The Scariest Chart You’ll See Today

Delinquent mortgages are piling up at a faster rate than they did during the Great Recession – and it is just getting started in the South.

That was clear in the Mortgage Bankers Association's National Delinquency Survey, which found some of the most rapid increases in its history, said Marina Walsh, MBA's vice president of industry analysis.

“The COVID-19 pandemic's effects on some homeowners' ability to make their mortgage payments could not be more apparent,” Walsh said. “The nearly 4 percentage point jump in the delinquency rate was the biggest quarterly rise in the history of MBA's survey. The second-quarter results also mark the highest overall delinquency rate in nine years, and a survey-high delinquency rate for FHA loans.”

The seasonally adjusted total mortgage delinquency rate increased for all loans outstanding. Here are some key points from the second quarter compared to the previous:

- 60-day delinquency rate increased to its highest rate since the survey began in 1979.

- 90-day delinquencies increased to the highest rate since the third quarter of 2010.

- 90 days or more or in foreclosure, aka “the seriously delinquent rate,” was at the highest rate since fourth quarter of 2014.

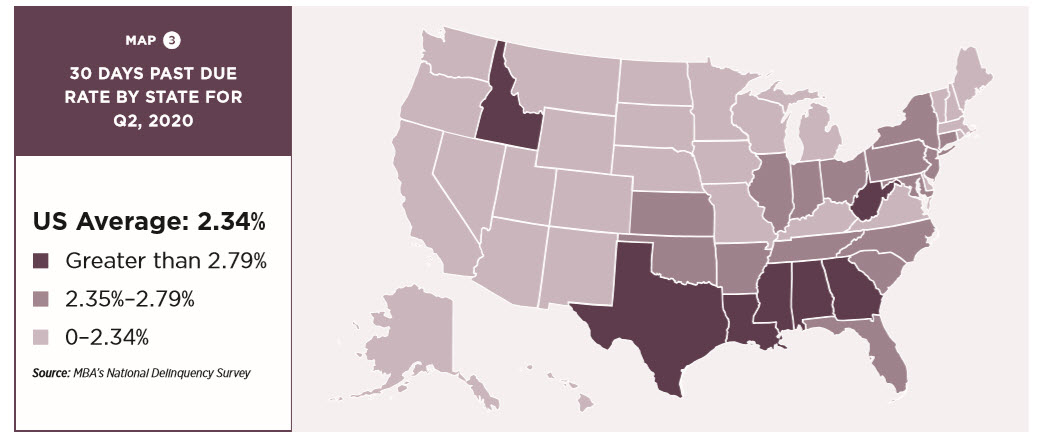

A couple of items on the good-news front, maybe. One is that mortgages that are 30 days late, the first stage of delinquency, dropped in the second quarter compared to the first.

Because the delinquencies are tied to job loss, the MBA attributed the improvement in the 30-day category to the decrease in unemployment.

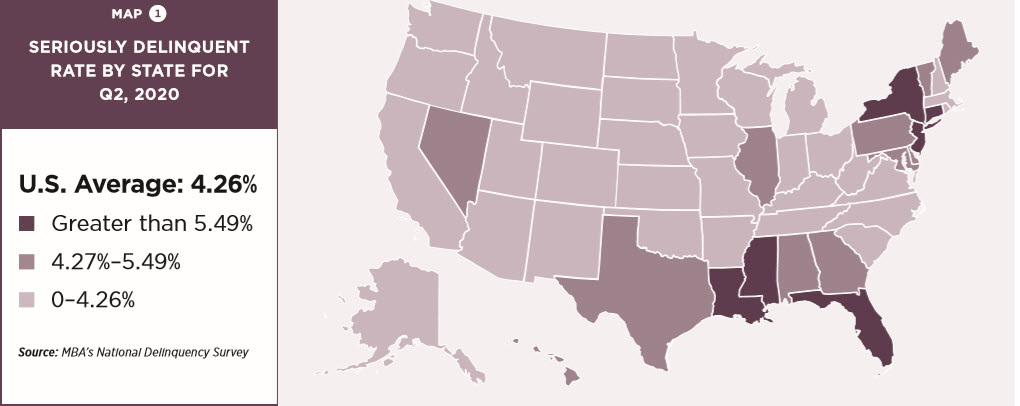

But the delinquencies also track where COVID-19 has been flaring. The map of seriously delinquent mortgages shows states that were hardest hit by the coronavirus in the first quarter or relied heavily on tourism dollars, such as New Jersey, Nevada, New York, Florida, and Hawaii.

The 30-day map shows that mortgage delinquencies are just getting started in the Southeast, which bore more of the COVID brunt in the second quarter.

The association also pointed out key factors that are improvements since the Great Recession.

“These factors include home-price gains, several years of home equity accumulation, and the loan deferral and modification options that present alternatives to foreclosure for distressed homeowners," Walsh said.

A couple of trends that might work against continued improvement in the third quarter are, the reclosing that is happening in some parts of the country that had reopened, the effect a rapid closing of schools might have, and the loss of the $600 weekly federal supplement to unemployment insurance, which had helped sustain mortgages.

Steven A. Morelli is editor-in-chief for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at smorelli@innfeedback.com.

© Entire contents copyright 2020 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Nearly Half Of Indy P/C Agencies Lost Revenue In 2020: Big ‘I’

Schwab Survey: Americans Lack Financial Education During COVID

Advisor News

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

- Political turmoil outstrips inflation as Americans’ top financial worry

- What is the average 55-year-old prospect worth to an advisor?

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- New Findings on CDC and FDA from Department of Emergency Medicine Summarized (The Long-term Trend of the Affordable Care Act On Health Insurance Marketplace Enrollment): CDC and FDA

- Proxy Statement (Form DEF 14A)

- More than 5M could lose Medicaid coverage if feds impose work requirements

- States try to rein in health insurers’ claim denials, with mixed results

- Social Security: New resources for sickle cell warriors

More Health/Employee Benefits NewsLife Insurance News

- SC regulators ‘reviewing’ rehab strategy for Atlantic Coast

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- 2025 Proxy Statement

- New York Life Appoints Christopher D. Kastner to Board of Directors

More Life Insurance News