The Goldilocks Plan Is A Fairy Tale: How World Events Impact Retirement

Retirees and preretirees often hope for a Goldilocks financial world where investment returns increase year after year, nest eggs are more than adequate to support a long retirement, and there’s money left over to fund bequests to children, grandchildren and favorite charities. World events during the last century have made it clear that the Goldilocks plan is indeed a fairy tale.

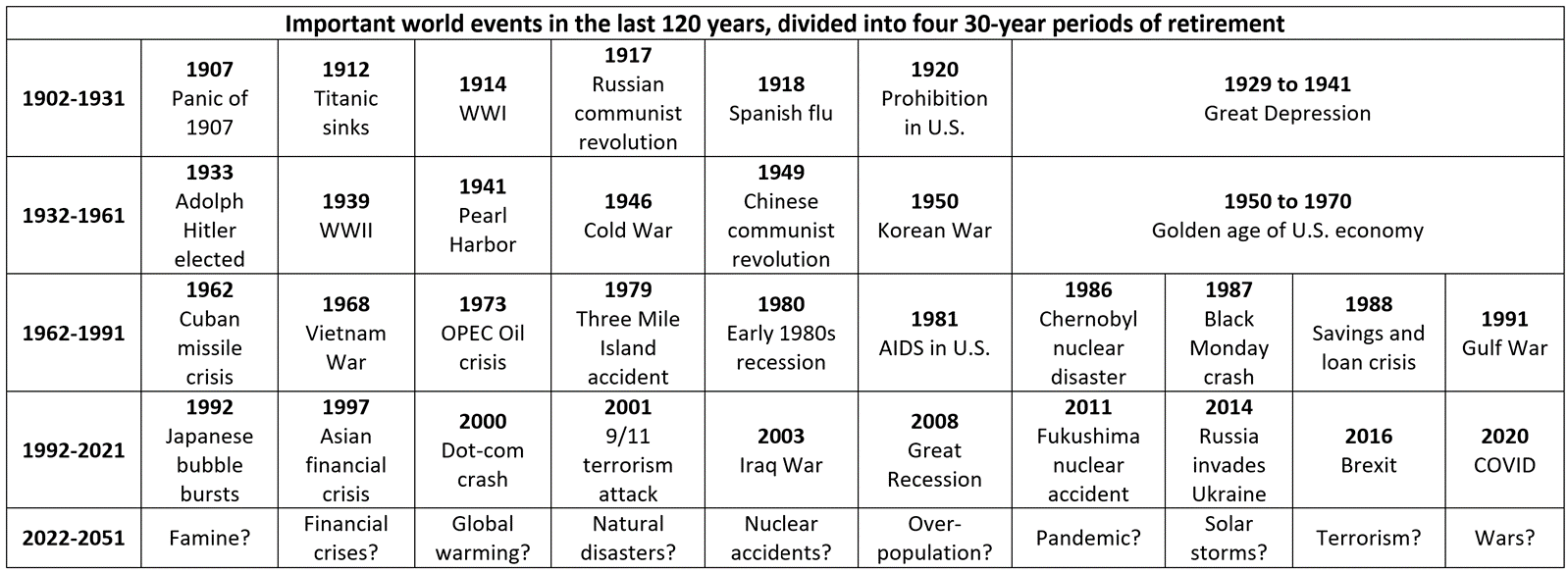

When I speak about longevity at meetings of financial advisors and their clients, I discuss world events over a 30-year retirement (see Table) and how these events could disrupt financial plans.

- 1902-1931: The first 30-year retirement period began with the financial Panic of 1907, continued with World War I (called “the war to end all wars,” a fanciful idea that was clearly wrong), included the Spanish flu pandemic (which killed at least 50 million people worldwide), and ushered in the Great Depression.

- 1932-1961: The next period was characterized by wars (World War II, Cold War, Korean War) and revolution, with a silver lining of the post-war “golden age of the U.S. economy,” a boom period that many economists believe will never be repeated.

- 1962-1991: Global instability increased, the world was perilously close to a nuclear war during the Cuban missile crisis, almost 60,000 Americans were killed in the Vietnam War. We also experienced an energy crisis, two nuclear accidents, a recession, the onset of AIDS, more financial crises and the Gulf War.

- 1992-2021: More financial crises, the 9/11 terrorism attack, the Iraq war, the Great Recession, another nuclear accident, and the 2014 Russian invasion of Ukraine. In addition, 2020 marked the beginning of the COVID-19 pandemic, which killed almost 1 million Americans and led to an unprecedented increase in national debt that will be repaid by future generations.

- 2022-2051: The current 30-year period of retirement began with the Russian invasion of Ukraine, which could have far-reaching consequences long into the future, plus the highest inflation in the U.S. in 40 years. What might lie ahead? A rising population will be forced to deal with global warming, shrinking arable land, a dwindling water supply, intense storms and other natural disasters, more wars and pandemics, the ongoing threat of terrorism, and surging migration as tens of millions of people search for a better life. As if this weren’t enough, history tells us that multiple financial crises are all but certain.

The net effect of these world events is uncertainty. That’s because the timing, severity and financial impact of these events cannot be predicted accurately by historical precedent or statistical modeling.

Perspective

Experienced financial professionals know that markets often decline during periods of uncertainty, but they always bounce back, even after wars and other catastrophic events. Reasonable investment advice is to prepare for the future via diversification and balanced portfolios, stick with long-term financial plans, and avoid decisions based on emotion and short-term market volatility. This table can help financial professionals convey this message to their clients.

Nonetheless, a few risks are worrisome if they occur at a particularly vulnerable point in retirement.

- Sequence of returns risk. Longevity of the portfolio could be significantly reduced if (a) markets decline shortly before or after retirement, and (b) ongoing withdrawals are made from the portfolio, especially if combined with rising inflation.

- Longevity risk. Risk that the nest egg may not sustain the desired lifestyle during retirement because of unexpected longevity, especially when combined with unforeseen world events late in life. For example, the nest egg of a middle-income couple may have dwindled during a 25- or 30-year retirement due to the combine effects of inflation, health care costs, and the need for expensive long-term care. Living expenses are paid from the nest egg and the couple can’t wait a year or two for financial markets to rebound.

Robert Pokorski. MD, MBA, is a consultant and public speaker with expertise in longevity, long-term care, and the decline of cognitive and financial ability at older ages. He specializes in educational meetings for financial professionals and consumers.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Robert Pokorski, MD, MBA, is a consultant and public speaker with expertise in longevity, long-term care, and the decline of cognitive and financial ability at older ages. He specializes in educational meetings for financial professionals and consumers. He may be contacted at [email protected].

SECURE 2.0 Up For A Key House Vote Tuesday

Hybrid Is The Future Of Work, Prudential Survey Shows

Advisor News

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

More Advisor NewsAnnuity News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

More Annuity NewsHealth/Employee Benefits News

- PID finds violations by Aetna Insurance

- Iowa insurance firms warn bill would make health costs rise

- ELLMAN BILL PROTECTS ACCESS TO HEALTH COVERAGE, PREVENTS DENIALS OVER PAST-DUE PREMIUMS

- Blue Cross Blue Shield of Wyoming CEO Gore announces retirement; Urbanek to take lead

- Wellpoint taps Rachel Chinetti as president

More Health/Employee Benefits NewsLife Insurance News

- Jackson Earns Award for Highest Customer Service in Financial Industry for 14th Consecutive Year

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

- How AI can drive and bridge the insurance skills gap

- Symetra Partners With Empathy to Offer Bereavement Support to Group Life Insurance Beneficiaries

More Life Insurance News