RILAs Pop 88% In Sales, Continuing Shift To Variables

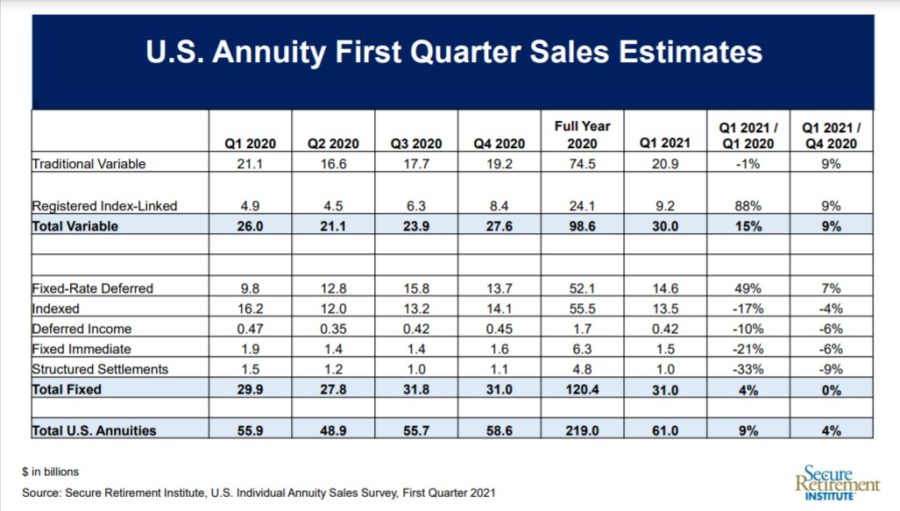

Annuity sales continued their shift from fixed to variable products in the first quarter with registered index-linked annuities booming with an 88% jump from the first quarter of 2020.

RILAs popped 9% over the previous quarter, as did traditional variable annuities, but VAs were down 1% compared with the year-ago quarter, according to the Secure Retirement Institute Individual Annuity Sales Survey.

In the fixed annuity camp, non-indexed, fixed-rate deferred annuities had a strong quarter, building on a year of growth, with 7% over the previous quarter and 49% over the first quarter of 2020. Although the $14.6 billion in sales in the first quarter bested the previous quarter, they fell short of the $15.8 billion in the third quarter of 2020. The products are simpler than other annuities, particularly indexed annuities, which helped in a virtual sales environment.

The two booming categories helped boost total annuity sales to $61 billion, up 9% from first quarter of 2020.

Other than fixed-rate deferred annuities, products designed for protection did not fare as well.

Indexed annuity sales fell 13% over the first quarter of 2020. FIAs’ $13.5 billion in sales fell below the $14.6 billion in fixed-rate deferred annuities for the quarter, a dramatic reversal from the first quarter of 2020 when $16.2 billion in indexed annuities were sold vs. $9.8 billion in fixed-rate deferred.

Todd Giesing, assistant vice president, SRI Annuity Research, said he expects that consumers’ shift in preferences will likely continue. Sales for products with income features dropped 16% compared with 1Q 2020, he said.

“While SRI is forecasting sales growth to continue through 2025 as economic conditions improve, we expect growth of protection-based products to slow and income products to increase as we transition into the new normal in the U.S.,” Giesing said.

In another shift, more consumers are putting more non-qualified money into annuities, he said.

“Nonqualified annuities increased 22% in the first quarter, while IRA sales only increased 2%,” Giesing said. “The last time nonqualified annuity sales increased this much was in third quarter 2018.”

Carriers have been struggling to offer attractive fixed products as interest rates have been at historic lows for a decade. Treasury Secretary Janet Yellen offered a glimpse of hope this weekend when she said she is pushing for rates to return to “normal.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Commercial Insurance Prices Increase Again In 1Q

25% Of Parents Don’t Enforce Teen Driving Laws, Insure.com Says

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsHealth/Employee Benefits News

- Expiring health insurance tax credits loom large in Pennsylvania

- Confusion muddies the debate over possible Medicaid cuts

- Trump protesters in Longview aim to protect Medicaid, democracy, due process

- Grant Cardone, Gary Brecka, settle dueling state lawsuits

- 9 in 10 put off health screenings and checkups

More Health/Employee Benefits NewsLife Insurance News

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

More Life Insurance NewsProperty and Casualty News

- Home insurance rates are through the roof. Can Texas lawmakers do anything?

- The top 3 insurance products every new business needs

- Flood risk rises as coverage declines in KY, TN & WV

- Arson continues to be a concern for insurers

- Tariffs hit auto repair costs hard, add uncertainty, say experts

More Property and Casualty News