Position A Portfolio: Finding Certainty In The Midst Of Uncertainty

Uncertainty is an inescapable part of life. Google the word “uncertainty” and you will not discover ways to do away with it, you will only find ways to deal with it.

The changes brought to our world by the COVID-19 pandemic revealed just how all-encompassing uncertainty can be. From infection rates to interest rates, many experts had to admit that the “new normal” makes it difficult to be certain about anything. Nowhere is this more obvious, or more unsettling, than in the area of financial investing.

Addressing The Certainty Of Uncertainty

The certainty of uncertainty always has and always will be a component of investing. Investing well does not mean you have done away with uncertainty; it simply means you have found a way to manage it.

Financial advisors will never be able to offer their clients guarantees. However, by understanding the various market factors that are at work, we can provide our clients with investment strategies that acknowledge unavoidable uncertainties and incorporate the necessary flexibility, diversity and responsiveness into those strategies. Just because the market is unsure does not mean that an investor needs to be unsure.

Considering Inflation Concerns

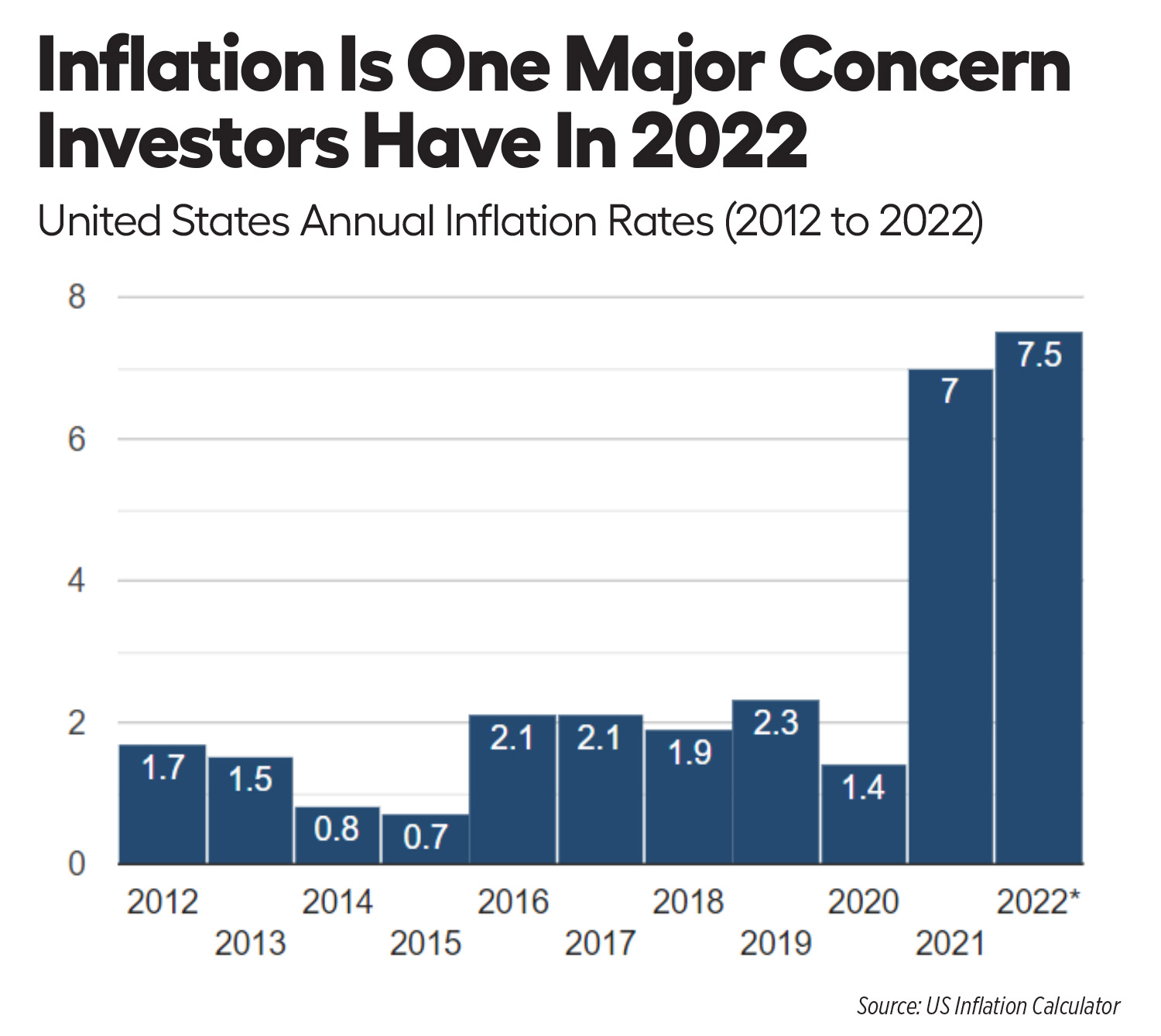

Inflation is one of the key factors to consider when positioning investment portfolios for success in 2022. Although the current rise in inflation was initially deemed “transitory,” a recent article in Forbes reported some experts predicting inflation will last well into 2022 and possibly beyond.

