Raising the 10-year Treasury yield year-end forecast

By Lawrence Gillum

The LPL Research Strategic and Tactical Asset Allocation Committee (STAAC) uses a number of quantitative models to help inform investment decisions.

For interest rate forecasts specifically, we utilize a range of econometric models that take into consideration economic growth and inflation expectations, foreign interest in U.S. Treasury markets, equity volatility and Federal Reserve (Fed) terminal rates, to name just a few of the factors.

Because of the recent release of the Fed’s “dot plot”, however, we’ve increased our expectation of where the fed funds rate will end the year. Add to that still elevated inflationary pressures and presumably less interest by foreign investors in U.S. Treasury markets going forward, and we think the 10-year Treasury yield can end the year between 3.25% and 3.75%, up from our previous year end forecast range of 2.75% to 3.25%.

Moreover, with this new range, we think the risks to both the upside and downside are more balanced. The increased yield target is in concert with our recent decision to increase our recommended interest rate exposure in tactical allocations from underweight to neutral.

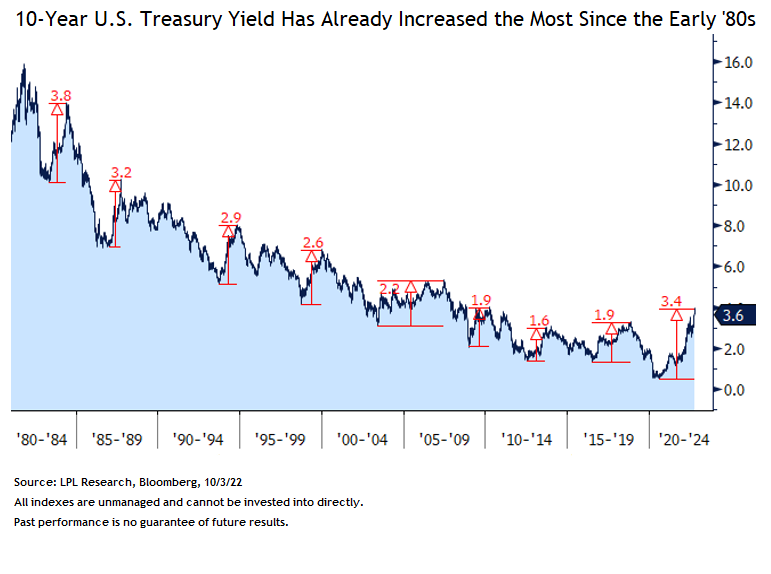

As seen in the LPL Chart of the Day, the yield on the 10-year Treasury yield was up over 3.4% from its August 2020 lows and has already seen the biggest move higher in yields since 1983-84, when rates moved higher by 3.8%. Since the 1980s, the average trough-to-peak increase in 10-year Treasury yields has been closer to 2.5%, but that includes large rate increases in early 1980s when Treasury yields were much higher.

Since 2000, the average increase in the 10-year yield during major moves higher is around 1.8%. Clearly, we’re not in normal times but the move on the 10-year Treasury yield since it bottomed in August 2020 has been significant.

The significant increase in yields, especially this year, is because of changing Fed rate hike expectations. Late in 2021, markets expected the Fed to largely stay on the sidelines and keep short-term interest rates low. However, as inflationary pressures remained (and still remain), the Fed has embarked on a historically aggressive rate hiking campaign.

Because of the Fed’s stated desire to front-load rate hikes, the current rate hiking cycle is the most aggressive campaign since the early 1980s in both the speed and magnitude of rate hikes. The Fed has signaled that more interest rate hikes will likely be necessary to arrest the generationally high consumer price increases we’re currently experiencing.

Markets have already priced in what we think is an appropriate terminal Fed Funds rate. As such, we think we may be at or near peak “hawkishness” from the Fed, which should allow fixed income yields to stabilize at or near current levels.

Lawrence Gillum is a fixed income strategist for LPL Financial

Mass. ballot initiative may represent start of nationwide dental insurance reform

Mythbusters: the impact investing edition

Annuity News

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- GBU Life introduces Defined Benefit Annuity

- EXL named a Leader and a Star Performer in Everest Group's 2025 Life and Annuities Insurance BPS and TPA PEAK Matrix® Assessment

- Michal Wilson "Mike" Perrine

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

More Annuity NewsHealth/Employee Benefits News

- In defiant speech, Lawson-Remer calls for bigger county spending, unity against federal cuts

- Editorial | Why Medicaid funding crisis matters here

- Recent Findings in Liver Cancer Described by Researchers from Kaohsiung Chang Gung Memorial Hospital (Comparing Health Insurance-reimbursed Lenvatinib and Self-paid Atezolizumab Plus Bevacizumab In Patients With Unresectable Hepatocellular …): Oncology – Liver Cancer

- Missouri Farm Bureau wants to offer health insurance alternatives for members

- Don’t let Texas move Fort Worth-area kids off health plans their families prefer | Opinion

More Health/Employee Benefits NewsLife Insurance News

- AFBA and 5Star Life Insurance Company Name Erica L. Jenkins Senior Vice President, General Counsel, and Corporate Secretary

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- Empathy Collaboration with Voya Financial Brings Industry-First Legacy Planning to Millions

- Federated celebrates record year despite industry challenges at 121st annual meeting

- Proxy Statement (Form DEF 14A)

More Life Insurance NewsProperty and Casualty News

- All Talentz Showcases Excellence in Claims Support Services at the 2025 PLRB Claims Conference & Insurance Services Expo

- Mercury Insurance Named to Forbes' America's Best Employers 2025 List

- Flood risk rises as coverage declines in KY, TN & WV

- General Indemnity Group Announces Impressive FY 2024 Results

- First Quarter 2025 Earnings Release

More Property and Casualty News