Principal Beats Projection With Lower Claims, Diverse Business

Principal Financial Group reported about 150 claims across its life insurance business during the second quarter -- a claims experience that allowed the company to dial back its COVID-19 projection going forward.

Despite death numbers up to double what was expected in the spring, Principal is cutting its projected impact on earnings from $20 million to $10 million per 100,000 U.S. deaths from the virus.

"We're better able to just look at the nature of those claims, whether it be age, whether it be face amount, whether it be the size of the annuity product, and update how that translation happens between the general population experience and the experience of our insured population," explained Deanna Strable, Principal’s chief financial officer.

Principal reported a second-quarter operating revenue decline of 20.5% year over year to nearly $3.2 billion, a result of lower premiums and net investment income. However, total expenses decreased 25.7% year over year to $2.6 billion due to lower benefits, claims and settlement expenses as well as reduced operating expenses.

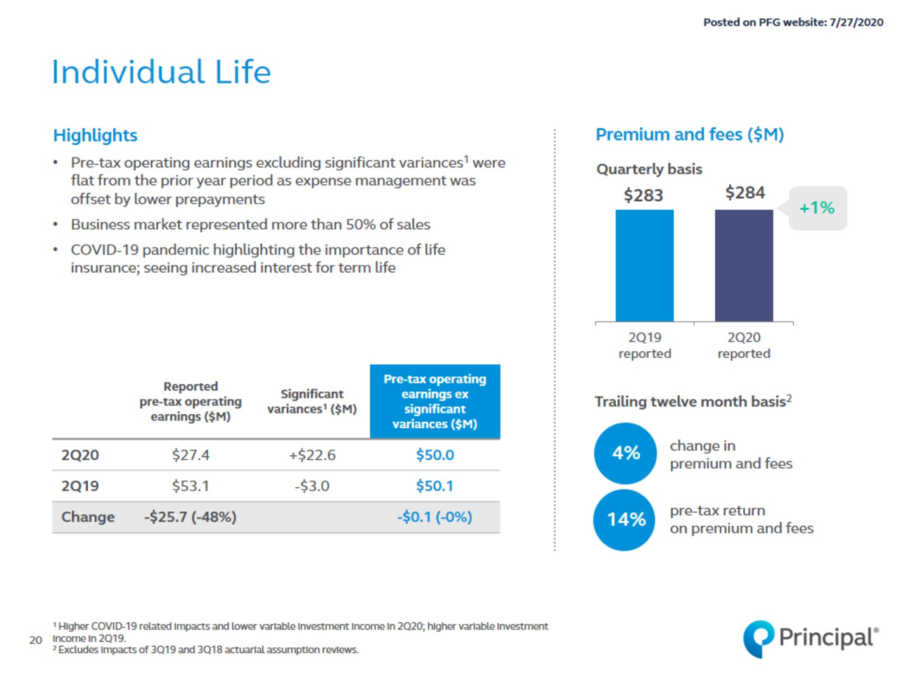

Principal reported declines in life insurance and annuity sales, a result largely offset by strong performance at the Specialty Benefits Insurance business. As a result, its U.S. Insurance Solution segment revenues grew 0.1% year over year to $1.1 billion.

During a conference call this morning, little mention was made of annuity sales, and Principal did not include an annuity focused slide in its accompanying report. In one of the few mentions of annuities, CEO Dan Houston said, "we continue to expect lower annuity sales for the remainder of the year."

The insurer's individual life book is "holding up well," said Amy Friedrich, president of U.S. insurance solutions.

"We have probably a disproportionate amount of working-age population, even in our individual life insurance coverage because of our business market focus," noted Friedrich, pointing out that they are generally smaller policies.

Principal is seeing gains in its digital efforts, Houston said, partly because of its direct-to-consumer life insurance sales plan.

"Since January, we've had 25,000 applicants utilizing this tool," Houston said. "By leveraging our digital application tools, and investments in the underwriting automation, more than a third of our underwriting approvals are able to be completed with less than 10 minutes of underwriting time."

Benefits Business Strong

Principal's retirement benefits business held up well in the second quarter, due in part to the Paycheck Protection Program funds from the federal government, Houston said. But more importantly, Principal's business is heavily located within industries less affected by the pandemic, he added, such as professional services, wholesale trade, and finance and insurance.

"As a result, our U.S. retirement and group benefits businesses have had less of an impact from the current environment during the second quarter than some may have expected due to our intentional diversification by industry and geography," Houston explained.

Principal's second-quarter operating net income of $1.46 per share beat the Zacks Consensus Estimate by 11.5%. Company executives said diversity of products is helping Principal avoid serious financial trouble.

For example, the company's dental and vision claims were down during the quarter, mostly due to people staying inside. Principal projects increased claims for the remainder of 2020.

"Our assumption is the dental offices will stay open in the second half of the year," Friedrich said. "Our assumption also is that there will continue to be a little bit of pent-up demand, probably play through the rest of the year."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at john.hilton@innfeedback.com. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

More Americans Suffering DIY Injuries Since Pandemic, Unum Finds

6 States Taking A Multiyear Approach To LTC Costs

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Expiring health insurance tax credits loom large in Pennsylvania

- Confusion muddies the debate over possible Medicaid cuts

- Trump protesters in Longview aim to protect Medicaid, democracy, due process

- Grant Cardone, Gary Brecka, settle dueling state lawsuits

- 9 in 10 put off health screenings and checkups

More Health/Employee Benefits NewsLife Insurance News

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

More Life Insurance News