Strongest Life-Annuity Market In 20 Years, Conning Says

Annuities, especially variable and indexed products, will boom in what was called the best insurance environment in 20 years during Conning’s 2022 Outlook webinar.

“The overriding theme is that the insurance industry is going through a strong growth mode, and probably the strongest we've seen in 20 years now,” said Steven Weberson, head of insurance research. “We see evidence of that in just about every line of business throughout both the property/casualty and the life sectors.”

Strong consumer demand for new products is propelling the growth. In the life sector, the SECURE Act opened the door for enormous opportunity in retirement accounts.

Carriers already in the retirement space will be able to develop products for retirement accounts, but even carriers not in that space will benefit from asset managers who need to link with insurers, said Scott Hawkins, director of life/annuity insurance research.

Demographic shifts are also benefitting annuities, Hawkins said, as more boomers retire and shift their retirement assets from 401(k)s to IRAs to generate retirement income. Generation X is also moving into their prime years for retirement saving, and annuities will likely benefit from that savings, as well as the introduction of annuity life solutions in 401(k)s in response to the SECURE Act.

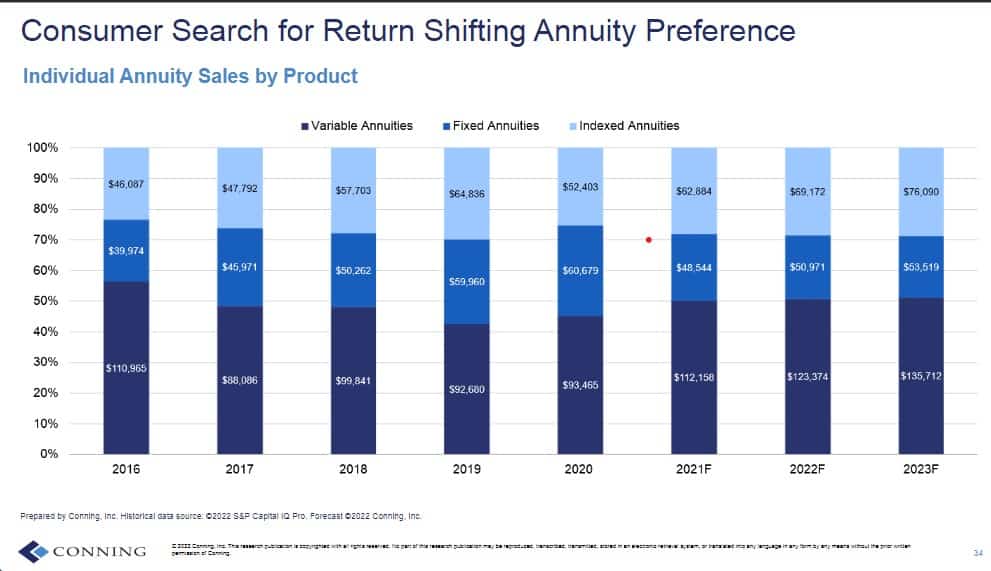

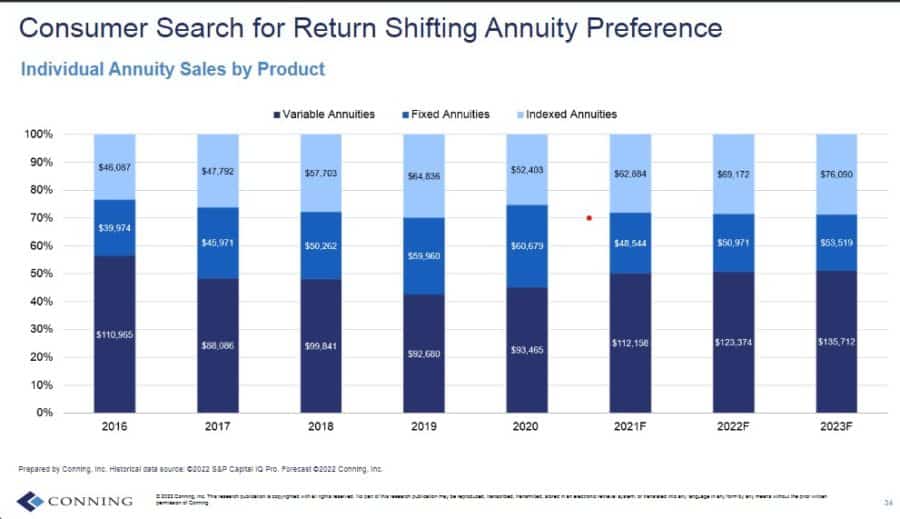

Demand will push fixed index annuities and variable annuities, particularly registered index-linked products, as consumers seek a higher return in a low-interest environment, Hawkins said. But consumers have regained a VA appetite not seen since the 2008 crash.

Conning forecasts that VAs will increase from 43% of total individual annuity premium in 2019 to 52% in 2023, Hawkins said. Fixed index annuities will grow from 36% to 42% over the same period.

