.

The average premium per whole life policy for the quarter was $2,675, a decline of more than 25% from the prior quarter.

“As forecasted, whole life sales are going to continue to be strong for the foreseeable future. The guarantees become more valuable during periods of sustained low interest rates,” Moore said.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

NY Insurer Fined $500,000 For Alleged Unlawful Use Of Data To Set Rates

Bill Would Change How Social Security COLA Is Calculated

Advisor News

- The ‘guardrails approach’ to retirement income

- Is there a mismatch between advisor marketing and consumer preferences?

- State health plan users may see premium increases under SC House budget proposal

- Advisor: SEC trying to ambush my defense on bad annuity sales charges

- Partner split: Grant Cardone and Gary Brecka swap charges in dueling lawsuits

More Advisor NewsAnnuity News

Health/Employee Benefits News

- President of Insurance Brokerage Firm and CEO of Marketing Company Charged in $161M Affordable Care Act Enrollment Fraud Scheme

- STATEHOUSE: Senate Republicans approve limiting health insurance program for Hoosiers

- State health plan users may see premium increases under SC House budget proposal

- Senate Republicans approve limits on health insurance program

- Health agents ‘optimistic’ as a new administration takes charge

More Health/Employee Benefits NewsLife Insurance News

- Northwestern Mutual sees record dividend, surplus

- IUL vs. annuities: Settling the debate

- While U.S. mortality spike is normalizing, 5 troubling trends continue

- Whole life vs. term life: The great debate

- Prudential launches OneLeave

More Life Insurance News