Study: Consumers find life insurance policies overly complex

Despite efforts to improve customer communications, life insurers are seen as unnecessarily complicating explanations of their policies, according to the J.D. Power 2024 U.S. Individual Life Insurance Study released Thursday.

This perception is most pronounced among younger customers, including Gen Zers, according to the study.

“Life insurers are facing new communication challenges as they court younger consumers,” said Breanne Armstrong, director of insurance intelligence at J.D. Power. “Currently, only 29% of life insurance customers ‘strongly agree’ that their insurer makes complex policies simpler, and Gen Z has the lowest incidence of saying their agent or advisor explains things in terms they can easily understand. The old model of text-heavy binders and jargon-filled informational packets will no longer cut it. Younger customers are looking for simpler guides, diagrams and easy-to-understand definitions when evaluating policies.”

Key Findings

Policies are too complex to understand. Let than one-third (just 29%) of life insurance customers say they “strongly agree” their insurer makes complex policies simpler while 61% say their agent or advisor explains things in terms they can understand. Among members of Gen Z, that number falls to 57%. Overall, 64% of life insurance customers say they fully understand their policies.

Simplifying the life insurance statement: When asked what insurers could do to make life insurance statements easier to understand, most customers say: “reduce complexity/make statements easier to read.” Younger Gen Z and millennial customers are looking for a guide or diagram on how to read the statement or links to educational videos and materials that explain how to read it, according to the study.

Meeting future needs: Fewer than three-fourths (72%) of life insurance customers say their policy completely meets their future needs. According to the study, insurers can increase this rate significantly by “tailoring communications to specific customer needs, delivering the right frequency of communication and ensuring that the policy is completely understood.”

Study Rankings

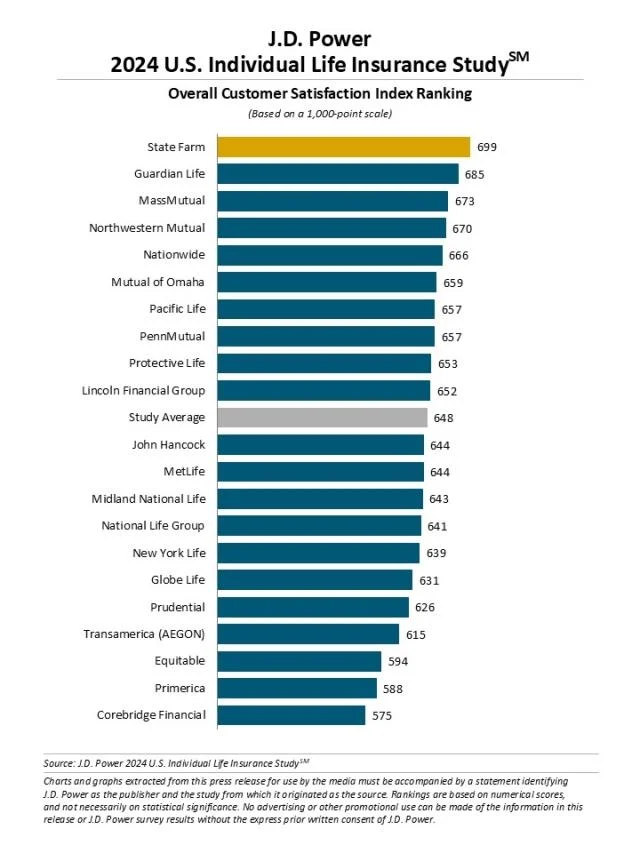

State Farm ranks highest among individual life insurance providers for a fifth consecutive year, with a score of 699. Guardian Life (685) ranks second and MassMutual (673) ranks third.

The U.S. Individual Life Insurance Study was redesigned for 2024. (Scores are not comparable year over year with previous studies.) The study measures the experiences of customers of the largest individual life insurance companies in the United States across eight core dimensions (in order of importance): trust; value for price; ease of doing business; people; product offerings; ability to get service; problem resolution; and digital channels. The 2024 study is based on responses from 4,731 individual life insurance customers and was fielded from April through July 2024.

FMO: Does an independent insurance agent need one?

Hawaii’s high court sides with AIG in climate change lawsuit

Advisor News

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

- Todd Buchanan named president of AmeriLife Wealth

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Reed: 2026 changes ABLE accounts benefit potential beneficiaries

- Sickest patients face insurance denials despite policy fixes

- Far fewer people buy Obamacare coverage as insurance premiums spike

- MARKETPLACE 2026 OPEN ENROLLMENT PERIOD REPORT: NATIONAL SNAPSHOT, JANUARY 12, 2026

- Trump wants Congress to take up health plan

More Health/Employee Benefits NewsProperty and Casualty News

- Insurance carriers can now carve out wildfire coverage from Nevada homeowner policies

- The Seattle Times: Remain wary even as feds resume review of research grant applications

- Big changes in 2026 traffic laws: What drivers should know nationwide

- Napa County working on wish list for Sacramento, Washington

- Big changes in 2026 traffic laws: What drivers should know nationwide

More Property and Casualty News