“We think it will continue beyond that,” Hawkins said of the VA trend. “Now a major reason for that reversal is the emergence of RILAs, those are registered index-linked annuities, which have been the hot annuity product for the past few years. That said, even traditional VA sales have increased, especially sales of investment-only VAs which do not have embedded guarantees.”

Carriers have seen a lift over the past year or so not just from increasing demand, but also from capital injections, such as from selling legacy or closed blocks, Hawkins said. Annuity insurers looking to restructure their annuity business now have multiple reinsurance partners to work with, particularly registered investment advisors backed by private equity.

'More Difficult'

A relatively small number of PE-backed firms are consuming smaller operations. Of 391 acquisitions of life annuity brokers, RIAs and financial advisors last year, the top 10 accounted for 122 of those transactions, and the top 20 acquirers accounted for 174.

“The PE-backed distributors are consolidating insurance shelf space, which may make it more difficult for smaller life and annuity insurers to increase distribution,” Hawkins said. “On the other hand, larger insurers may find themselves partnering with larger distributors to create proprietary products, as well as more closely integrate their technologies to smooth application customer service processing.”

Integrating technology has been slow in the life/annuity sector, but uptake is accelerating.

Insurtech acquisitions are picking up, Hawkins said. Through the first three quarters of 2021, there were 115 global life/annuity insurer tech deals, compared with 74 for the same period in 2020, and 80 for the same period in 2019. Most of those insurtech investments have been to support distribution.

“This focus on distribution is driven by the opportunity to squeeze expenses from the sales process in both carriers and distributors as well as the shift toward consumer demand for digital sales solutions,” Hawkins said.

Besides individual companies and collaborations between companies, new “full-stack” insurers are emerging. Three of these companies were established as of the third quarter of 2021.

They have yet to begin sales but they are in operation, Hawkins said. Two of the companies, Bestow and Ladder, began as digital distribution agencies selling term life products. They have acquired life insurers to become full-stack digital insurers. Dayforward began as a digital startup initially focused on Texas with plans to expand across the nation.

“There are a couple of points for insurers to think about here,” Hawkins said. “First, these companies have attracted capital, which shows that the idea of a digital life insurance appeals to investors. Second, if these companies are financially successful and prove the concept of a full-stack, digital life insurer, then we will expect others to follow suit.”

Life Insurance Perks Up Slightly

Individual and group life insurance losses and sales continue to see a significant impact from COVID-19, which is expected to continue but differently for the individual and group markets.

For individual life, higher levels of vaccination, improved medical care and tighter underwriting led Conning to forecast a slow decrease in death benefits paid out through 2025. Death benefits still remain well above pre-pandemic levels.

Death benefits for group life are likely to continue increasing as more workers returned to the workforce. Because group life coverage is often not underwritten, it can be higher mortality risk exposure for group insurance than for individually underwritten policies.

“It's important to understand that COVID-19 has been just one factor in the increased mortality experienced by the industry,” Hawkins said. “There have been different causes for that mortality based on age. At the oldest stages, excess mortality has been almost completely explained by COVID-19. There's been a great deal of relatively excess mortality at younger ages during the pandemic as well, but that mortality reflects COVID as well as other external causes. Chief among those external causes or accidental causes, such as drug overdose and motor vehicle accidents, homicides and suicides, as well as other non-COVID-19 natural causes of death.”

The younger age excess mortality is troubling because those trends may persist past the pandemic. This is particularly concerning for group life claims because employees are generally younger. This could also affect carriers because they tend to hold less policy reserves for younger policyholders.

On the pluse side, the pandemic has heightened awareness for life insurance with a spike spike in applications in the fourth quarter of 2020 and the first quarter of 2021. Another spike followed the Delta and Omicron waves of COVID-19.

Although that might signal a reversal of the pre-pandemic trend of lower insurance ownership, the increased application activity did not necessarily translate into more policies being issued, Hawkins said. In fact, the total number of policies issued in 2020 decreased compared to 2019, he said, reflecting a shift to a work from home environment, as well as stricter underwriting during the pandemic.

“What's interesting is the total number of policies decreased, but the number of term life policies issued increase,” Hawkins said. “This suggests to us a consumer shift towards term life, which traditionally has been favored by younger buyers. Looking ahead, the increase consumer demand for new policies is a strong positive, but insurers need to remember that demand may not translate into large premium increases if fewer policies are issued, and if consumers favor lower costs term life over whole life.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Regulators Split On Plan For Insolvent Pennsylvania Health Insurer

California Couple Sentenced In Insurance Fraud Case Totaling Nearly $1M

Advisor News

- Social Security retroactive payments go out to more than 1M

- What you need to know to find success with women investors

- Senator Gary Dahms criticizes Governor Walz's proposed insurance tax increase

- Social Security staff cuts could ‘significantly impact’ beneficiaries

- Building your business with generative AI

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Idaho House approves Medicaid reform bill

- Trump makes it official: The American apology tour is over

- People, News & Notes: State treasurer advocates for increase in health plan premiums

- Accounts way to empower Americans with disabilities

- State employees denounce looming cost hikes as NC health plan tackles $1.4B shortfall

More Health/Employee Benefits NewsLife Insurance News