Prudential Posts Big 2Q Loss, Accelerates Shift To Variable Products

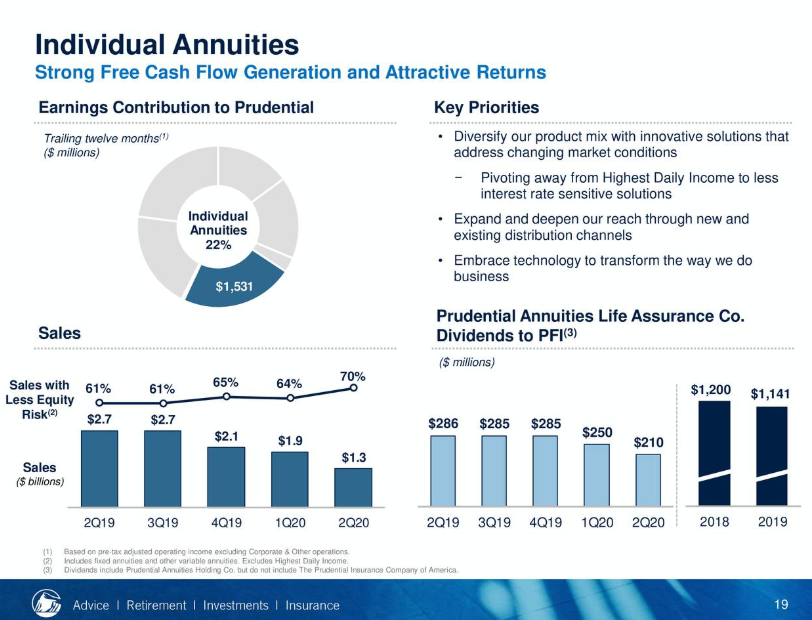

Prudential took another beating at the hands of historically low interest rates in the second quarter, and executives said they expect life insurance and annuity sales to drop further.

But the insurer is continuing to shake up its product mix to find the right combination, Vice Chairman Rob Falzon said.

"We've implemented pricing and product actions to simplify and de-risk our business mix, while protecting profitability," he explained.

For example, Prudential took "aggressive pricing actions" to "significantly reduce sales" of its High Daily Income variable annuity, and launched FlexGuard, a buffered annuity product in late May. The moves "support our product mix shift to less sensitive, less interest rate sensitive solutions," Falzon said.

In response to annuity losses, the insurer has "repriced almost our entire product line," said Charlie Lowery, chairman and CEO, and is looking at alternative books of business that are more profitable.

Overall, Prudential posted a net loss of $2.41 billion, compared with net income of $708 million a year earlier. The loss was mainly due to a decline in the value of its derivatives holdings due to tightening credit spreads.

Suspended Sales

On the life side, Prudential suspended sales of its single life guaranteed universal life product in July, Falzon noted.

"This will result in the continued shift to variable life and other less interest rate sensitive products," he said. "We will continue to take product and pricing actions, including steps to diversify our mix of business to maintain profitability in this interest-rate environment.

"As a result, we expect individual annuities and individual life sales to continue to move lower in the near term."

Prudential's individual solutions unit, consisting of annuities and life insurance, reported adjusted operating income of $185 million, down 43.4% mainly due to lower annuity sales.

"We are examining ways to further reduce the sensitivity to interest rates and exploring the potential to generate cost savings on top of our existing 2022 target of $500 million," Lowery said.

PGIM, Prudential’s global investment management business, was a bright spot, reporting record high adjusted operating income of $324 million in the second quarter, compared to $264 million in the year-ago quarter.

The increase reflects an increase in strategic investment earnings, lower expenses, and higher asset management fees, driven by an increase in average account values, the company said.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Americans Favor Aggressive Measures To Stop COVID-19, Poll Finds

US Might Be Facing Extended Economic Depression: Opinion

Advisor News

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News