Traditional universal life is withering on the vine, says Wink CEO

As traditional universal life insurance sales continue to plummet thanks to low interest rates and carriers exiting the business, "it is heartbreaking to see a product wither on the vine, the way traditional UL has," said Sheryl Moore, president and CEO of Wink, Inc.

Fixed UL sales for the first quarter were $107.4 million, down 21.4% compared to the previous quarter and down 10.9% as compared to the same period last year, according to Wink's Sales and Market Report.

Moore bemoaned the declining sales of traditional fixed UL. Normally, guaranteed universal life sales help buoy UL sales, she explained. However, carriers keep getting out of the business, and the regulatory environment is not favorable for GUL, she added.

Furthermore, interest rates remain low despite recent moves by the Federal Reserve.

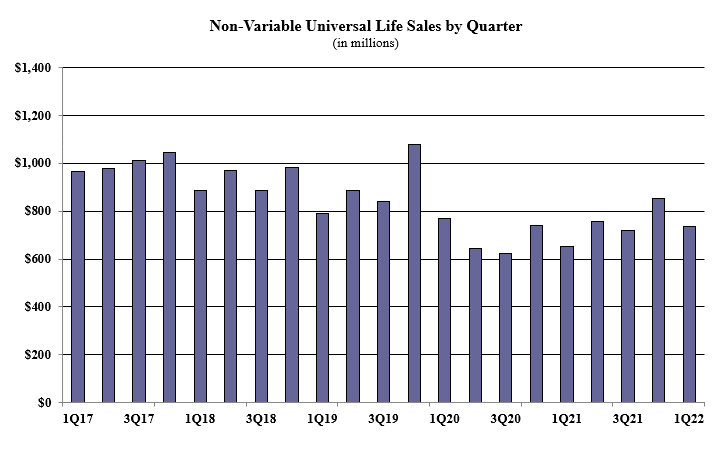

Overall, non-variable universal life sales for the first quarter were $737.4 million, down 13.7% when compared to the previous quarter and up more than 12.8% over 1Q 2021. Non-variable universal life sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the first quarter included Pacific Life Companies with the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 10%. Transamerica Life’s Transamerica Foundation IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined.

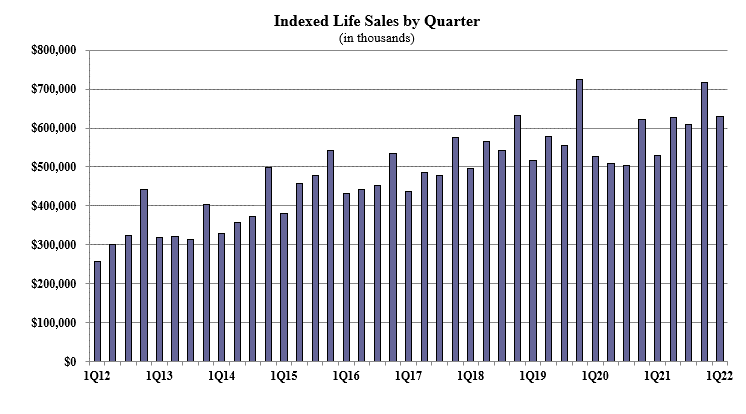

Indexed life sales for the first quarter were $629.9 million, down more than 12.2% compared with the previous quarter, and up more than 18.1% over 1Q 2021. Indexed life sales include both indexed UL and indexed whole life.

“This was the highest first quarter indexed life sales have ever been,” Moore said. “Sales were up nearly 20% over the same period, a year prior.”

First-quarter sales for indexed life were bad last year due to product repricing for new reserving tables and regulations from the National Association of Insurance Commissioners, Moore noted.

Items of interest in the indexed life market included National Life Group with the No. 1 ranking in indexed life sales, with an 11.1% market share. Pacific Life Companies, Nationwide, Transamerica, and John Hancock rounded out the top five, respectively.

Transamerica Life’s Transamerica Foundation IUL was the No. 1 selling indexed life insurance product, for all channels combined. The top pricing objective for sales this quarter was Cash Accumulation, capturing 80.9% of sales. The average indexed life target premium for the quarter was $11,554, a decline of nearly 3% from the prior quarter.

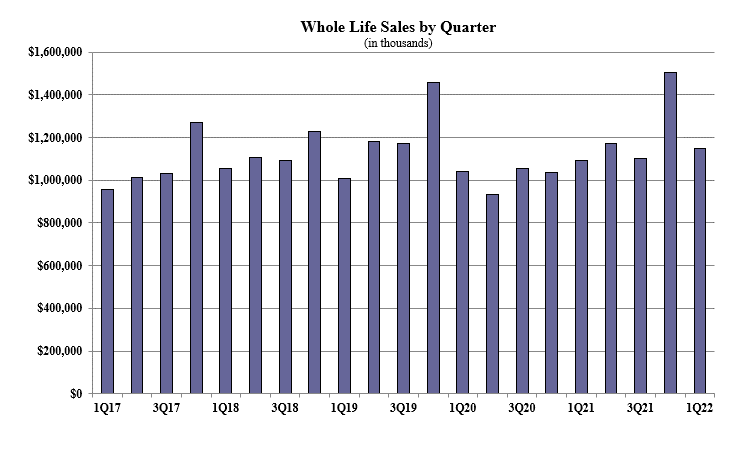

Whole life first-quarter sales were $1.1 billion, down more than 23.6% compared with the previous quarter, and up more than 5.2% as compared to the same period last year. Whole life was down primarily because the top seller was down by nearly half of what their sales were a year ago, Moore said.

Items of interest in the whole life market included the top pricing objective of Final Expense capturing 55.1% of sales. The average premium per whole life policy for the quarter was $3,177, a decline of nearly 14% from the prior quarter.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Most workers withdrew as much from their FSA as they contributed

California couple charged with insurance fraud, arson after investigation

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- DEMOCRATS: Iowa’s farm income projected to plummet in 2026, ag-related layoffs expected to continue. Who is here to help?

- VERMONT SMALL BUSINESSES SUPPORT HOUSE BILL TO IMPROVE AFFORDABLE HEALTH INSURANCE OPTIONS

- ALASKA HOUSE LABOR AND COMMERCE COMMITTEE HEARS TESTIMONY FROM LOCAL BUSINESS OWNERS ON THE CONSEQUENCES OF INCREASING HEALTH CARE COSTS

- RELEASE: HILL, COSTA, DAVIDS, DAVIS, MILLER, MOORE INTRODUCE BIPARTISAN BILL TO BOOST TICKET TO WORK AWARENESS

- Health care workers warn of 'ripple effects' amid medical system issues

More Health/Employee Benefits NewsLife Insurance News