Suozzi to reintroduce WISH Act to assist with long-term care

More older Americans have severe cognitive impairments or are unable to perform at least two activities of daily living. At the same time, this aging and vulnerable population has fewer people who are available to help them with their needs.

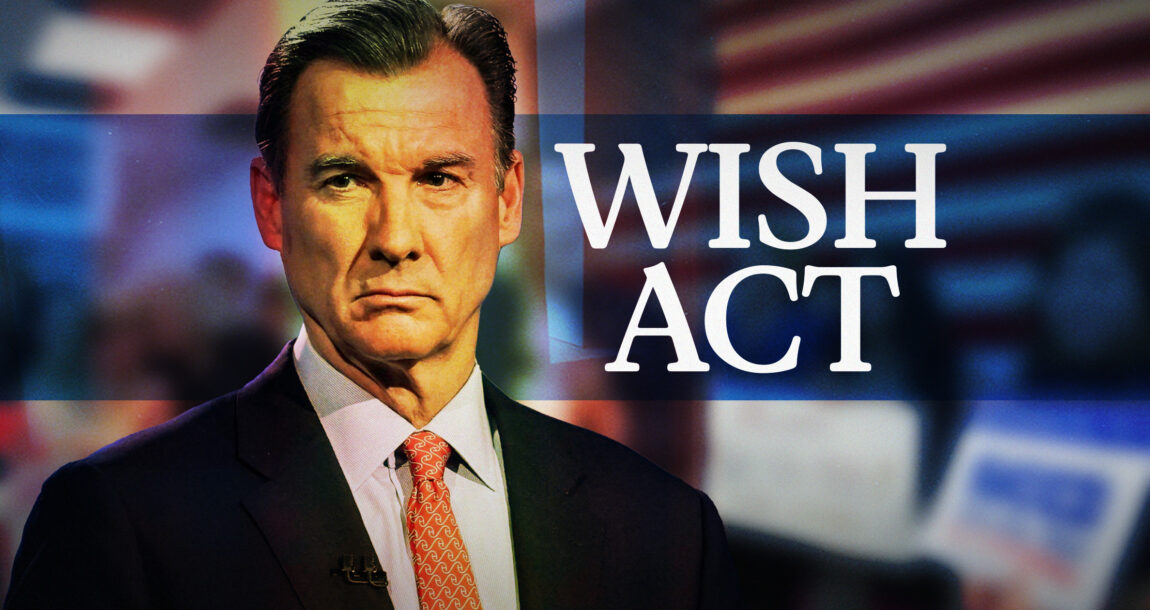

Congressman Tom Suozzi, D-N.Y., announced his plan to reintroduce the Well-Being Insurance for Seniors to be at Home, or WISH Act during the National Association of Insurance and Financial Advisors Peak 65 Impact Day.

Suozzi introduced the WISH Act in 2021 but the bill received little traction in Congress. Suozzi said he plans to try again, describing the issue of caring for the nation’s elderly “a real life issue for a lot of America.”

“We have to address what is a major storm coming in America,” he said. “People have fewer kids, kids move away from their community. There are fewer people available to take care of more people who are seniors and need help. We recognize that the long-term care insurance industry can’t provide affordable products because people who live longer than average break the actuarial tables.”

The WISH Act would target benefits to those with disabilities and would be paid for by an additional 0.6% payroll tax split equally between employees and employers.

Long-term care benefits would be available for applicants who have reached the retirement age, have paid the tax for at least six quarters, are unable to perform at least two activities of daily living or have severe cognitive impairment, are expected to have a disability for at least one year or until death, and have completed a waiting period after the onset of the disability.

The waiting period would be based on income: beneficiaries with income in the bottom 40th percentile would receive benefits after one year. Then, for every 1.25 percentile increase in lifetime income, the waiting period would increase by one month (for example, an individual in the 50th percentile would have to wait one year and eight months for benefits, while an individual in the 100th percentile would have to wait five years). This ensures benefits flow most quickly to those most in need, while keeping the program actuarially sound.

The long-term care benefit would be a cash amount equal to the median cost of six hours per day of paid personal assistance, or $3,600 per month.

“This will help the private sector develop products that are affordable by taking the catastrophic aspect of long-term care off the table,” Suozzi said.

He said he plans to hold a national conference in spring 2025, bringing together those from the private sector who work in the long-term care space, as well as advocates for the elderly, trade groups and labor groups, to discuss how a public/private partnership can help Americans pay for catastrophic long-term care.

“We must build a national coalition of people to make this issue more prominent,” he said.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

IUL: What agents should know to present an illustration effectively

Financial sector under new Trump administration taking shape

Advisor News

- Millennials are inheriting billions and they want to know what to do with it

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsLife Insurance News

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

More Life Insurance NewsProperty and Casualty News

- Best’s Special Report: Catastrophe Bond Market Growth Accelerates, As Loss Multipliers Compress

- Visitor Guard® Rolls Out 2026 FIFA World Cup Travel Insurance for Fans Visiting the USA, Canada, and Mexico

- Medical malpractice success a win, but more needed

- Going Places: Global Insecurity Heightens Need for Emergency Plan, Travel Insurance

- New Mexico governor signs major medical malpractice bill into law

More Property and Casualty News