Prudential rides five $1B-selling annuity products to solid Q3

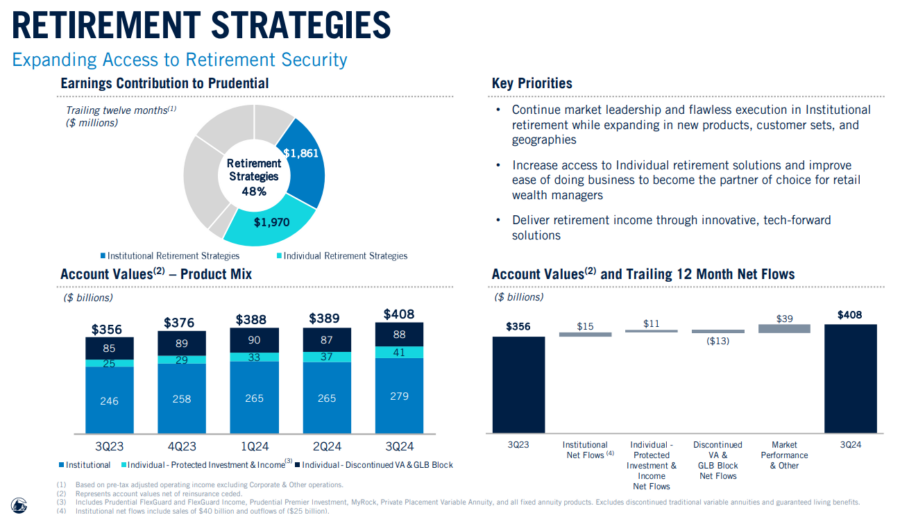

Main takeaway: Booming annuity sales helped Prudential record strong performance in its retirement businesses during a successful third quarter.

The insurer recorded net income of $448 million, a turnaround from a net loss of $802 million in the year-ago quarter. Executives discussed the results with Wall Street analysts early Thursday.

Chairman and CEO Charlie Lowrey noted that Prudential already has five annuity products exceeding $1 billion in 2024 sales. Two years ago, it had just one for the entire year.

“We are extremely pleased with our individual retirement results,” said Caroline A. Feeney, executive vice president and head of U.S. Business. “In the third quarter, we drove over $3.5 billion in sales, making it our best quarter in over a decade. And this strong performance is the direct result of our efforts over the past few years to diversify our annuity portfolio, allowing us to meet more of the consumer need for protected savings and income.”

It's the second consecutive quarter that annuity sales led Prudential's earnings report. Likewise, the business’s bottom line continues to benefit from a runoff of the insurer’s legacy variable annuity block, noted Rob Falzon, vice chairman.

Like other U.S. insurers, Prudential is an active player in the pension risk transfer market. In fact, it might be the biggest.

In September, Prudential completed a $6 billion deal with International Business Machines. The annuity deal covers about 32,000 participants and beneficiaries of the IBM Personal Pension Plan whose benefits began to be paid prior to 2016, according to IBM’s Form 8-K filed with the Securities and Exchange Commission.

“We have now closed seven out of the 10 largest pension risk transfer deals in the U.S.,” Lowrey said.

Additional takeaways

Prudential’s international business is the one area that underperformed during the quarter. It recorded adjusted operating income of $766 million in Q3, compared to $811 million in the year-ago quarter.

“This decrease primarily reflects less favorable underwriting results and higher expenses, partially offset by higher joint venture earnings and higher net investment spread results,” Prudential said in a news release.

The Newark, N.J.-based insurer’s international business is primarily Life Planner and Gibraltar Life. Lowrey and his team expressed enthusiasm for international markets, in particular, Japan.

“Our Japan business is another great example of how we are addressing the growing demand for retirement products,” he explained. “While life insurance has traditionally comprised the bulk of our business in Japan, year to date, sales of retirement and savings products are up 30% combined year-over-year.”

Management Commentary

“Prudential reported robust sales across our U.S. and international insurance and retirement businesses, as well as strong investment performance and private credit originations in PGIM. We also continue to shift our business mix, through the recently announced $11 billion Guaranteed Universal Life reinsurance transaction, and by expanding our distribution capabilities and diversifying our products to grow our market-leading businesses.”

