The LTCi evolution: insurers search for a successful formula

Insurance is sold to customers who hope they never have to use it.

While that might also have been the hope for most buying LTCi – and likely policy underwriters – reality has turned out to be quite a different story and has played havoc with the product.

Approximately 70% of people who turn 65 today will require long-term care at some point, according to the U.S. Department of Health and Human Services. But just over 7.5 million people have a policy, according to the American Association for Long-Term Care Insurance.

LTCi is needed but has a long and troubled history of inaccurate assumptions. Many carriers have either left the LTCi business entirely, are seeking repeated rate hikes, or both. Meanwhile, the products that remain on the market are selling well but reflect the continued evolution of LTCi from its beginnings as a nursing home care product in the 1970s.

Advisors selling LTCi all report similar interactions with prospective buyers leery about spending a significant sum of money on something they might not use.

“For some reason, it's been a prevalent objection with the purchase of traditional long-term care insurance,” said Wesley Warren, president of Financial Security Services Group outside Dallas, Texas. “People say, ‘Heck I could drop dead mowing the lawn after 20 years and get nothing out of it.’”

LTCi can be viewed as a quality-of-life benefit, as opposed to disaster protection, and that might explain the objections. Still, the insurance industry had to evolve on long-term care. And it did.

Single-premium LTCi is an early product adaptation that many advisors still love. The advantages are clear: no premium increases, a death benefit and no lapsing of coverage. Of course, the client must have a sizable chunk of money to pay upfront.

“It eliminates the use-it-or-lose-it mentality that people might have about long-term care,” Warren said. “I even have some wealthier clients who probably could self-insure, but they buy this because of the care coordination. They don't have much in the way of other family, so they value the concierge care services available to them.”

Riders to the rescue

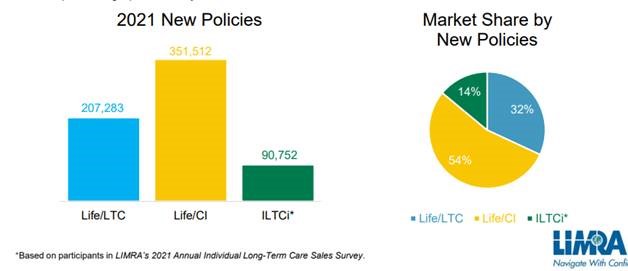

In today’s market, long-term care coverage is most likely to be sold as a rider on another insurance product. As of year-end 2021, total new premium for individual life combination products increased 22% to $4.3 billion, according to LIMRA’s 2021 U.S. Individual Life Combination Products Annual Review. There were nearly 559,000 policies sold in 2021, up 37% compared with 2020 results.

Standalone individual long-term care products held only 14% of the broader long-term care insurance policy market in 2021, LIMRA said, a 4-percentage-point increase from 2020. There were 90,752 new LTCi policies in 2021.

That last figure comes with an asterisk, however. Sales received a bump from a Washington state program – the first of its kind – that required residents to get LTC insurance or face a tax to pay for a state-provided benefit.

An August 2020 federal task force report compiled by the Treasury Department encouraged the growth of riders and combination policies.

“Innovation and product development have the potential to significantly strengthen the private LTCi market and better address the LTC needs of consumers,” the report concluded. “Accordingly, the Task Force recommends that federal and state policymakers foster a regulatory environment that encourages flexibility, experimentation, and innovation in product design to improve consumer choice and access to benefits."

Not everyone is a fan of adding LTC coverage as a ride on a life insurance product. Jesse Slome is executive director of the American Association for Long-Term Care Insurance. LTC riders are a “nice solution” for upper-middle-class and wealthier folks, he said.

“The costs are much higher because you have a product doing double duty,” Slome explained. “It's either giving you life insurance and or long-term care, or it's giving you an annuity benefit and/or long-term care. It's not as if the companies have figured out, ‘My God we had this revelation, and we just figured out how to make it cheaper and better.’”

Inflation ride

Inflation is hitting senior Americans especially hard. The average cost of long-term care at home is $50,000 a year and $100,000 annually in a nursing home, according to LTCG, which provides LTC administration services.

