Principal Financial’s benefits business jumps while AUM slumps in 2Q

Principal Financial CEO Dan Houston said he was “awestruck” by the performance of employee benefits in the second quarter as the company continues to delve into the small- and medium-sized business space.

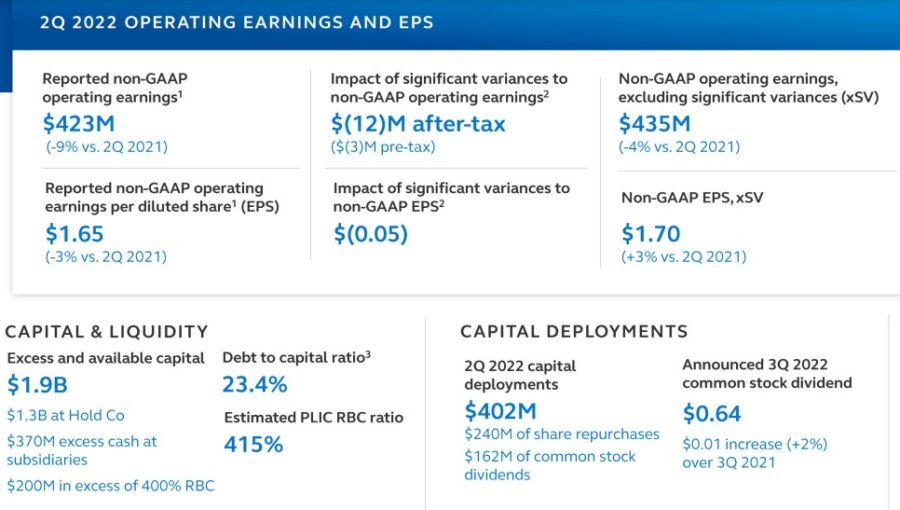

The sector was a highlight in a quarter that Houston characterized in an investors call as challenging largely because of volatile markets, high inflation and macroeconomic uncertainty. Principal Financial had $423 million in earnings, which was down 9% compared to 2Q of 2021. The losses were largely in lower net investment income, fees and other revenue.

The company had higher revenues in its Principal Global Investors and Principal Global Investors divisions but lower assets under management. Principal also closed the sale of its U.S. retail fixed annuity and universal life with secondary guarantees business to an affiliate of Sixth Street in the second quarter. Total invested assets decreased $23 billion in the quarter as a result of the reinsurance transaction.

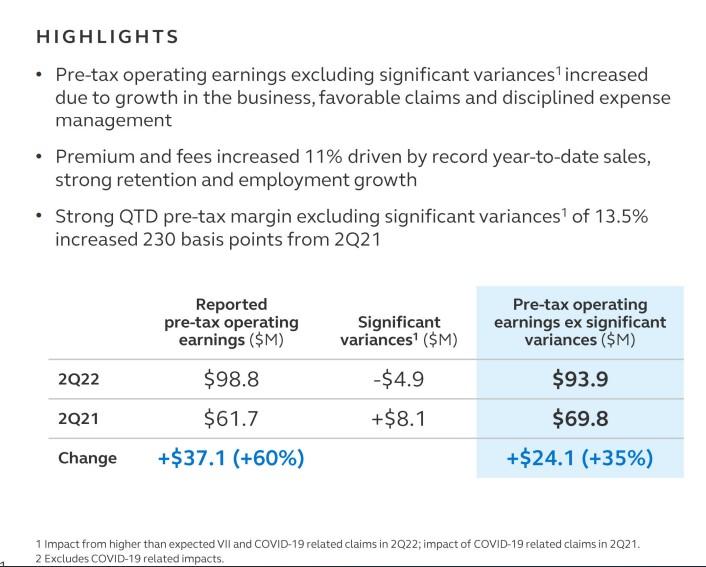

Principal offloaded the lines of business to focus on more profitable segments such as specialty benefits, which saw a record 11% increase in premium and fees over the previous quarter.

The strong labor market has helped the benefits segment by the increase in the number of employees in the program but also increases in employer benefits and matches. Half of the growth was due to new business, Houston said.

“This includes customers moving their benefits to Principal, selling additional products to existing customers, attracting customers that are offering benefits for the first time and maintaining strong retention,” Houston said. “The remaining growth is attributable to employment growth and higher salaries from existing customers.”

The company did see a slight increase in employees’ hardship withdrawals.

Houston also pointed to the division’s tech, which won recognition when DALBAR rated the company No.1 in online group benefits administration.

“This award spotlights one of our strategic priorities, customer experience, by listening to our customers and responding with systematic improvements to both digital and human interactions,” Houston said.