Chairman and CEO Charlie Lowrey

Additional Notes

Partnerships: Midway through the third quarter, Prudential announced its participation in a new retirement income offering by J.P. Morgan Asset Management. SmartRetirement Lifetime Income is a target date offering that helps participants navigate the challenges associated with generating retirement income.

The lifetime income feature allows electing participants to draw down their balance over an expected time horizon correlated with average life expectancies and then, upon meeting certain requirements, the participants will begin to receive annuity income directly from the supporting insurers.

Prudential is looking for more opportunities such as this one, Lowrey told analysts.

Financial Overview

Net Income: $448 million (-802 million in Q3 2023)

Earnings Per Share: $3.48 ($3.62 in Q3 2023)

Operating Income: $1.26 billion ($1.33 billion in Q3 2023)

Share repurchases: $250 million

Dividend declared: $471 million

Stock price movement: Down about 2.5% midday Thursday to $123.31

Segment Performance

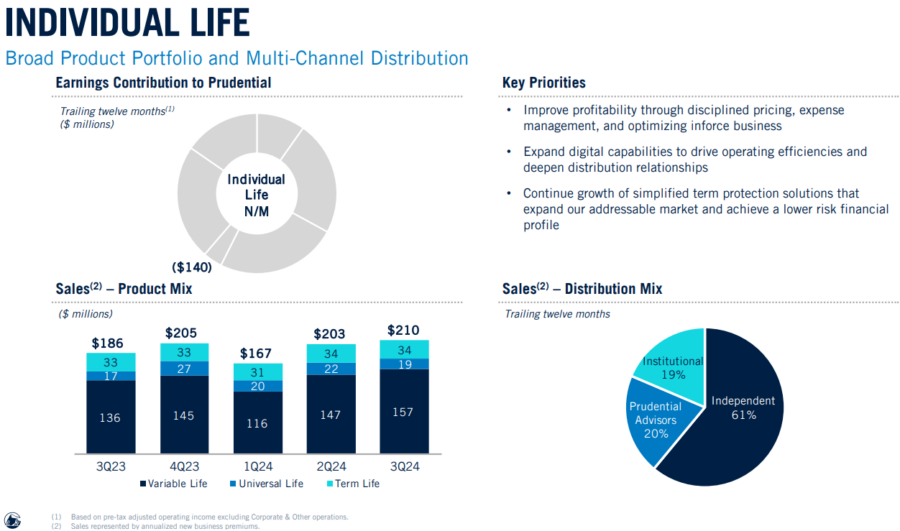

Life Insurance:

- Operating Income: $60 million ($58 million in Q3 2023)

- Sales: $210 million ($186 million in Q3 2023)

Individual Retirement Strategies (includes annuities):

- Operating Income: $528 million ($502 million in Q3 2023)

- Sales: $3.6 billion ($1.9 billion in Q3 2023)

Group Insurance:

- Operating Income: $82 million ($89 million in Q3 2023)

- Sales: $63 million ($95 million in Q3 2023)

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

A dynamic duo — Judith and Simone Lee

How insurers can tackle the cyber insurance risk of deepfakes

Advisor News

- Bill that could expand access to annuities headed to the House

- Private equity, crypto and the risks retirees can’t ignore

- Will Trump accounts lead to a financial boon? Experts differ on impact

- Helping clients up the impact of their charitable giving with a DAF

- 3 tax planning strategies under One Big Beautiful Bill

More Advisor NewsAnnuity News

- An Application for the Trademark “EMPOWER INVESTMENTS” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Bill that could expand access to annuities headed to the House

- LTC annuities and minimizing opportunity cost

- Venerable Announces Head of Flow Reinsurance

- 3 tax planning strategies under One Big Beautiful Bill

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- On the Move: Dec. 4, 2025

- Judge approves PHL Variable plan; could reduce benefits by up to $4.1B

- Seritage Growth Properties Makes $20 Million Loan Prepayment

- AM Best Revises Outlooks to Negative for Kansas City Life Insurance Company; Downgrades Credit Ratings of Grange Life Insurance Company; Revises Issuer Credit Rating Outlook to Negative for Old American Insurance Company

- AM Best Affirms Credit Ratings of Bao Minh Insurance Corporation

More Life Insurance News