While history provides lessons on the impact inflation can have on investing, the uncertainty associated with inflation makes predicting fluctuations impossible even with years of history from which to glean. Not only is the course of inflation uncertain, with many variables affecting it, but the way in which investors react to inflation and their impact on the market is also uncertain. For example, the market can change in anticipation of government action, such as the raising of interest rates, that may never come.

If inflation lingers, your clients must be aware of its impact and must be encouraged to adjust accordingly. Typically, growth stocks are not the best option during times of inflation. Value stocks and government bonds are better options for times of inflation.

Considering COVID-19 Impacts

The COVID-19 pandemic has added to, and will most likely continue to add to, the uncertainty of investing. The interruption in supply chains provided considerable challenges for many companies. The changes COVID-19 brought to the workforce mean companies and consumers alike have fewer resources.

How long these factors will continue to challenge companies remains unclear. Should they become part of the new normal, wise investing will involve identifying the sectors and companies that have discovered ways to overcome the challenges and operate profitably.

Considering Political Risk

Regardless of your clients’ political leanings, their investments could be impacted by political risk. When governments make or influence decisions affecting taxes, spending, fiscal policy or international relations, they can affect in unpredictable ways the success of domestic and international organizations and the ways in which their stocks perform.

Determining what stocks are safe from political risk is a challenging endeavor. All companies — especially multinational companies — are subject to the effects of political risk. The best investments are investments in companies that take steps to understand and mitigate their political risk.

Moving Beyond Diversification

Guiding your clients toward a diversified investment portfolio is a good strategy for investing during uncertain times. Diversification manages uncertainty by relying on a varied group of investment vehicles, each of which can be reasonably expected to respond differently to the factors that affect markets. As a result, when one sector of the economy loses ground from any of the factors explored above, another sector may gain ground.

Diversification typically will keep a portfolio on an increase that tracks with the market. However, for those looking to provide sound investment guidance during uncertain times, diversification is only the beginning of a good strategy.

Those who are familiar with the stock market know that in 2008, the market experienced a historic decline, ultimately dropping more than 55%. Even the most diversified portfolios were not safe from considerable losses during that season. I realized at that time that I needed a better solution than diversification to guide my clients through times of uncertainty.

My research led me to a solution that manages uncertainty by combining diversification with a trading discipline known as technical analysis. Obviously, healthy investing begins with identifying healthy companies with a proven track record and a promising future. Once that is done, technical analysis analyzes statistical trends to guide the timing for buying and selling stock in those companies.

My personal experience during the 2020 market drop caused by the COVID-19 pandemic proved the wisdom in this strategy. When the market fell from peak to trough over 36%, our all-equity aggressive portfolio served our clients well, outperforming a conservative 60/40 blended index on the downside, as well as beating the S&P 500 on the upside for the year.

The best guidance you can give your clients in 2022 and beyond is that uncertainty will continue, and you will analyze the market on an ongoing basis so that you can help your clients continue to invest with clarity and confidence.

Bryan Cannon, CFP, is a stock market technical analyst with more than 25 years of financial planning and investment experience. He may be contacted at [email protected].

Ripples On A Pond? Or Spaghetti Thrown Against The Wall?

How Will Your Clients Protect Their Virtual Assets?

Advisor News

- OBBBA and New Year’s resolutions

- Do strong financial habits lead to better health?

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- U.S. Federal Minimum Wage Remains Flat for 16th Straight Year as Billionaires’ Wealth Skyrockets

- Reports from Case Western Reserve University Add New Data to Findings in Managed Care (Improving Medication Adherence and Medication Optimization With a Medicaid-Funded Statewide Diabetes Quality Improvement Project): Managed Care

- Data on COVID-19 Published by Researchers at Peking University (Socioeconomic Disparities in Childhood Vaccination Coverage in the United States: Evidence from a Post-COVID-19 Birth Cohort): Coronavirus – COVID-19

- 2025 Top 5 Health Stories: From UnitedHealth tragedy to ‘excess mortality’

- AMO CALLS OUT REPUBLICANS' HEALTH CARE COST CRISIS

More Health/Employee Benefits NewsLife Insurance News