RMD strategies: Funding the ‘third trimester’ of life

(Editor's Note: Part 2 of a 3-part series on required minimum distributions.)

By Lloyd Lofton and Gene Bond

Many Nobel Prize winning economists and health care professionals refer to the retirement years as the third phase or “third trimester” of life.

It is likely that if you are in good health, you will live 30 years or longer in retirement, and this is especially true if you are married.

As you can see from Part 1 in our series about Required Minimum Distributions, RMDs can be complex and complicated. If your client fails to withdraw enough from their traditional retirement account in a given year, the tax penalty is pretty stiff – equal to 50% of the amount your client failed to withdraw.

When to take RMD

At the same time, the rule about when your client must take their first RMD can be confusing.

You must take your first RMD no later than April 1 of the year after you turn 72.

So, if your client turns 72 this year (2022), they must take their first RMD no later than April 1, 2023.

All RMD withdrawals after the first one must be taken no later than Dec. 31 of the year the withdrawal is due.

I know what you are thinking: I don't have to withdraw my first RMD until April 1 of the year after I turn 72. If you do that, then you will postpone taking your first RMD in the year you turn 73.

See, Lloyd, I get the strategy!

There could be a problem with that.

You will also have to take the RMD for the year you turn 73 in the same year you took your first RMD. So you will be taking two RMDs in the year you turn 73.

Is that what your clients want to do? Are they prepared for the impact on their tax filing?

This could cause your clients to pay more federal income tax the year they turn 73. Your clients may have to pay federal income tax on an increased amount of their Social Security the year they turn 73. They may have to pay a higher premium for their Medicare Part B and Medicare Part D Prescription Drug Plan. They also may have to pay an additional Medicare tax

Is that anything else for your client to be concerned about? Things also can get more complicated for people who are not 72 yet.

There are several bills currently floating around in Congress that may change the age someone must begin taking RMDs. One of those bills establishes a sliding scale for RMDs.

Instead of 72 serving as the default age when minimum distributions start, RMDs would begin according to the following schedule:

- Age 73 in 2023 for people who turn 72 after Dec. 31, 2022, and for people who turn 73 before Jan. 1, 2030.

- Age 74 in 2030 for people who turn 73 after Dec. 31, 2029, and for people who turn 74 before Jan. 1, 2033.

- Age 75 in 2033 for people who turn 74 after Dec. 31, 2032.

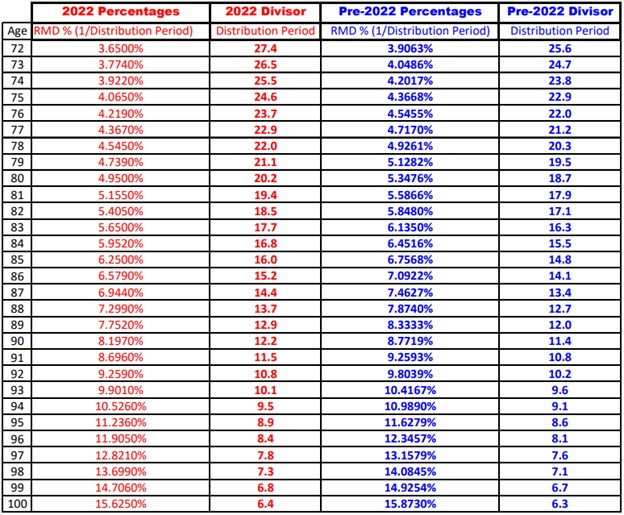

In other words, using the new rules, a 75-year-old must take about the same amount as someone who is 73 years old under the old rules; a 76-year-old must withdraw about the same amount as a person who is 74 years old under the old rules.

The old and the new and 2 strategies to reduce federal income taxes

2 strategies

Once you know the account balance, you either divide that number by the divisor for that age or you can multiply that number times the percentage for that age.

For example, if the account balance is $1 million and your client is 72 years old, you can either divide that number by 27.4 or you can multiply the number by 0.0365.

If you multiply $1 million times 0.0365, you get $36,500. If you divide $1 million by 27.4, you get $36,496.35.

Warning: Before you read part 3 of our series, take some Tylenol because your head may explode. You could become dizzy after reading some of the abbreviations and names on the bills currently in Congress, as we take a look at how these proposed bills can impact our clients and your practice.

Lloyd Lofton is the founder of Power Behind the Sales. He is the author of The Saleshero’s Guide To Handling Objections, voted 1 of the 11 Best New Presentation Books To Read in 2020 by BookAuthority. Lloyd may be contacted at [email protected].

Gene Bond, a Certified Financial Fiduciary, is founder of Bond Financial Group and is one of the producers of "The Baby Boomer Dilemma" a documentary that explores the science of retiring successfully. Gene may be contacted at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

When kittens go wild – how climate change is increasing loss

Panel examines COVID-19 impact on retirement expectations

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- Medicare Advantage Insurers Record Slowing Growth in Member Enrollment

- Jefferson Health Plans Urges CMS for Clarity on Medicare Advantage Changes

- Insurance groups say proposed flat Medicare Advantage rates fail to meet the moment

- As enhanced federal subsidies expire, Covered California ends open enrollment with state subsidies keeping renewals steady — for now — and new signups down

- Supervisors tackle $3.1M budget deficit as school needs loom

More Health/Employee Benefits NewsLife Insurance News