Securing income through a fully insured plan

Your business owner prospect or client has spent years navigating the highs and lows of running a business. Now, when it comes to their own financial future, they need to make up for lost retirement savings. At this point, they are also looking for predictability with their retirement plan more than anything else. The goal is to turn the business into a steady stream of income. However, many business owners do not have a plan where they can choose the benefit (sale price), choose the time (when to sell) and choose who will buy (a willing buyer).

What if there were a plan that provided a guaranteed lump sum offering a steady stream of income and no market volatility, at the time to be chosen by the owner, with no stress finding a buyer and a relatively large tax deduction? Solution — the fully insured plan!

A fully insured plan, or 412(e)(3) plan — for those who have been around, a 412(i) plan — is a type of defined benefit plan that must be funded by fixed annuity contracts or a mix of fixed annuities and life insurance. This funding shields the plan’s assets from market volatility, securing your client’s future income — predictably. Administration is simple and exact, and owners may contribute a substantial amount, offering larger tax deductions than a profit-sharing 401(k) plan or a 403(b) plan.

A fully insured plan is a way to provide those business owner clients who are making up for lost retirement income planning with the confidence and peace of mind that those funds will be there no matter what the market is doing, when they are ready to begin receiving their income. Not only does this strategy work in the for-profit world, but it also works for those in nonprofits.

A fully insured plan is a qualified defined benefit plan. Like all qualified defined benefit plans, it must meet certain minimum requirements prescribed by law. Furthermore, a fully insured plan differs from other traditional (defined benefit) pension plans with respect to the method of funding. A fully insured plan must be funded solely through life insurance contracts (fixed annuity or a combination of fixed annuity and life insurance).

In addition, just like other qualified defined benefit plans, it must meet the coverage, participation, nondiscrimination, top heavy, benefit limits and incidental (death benefit) rule required by law.

Qualified retirement plans, including fully insured plans, may be designed in a variety of ways provided they do not discriminate in favor of highly compensated employees. In 2025, an HCE is anyone who is compensated more than $160,000 or owns more than 5% of the business. In order not to violate the nondiscrimination requirements, the IRS has provided certain guidelines and tests as well as safe harbor provisions that may be used by plans for compliance purposes, though they are beyond the scope of this article.

To summarize, the client who is a best fit for a fully insured plan is one who

» is looking to play catch-up with their retirement income planning;

» would like a larger tax deduction;

» is committed to making contributions each year;

» values a plan with guarantees, with a guaranteed retirement benefit;

» may be looking for a plan that may be self-complete, providing for survivor income;

» is generally older and being compensated more than rank-and-file employees; and

» pairs well with an existing profit-sharing 401(k) plan or 403(b).