Individual life insurance was down 27% (excluding significant variances) compared with the previous quarter, driven by the sale of business lines to Sixth Street. But the business life segment shows the company’s focus on the small- and medium-sized business market with a 76% increase year-over-year.

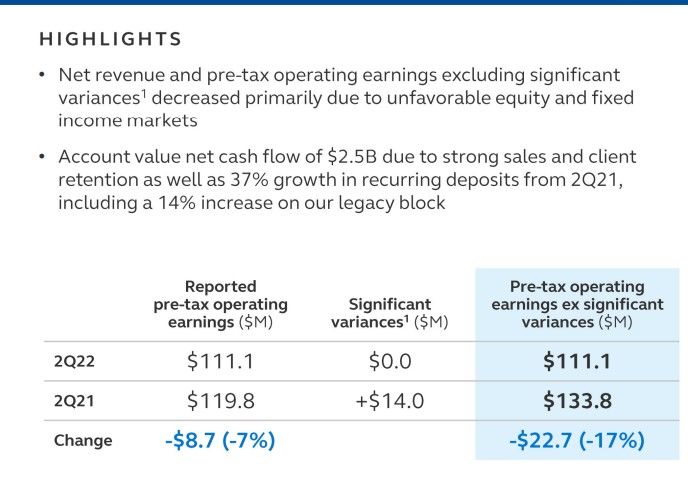

Retirement and income solutions (fee) revenue decreased 4% over the previous quarter due to unfavorable equity and fixed income markets. Revenue decreased 20% year-over-year.

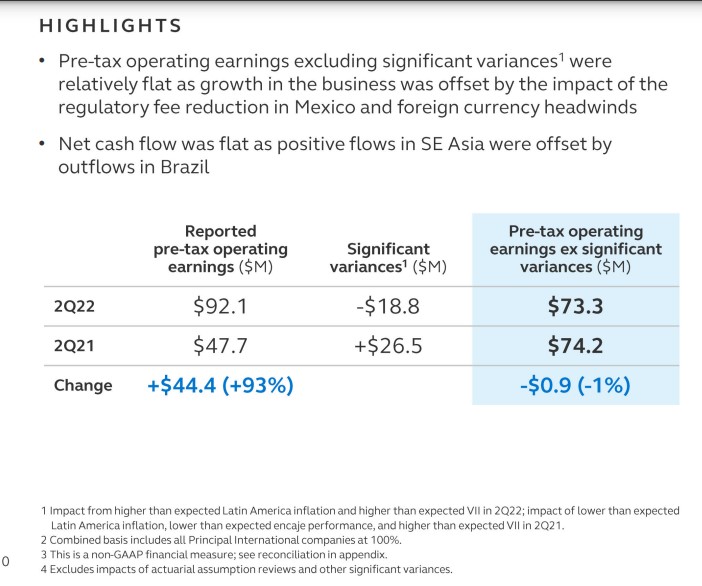

In Principal Global Investors, revenue was up 2.2% over the prior year, but Principal International was the big winner with a 43% revenue increase year-over-year because of higher investment income. But that increase was offset by higher than expected inflation in Latin America, along with other factors.

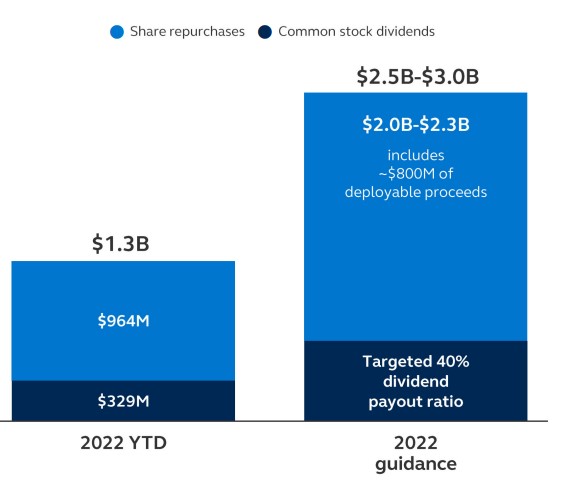

Principal also returned $1.3 billion of capital to shareholders this year.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Middle market businesses continue to thrive despite macroeconomic pressures

Insurance industry still victimized by growing number of scammers

Advisor News

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

More Advisor NewsAnnuity News

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

- Hildene Capital Management Announces Purchase Agreement to Acquire Annuity Provider SILAC

- Removing barriers to annuity adoption in 2026

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Jackson Awards $730,000 in Grants to Nonprofits Across Lansing, Nashville and Chicago

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

- Reinsurance Group of America Names Ryan Krueger Senior Vice President, Investor Relations

- iA Financial Group Partners with Empathy to Deliver Comprehensive Bereavement Support to Canadians

- Roeland Tobin Bell

More Life Insurance News