Those older Americans with an LTCi policy might own an inflation rider with it, perhaps as juicy as 5%. Many of these policies were sold at a time when interest rates were substantially higher, while inflation was nearly nonexistent.

Fast forward and those rewarding inflation riders are adding to the financial woes around LTCi. As Slome puts it, LTCi products are based on a 30-year-old model that has been “tweaked and tweaked” and might not work any longer.

Hence, you have insurers asking various state regulators for repeated rate hikes.

“A lot of times consumers bought a policy with a 5% compound inflation growth factor, which means the benefits go up 5% a year,” Slome said. “Well, that was predicated on interest rates at the time being 6% or 7%. The issue with long term care is it's a product that today, if it's going to survive or go forward into the future, needs to be redesigned.”

Gender divide

As the long-term care industry evolved into the 21st century, assisted living and skilled nursing became familiar terms as older Americans considered their living options. It quickly became apparent that women significantly outnumbered men in these settings.

Insurers responded in kind. In 2013, insurers adopted gender-distinct pricing for LTCi policies going forward. Women account for about two-thirds of all claims, Slome said. The practice withstood a complaint alleging discrimination under the Affordable Care Act and it is now standard practice for women to pay several hundred dollars more per year than a man for the same LTCi policy.

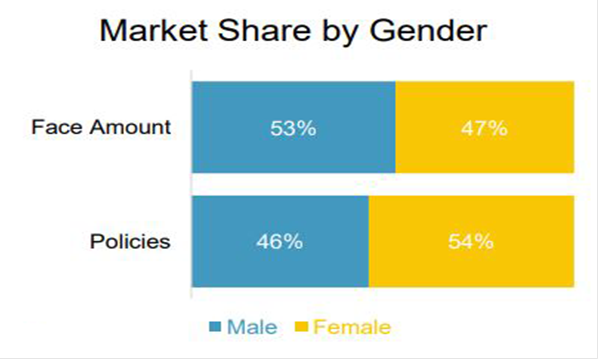

Still, women continue to be good customers for LTCi, LIMRA reports.

“Both policy and face amount market shares in 2021 stayed fairly consistent between males and females compared to 2020 for combination products,” said Karen Terry, assistant vice president, Insurance Research, LIMRA. “Women continue to be more likely than men to own combination products, perhaps due to longer life expectancy, although men still own larger life policies on average.”

LIMRA does not collect gender sales data on standalone LTCi sales, Terry added.

Silver brick road

LTCi evolution is not all about pricing and care coverage. Insurers are adopting technology to boost benefits in unique ways. That can be significant for families of declining parents and grandparents, said Kevin Patrick Peters, a wealth advisor with XML Financial Group in Rockville, Md.

For example, many LTCi products now include a “family engagement system” to better track things like medication, appointments and other needs. Silver Brick Road is one app that serves as a hub for families.

“You can see updates, such as, ‘Mom received her medications, she's at home, she's in a good mood,’ and so on,” Peters explained. “And then a family member can chime in and say, ‘I'll be there’ at a certain time tomorrow.”

It’s that kind of service that personalizes an impersonal insurance product, he added.

“I think that's going to help the industry going forward,” Peters said. “You have to adapt to the availability of the technologies.”

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback.com. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Help your client navigate the changes in RMD requirements

Opinion: Burdensome regulations could make seniors more vulnerable to aggressive Medicare sales tactics

Advisor News

- Political turmoil outstrips inflation as Americans’ top financial worry

- What is the average 55-year-old prospect worth to an advisor?

- A recession could leave Americans humming 'Oh, Canada'

- Market volatility driven by fear, emotion

- Grant Cardone, Gary Brecka seek mediation in business breakup lawsuit

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Proxy Statement (Form DEF 14A)

- Proxy Statement (Form DEF 14A)

- Analysis | It's Time To End HUSKY's 'Value-Based' Medicaid Program

- Nebraska dentists tout bill as path to better patient care; insurers say it will be costly

- PA House Passes Bills To Protect Affordable Care Act Coverage

More Health/Employee Benefits NewsLife Insurance News