Regulators adopt mortality tables reflecting decade of COVID-19 loss

A state insurance regulator task force adopted mortality tables Thursday reflecting COVID-19 pandemic mortality loss over the next decade.

The Life Actuarial Task Force adopted recommendations put forth by the Society of Actuaries Research Institute and the American Academy of Actuaries for past and future mortality table adjustments.

Mortality tables are used by insurance companies to calculate reserves for claims and benefits and cash surrender value of life insurance policies. The adjustments are needed due to the 1.08 million COVID-19 deaths in the United States since 2020.

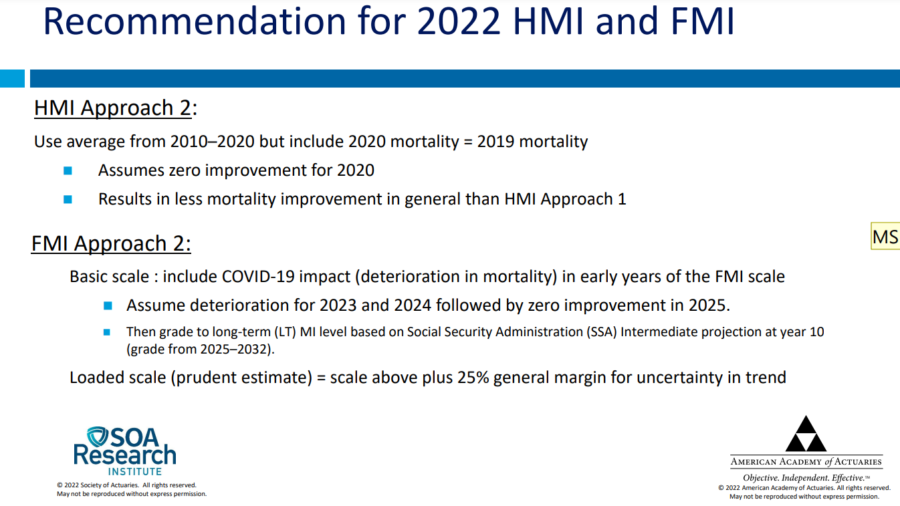

The task force adopted the following for the historical mortality improvement (HMI) and future mortality improvement (FMI):

- HMI will substitute 2019 mortality for 2020, effectively removing the COVID-19 impact from the equation.

- The FMI impact will "assume deterioration" for 2023 and 2024, followed by zero improvement in 2025. Mortality will then be graded back to average level by year 10 (2032).

Regulators had few issues with the former recommendation, but disagreed on the latter.

'Covid isn't going away'

The other FMI option called for an "all-zero FMI" for all ages and projection years. Many regulators preferred that route, but lost a straw poll vote.

Michael D. Cebula is deputy chief life actuary for the New York State Department of Financial Services. He spoke in favor of zero FMI.

"In 2020, flu was the ninth leading cause of death," he said. "So it seems plausible, realistic ... that COVID isn't going away and that it will turn into a long-lasting leading cause of death."

Other state regulators were reluctant to set a precedent with zero FMI and voted for approach two.

"I appreciate the fact that [FMI approach two] does reflect a level of COVID," said Mike Yanacheak, chief actuary in the Iowa Insurance Division. "I think that's appropriate. But I also think that there have been decades of mortality improvement, and I tend to think that there will continue to be some level of mortality improvement."

The American Council of Life Insurers endorsed the HMI approach two/FMI approach two adopted by the task force, ACLI senior actuary Brian Bayerle said in a letter.

"The recommended approaches do an excellent job of balancing various considerations," Bayerle wrote. "With respect to the HMI scale, assuming some continued deterioration based on recent years experiences is a reasonable solution to address the excess mortality in the 2020 actuals. The FMI recommendation continuing some near-term deterioration that grades off before grading to the loaded long-term MI also is reasonable given the level of uncertainty."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Why group life insurance must change

Debunking 5 in-plan annuity myths – and why that matters

Advisor News

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

- Gen X’s retirement readiness is threatened

More Advisor NewsAnnuity News

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

- MetLife Completes $10 Billion Variable Annuity Risk Transfer Transaction

- Gen X’s retirement readiness is threatened

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

- Prudential leads all life sellers as Q3 sales rise 3.2%, Wink reports

More Life Insurance News