RIA Collectors Push M&As Into Record Territory

The biggest deals have come from a group that has been a focus of attention the last few years -- private-equity firms, which were responsible for three of the top five acquisitions.

A few players have been so aggressive in buying up registered investment advisors that they helped drive acquisitions to an all-time high in the first quarter.

The momentum is likely to continue, putting this year on pace to be the ninth consecutive record-breaking M&A year, according to a report from Echelon Partners.

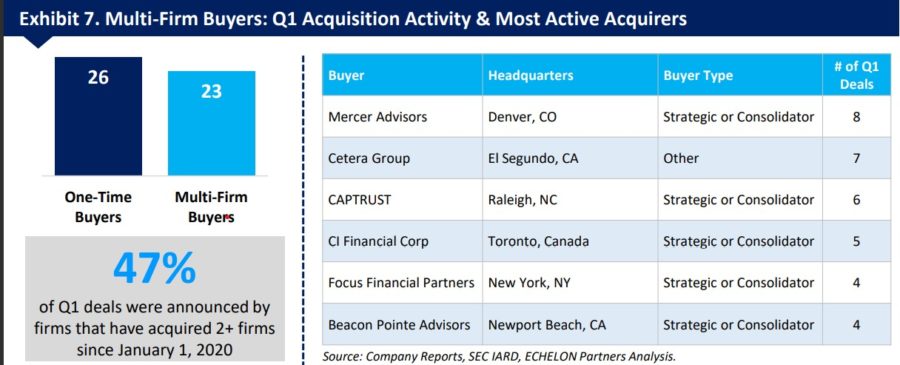

The “professional buyers” have that have engaged in multiple acquisitions across buyer categories.

Not only are those several consolidators propelling the market with about half of the acquisitions, they are also buying big.

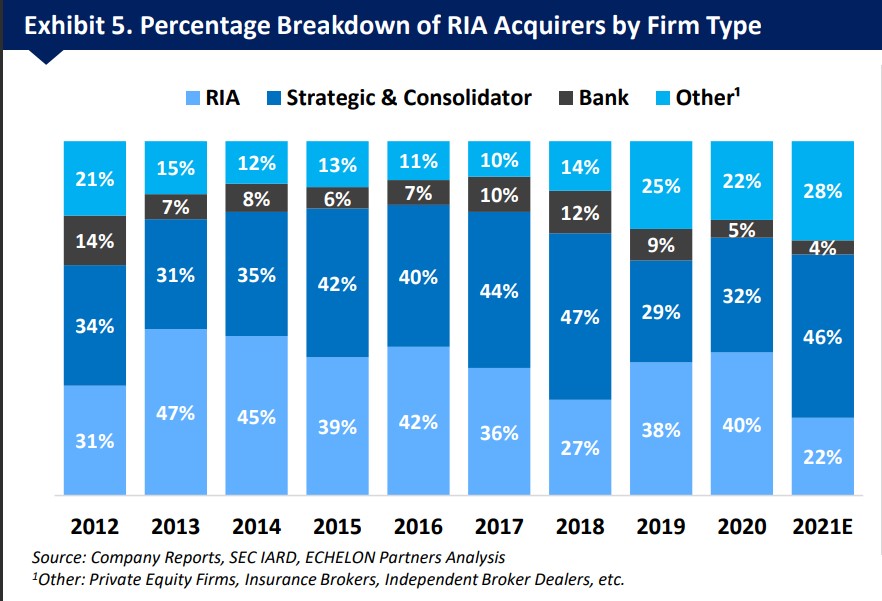

“The average AUM across the 35 transactions announced by these buyers in Q1 2021 was $2.2 billion, showing that they were much more frequently involved with the quarter’s mega-transactions,” according to the report. “Overall, strategic acquirers accounted for 46% of the deals announced this quarter, compared to only 32% in 2020. If this trend continues, it will put the category on pace to be the most active type, as was the case from 2015-2018.”

The biggest deals have come from private-equity groups have been the focus of attention these days. P/E firms were responsible for three of the top five acquisitions.

P/E firms are part of the “other” category, which also includes specialty firms and other financial buyers. Insurance brokers pushing into the advisor space are growing in this category.

“Insurance companies seeking to bolster their wealth management offerings are making up a larger portion of deals in this category,” according to the report. “Sammons Financial Group’s acquisition of Beacon Capital Management and Hub International Limited’s purchase of Alpha Pension Group both involved approximately $3 billion in AUM and were the largest deals completed by insurance companies this quarter.”

