The secret to financial security? Owning life insurance, survey says

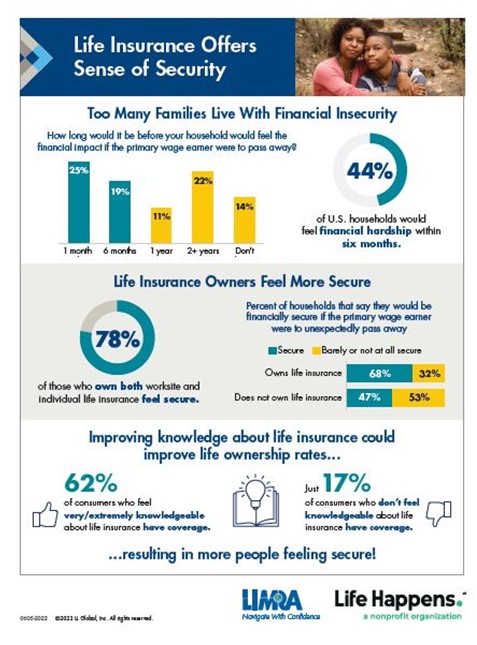

Arlington, Va. and Windsor, Conn., ―According to new findings from the 2022 Insurance Barometer Study, conducted jointly by nonprofit industry trade associations LIMRA and Life Happens, 2 in 5 parents say they are barely or not at all financially secure. This is increasingly critical, as most households haven’t prepared for the loss of a primary wage earner: 44% say it would take less than six months to feel financial hardship if this happened to their family.

Life Insurance Key To Financial Security

Financial insecurity transcends generations and is highest among Gen X (49%), followed by Millennials (44%), Gen Z (42%), and Baby Boomers (33%). One way to ease these concerns is life insurance. Two-thirds (68%) of life insurance owners report feeling financially secure compared with 47% of non-owners. Those who feel most secure are people who have life insurance both through the workplace and through individual coverage (78%).

“Life insurance is the foundation of any strong financial plan, and our results show it provides people with a sense of security that many are looking for, especially after the last two years,” said Faisa Stafford, LUTCF, president and CEO of Life Happens. “The lasting impact of COVID remains at the forefront for many, with the pandemic leading almost a third, or 31% of people, to say they are more likely to buy life insurance in 2022.”

Gender Gaps Extends To Life Insurance Coverage

The need gap for life insurance—what people have versus what they say they need—is at an all-time high (18 points), more than double what it was 12 years ago. For the sixth consecutive year, the percentage of uninsured women has increased. Just 46% of women report owning life insurance, compared with 53% of men. However, a greater proportion of women than men recognize they need (or need more) coverage (44% versus 38%).

Despite their acknowledged need, just over a third of uninsured women (36%) say they plan to buy life insurance in the next year. The reasons women give for not having coverage include:

- It’s too expensive — 39%

- I have other financial priorities right now — 37%

- I’m not sure how much or what type to buy — 22%

“There are still over 100 million people in this country who don’t own enough life insurance” said David Levenson, president and CEO of LIMRA and LOMA. “And, while new policy growth jumped last year to the highest levels since 1983, there is still a lot that our industry can do to ensure that families are properly protected.”

Study Methodology

In January 2022, LIMRA and Life Happens engaged an online panel to survey adult consumers who are financial decision-makers in their households. The survey generated 8,517 responses. The results were weighted to reflect the adult U.S. population.

Property, auto insurance shopping subdued in Q2, report finds

7 reasons to buy life insurance during a turbulent economy

Advisor News

- The silent retirement savings killer: Bridging the Medicare gap

- LTC: A critical component of retirement planning

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- Otsuka Medical Devices/Otsuka Pharmaceutical: Paradise Ultrasound Renal Denervation System for the Treatment of Resistant Hypertension, Now Covered by Insurance and Commercially Available in Japan

- After enhanced Obamacare health insurance subsidies expire, the effects are starting to show

- CommunityCare: Your Local Medicare Resource

- AG warns Tennesseans about unlicensed insurance seller

- GOVERNOR HOCHUL LAUNCHES PUBLIC AWARENESS CAMPAIGN TO EDUCATE NEW YORKERS ON ACCESS TO BEHAVIORAL HEALTH TREATMENT

More Health/Employee Benefits NewsLife Insurance News

- Baby on Board

- Kyle Busch, PacLife reach confidential settlement, seek to dismiss lawsuit

- AM Best Revises Outlooks to Positive for ICICI Lombard General Insurance Company Limited

- TDCI, AG's Office warn consumers about life insurance policies from LifeX Research Corporation

- Life insurance apps hit all-time high in January, double-digit growth for 40+

More Life Insurance News