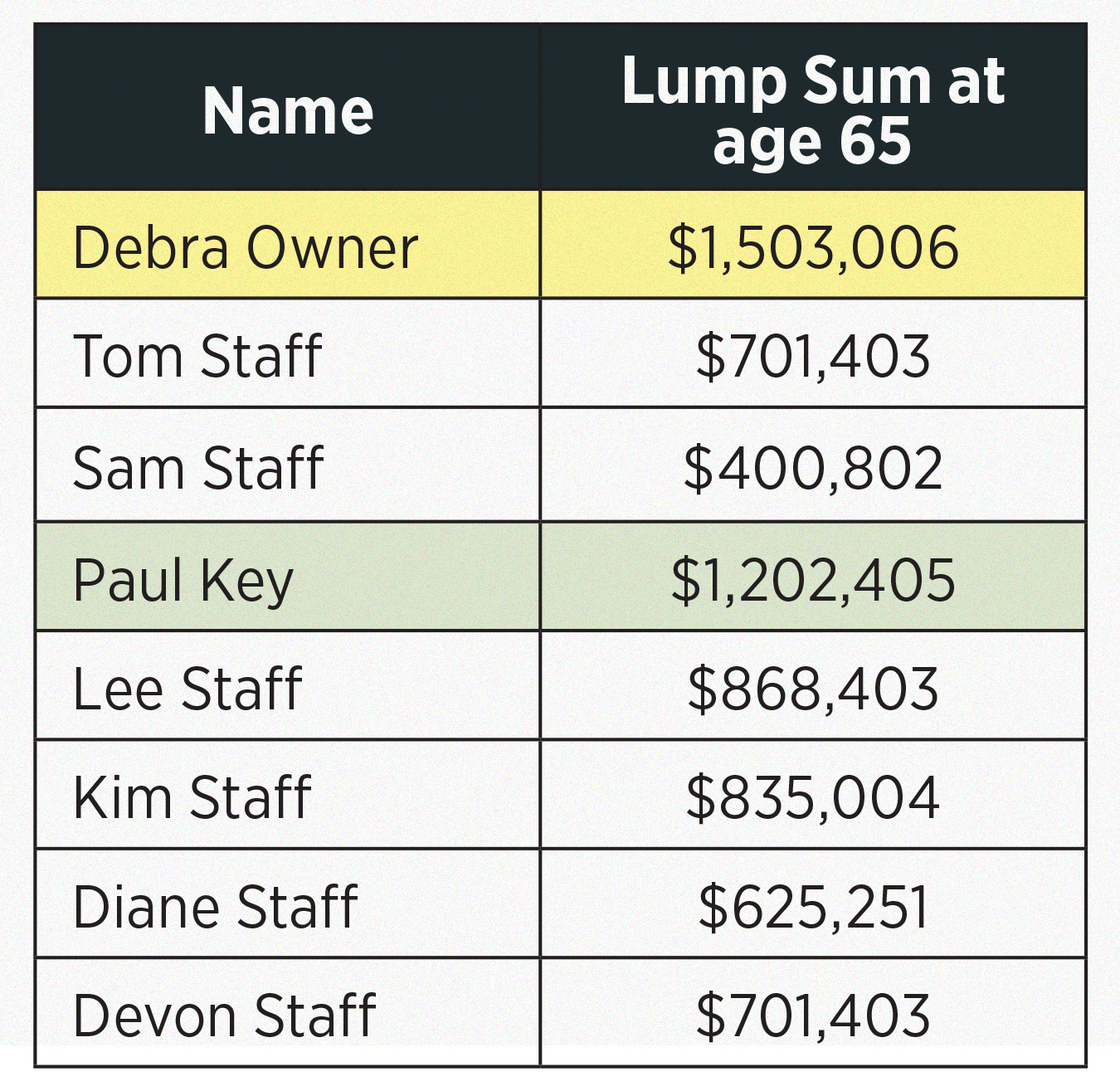

A case study will show how the fully insured plan prepared for Debra, a sole owner, carried out the goals of providing a catch-up plan for retirement income, providing a large tax deduction, and offering a valuable employee benefit. In addition, the solution also provided a benefit for a key employee. The employer has met the profile captioned above. The census is shown below.

The solution is a fully insured plan.

At retirement, age 65, here’s what they receive:

Debra received a large tax deduction, saving her $134,078 (in a combined 40%) in taxes; provided for her survivors with a permanent death benefit of more than $2.2 million, a portion of which remains income tax-free, and achieved her retirement income goal safely with more than $1.5 million with no market volatility (which may be used to fund an income annuity of approximately $7,500 per month for life, which will supplement her other savings from a profit-sharing 401(k) plan and the eventual sale of the business).

In addition, it was discovered that Paul is a key employee who eventually is targeted to take over this business; therefore, his contribution will be factored into the buy-sell arrangement and other nonqualified arrangements that are in place or will be established.

In your next review or prospecting conversation, ask, “What guarantees are currently in your portfolio?” “How much of your future financial income is guaranteed?” “Are you looking for larger tax deductions today?” and “Are you concerned about the market’s impact on your retirement income?”

Ernest J. Guerriero, CLU, ChFC, CEBS, CPCU, CPC, CMS, AIF, RICP, CPFA, national president of the Society of Financial Service Professionals, is the director of qualified plans, business markets for Consolidated Planning. He may be contacted at [email protected].

Wink reports a 4Q dip in annuity sales to close a record-breaking 2024

A changing approach to client prospecting

Advisor News

- Affordability on Florida lawmakers’ minds as they return to the state Capitol

- Gen X confident in investment decisions, despite having no plan

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

More Advisor NewsAnnuity News

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

More Annuity NewsHealth/Employee Benefits News

- TRUMP ADMINISTRATION DROPS MEDICAID VACCINE REPORTING REQUIREMENTS

- SLOTKIN, WHITEHOUSE, AND SCHAKOWSKY INTRODUCE PUBLIC HEALTH INSURANCE OPTION LEGISLATION

- Wittman, Kiggans split on subsidies

Wittman, Kiggans split on subsidies

- Wittman, Kiggans split on subsidies

Va. Republicans split over extending health care subsidies

- Report: Connecticut can offset nearly $1B in federal cuts

More Health/Employee Benefits NewsLife Insurance News