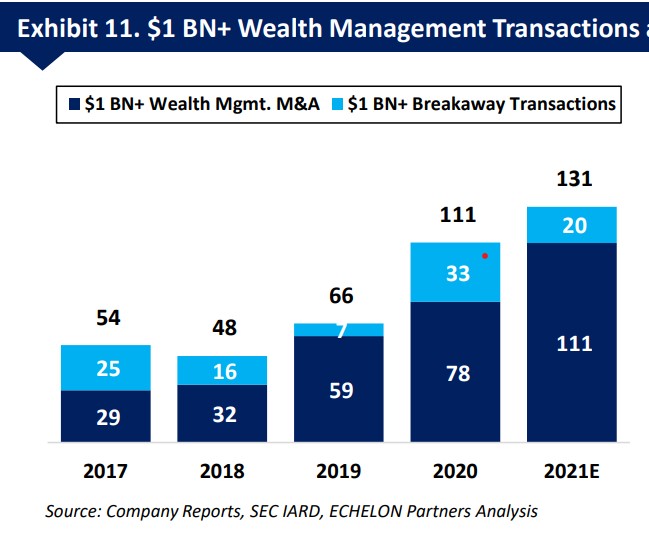

Wealth management firms are expected to be a hot commodity this year, exceeding the healthy wealth management M&A last year.

This is especially true of firms with more than $1 billion in AUM. Although Echelon expects an increase overall in the $1 billion-plus category, breakaway firms made up less of the $1 billion club.

“Even though the number of $1 BN+ breakaways is expected to decline by 39.3% from 2020’s record-breaking year, 2021’s forecasted total of 20 $1 billion-plus breakaways will still exceed the totals observed in 2018 and 2019,” according to the report.

The report cited three main reasons for the growing buyer interest in $1 billion-plus firms:

They Are Ideal Platforms. Most firms with $1 BN in AUM or more are believed to possess the ideal mix of size, structure and established platforms for future growth.

They Are Mature Businesses. Firms over $1 BN in AUM often have more infrastructure, systems, management, protective redundancy, and financial wherewithal.

Most Have More than $3 Million in EBITDA. Private equity and professional buyers seek this as a cushion to protect financial performance in the event of a market downturn.

Tech was a defining story of 2020, with firms of all sizes scrambling to improve electronic services.

“Both financial advisors and retail investors continue to demand improved customer service experience and technology as they navigate capital markets and key life decisions,” according to the report.

The acquisitions are growing larger in this space, led by a mammoth turnkey asset management platform: “The largest WealthTECH deal of the quarter was engineered by private equity firms Motive Partners and Clearlake Capital as they brought Tegra118, Finantix, and InvestCloud under one roof to create a super $1 billion+ enterprise value TAMP that boasts a wealth solutions platform with over $4 trillion in assets.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

11 Ways To Improve The Customer’s Digital Insurance Buying Experience

More Americans Confident Of A Secure Retirement, EBRI Says

Advisor News

- SEC in ‘active and detailed’ settlement talks with accused scammer Tai Lopez

- Sketching out the golden years: new book tries to make retirement planning fun

- Most women say they are their household’s CFO, Allianz Life survey finds

- MassMutual reports strong 2025 results

- The silent retirement savings killer: Bridging the Medicare gap

More Advisor NewsAnnuity News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

- Advising clients wanting to retire early: how annuities can bridge the gap

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

More Annuity NewsHealth/Employee Benefits News

- ELLMAN BILL PROTECTS ACCESS TO HEALTH COVERAGE, PREVENTS DENIALS OVER PAST-DUE PREMIUMS

- Blue Cross Blue Shield of Wyoming CEO Gore announces retirement; Urbanek to take lead

- Wellpoint taps Rachel Chinetti as president

- Proposed changes to MA and Part D would harm seniors’ coverage in 2027

- Pan-American Life Insurance Group Reports Record 2025 Results; Premiums Reached $1.86 Billion and Net Income Totaled $110 Million as Company Enters Its 115th Year

More Health/Employee Benefits NewsLife Insurance News

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- LIMRA: Individual life insurance new premium sets 2025 sales record

- How AI can drive and bridge the insurance skills gap

- Symetra Partners With Empathy to Offer Bereavement Support to Group Life Insurance Beneficiaries

- National Life Group Ranked Second by The Wall Street Journal in Best Whole Life Insurance Companies of 2026

More Life Insurance News