How Will Your Clients Protect Their Virtual Assets?

A ccording to a Statista survey published last year, nearly three-quarters of American adults either have avatars in the metaverse already or are considering building some type of virtual life soon.

Inevitably, more of us are considering our virtual security these days. Hacks are way up, and while Mark Zuckerberg’s Facebook Connect keynote video envisaged a kind of Mayberry-verse populated entirely by polite coworkers, cute puppies, family members and friends, the reality is that phishers and scammers will clearly show up in that world as well. What these phishers and scammers see is a whole new environment in which to operate.

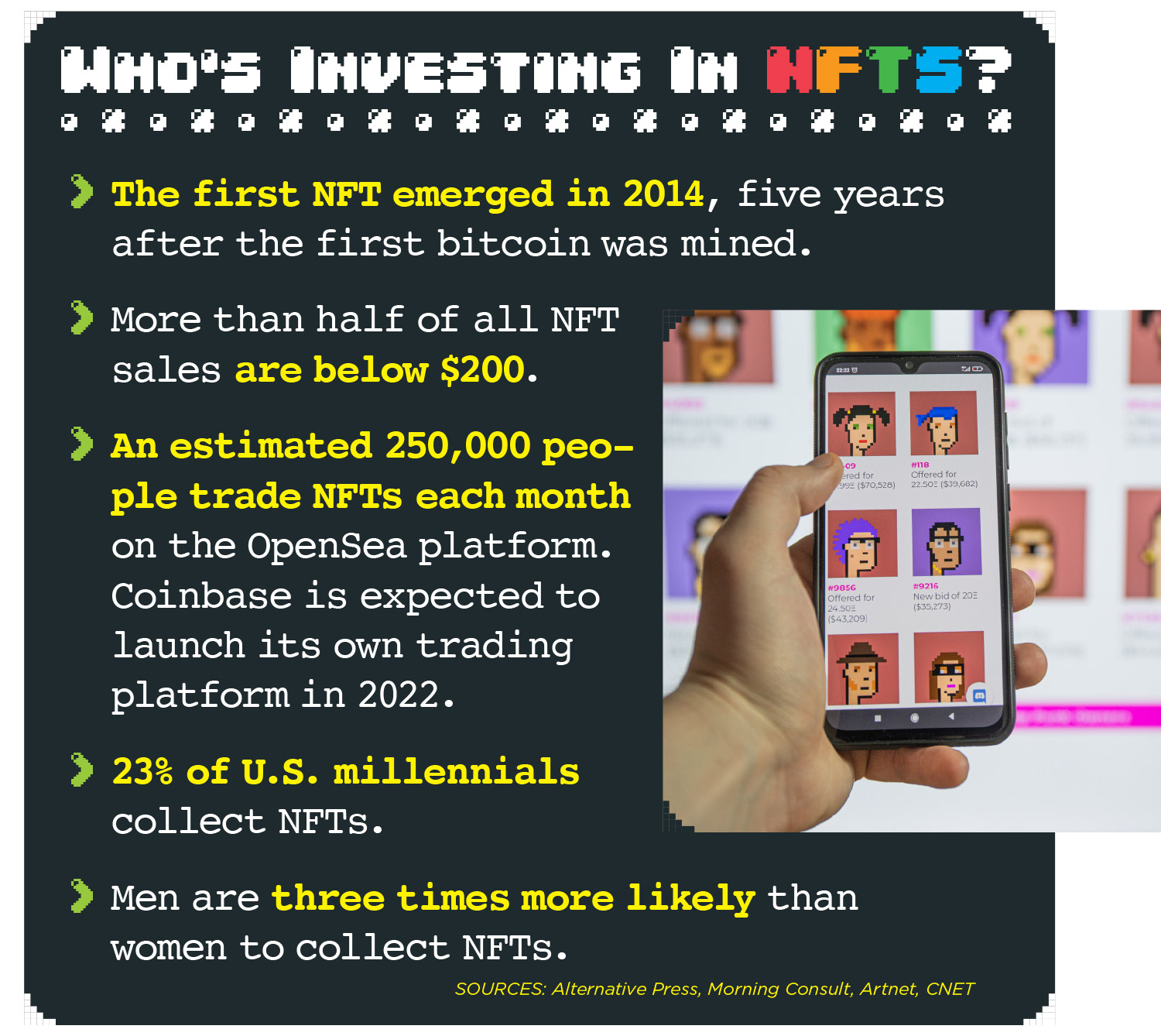

An obvious target will be nonfungible tokens, or NFTs. NFTs are unique, digitized art, gameplay, video or any other type of intellectual property, or IP. Christie’s sold more than $100 million in NFTs during the first three quarters of 2021 alone. Over the coming years, this number should rise exponentially as NFTs go mainstream and avatars go shopping. This begs the question, how will your clients protect their virtual assets?

So far, the protection of digital assets has been considered from a proactive standpoint. For example, both cold wallets and decentralized verification processes trace their roots to the blockchain, and both seek to prevent hacks. But what if something nefarious happens while acquiring a digital token or afterward? What kind of insurance would apply to a virtual asset, if any? Can NFTs even be insured at all? If so, are there any insurance agents in the metaverse who will sell policies — now or in the future?

The answers to these questions may have less to do with technology and more to do with the unique risks involved — and how they present themselves.

Rights Of NFT Ownership

As with any financial transaction, the first risk that an NFT buyer takes is in trusting the seller. What happens, for example, if the seller does not own the rights to the IP being sold? Equally important, though less common: What if the web address, or the URL, where the IP is stored disappears? Or what if the hyperlink is broken, and the NFT no longer directs to the image that it’s supposed to?

No insurance is yet available for these scenarios, though they all are eminently insurable risks. Title insurance, for example, is a common way to guarantee that the seller owns the real estate being purchased, while property insurance can protect the owner of all sorts of assets against loss, no matter how that loss occurred.

Theft

But what if the loss occurred after the transaction? This scenario is the one we most commonly read about. For example, a crypto-owner’s keys are stolen, probably in a phishing scheme or as the result of a wider hack of a trading platform.

Theft happens to be an unfortunate but not an uncommon occurrence. It’s also an eminently insurable one. Coincover.com is a noncustodial crypto platform that sells security technology that comes with insurance backed by underwriters at Lloyd’s of London. The company insures more than 200 types of crypto from theft, promising to reclaim hacked or lost funds up to a fixed amount.

Fraud

Fraud is a more nuanced type of theft, and one that has been increasingly common in the NFT space. Although frauds can be enormously creative, the scourge of NFT platforms is a remarkably straightforward one: the rug pull. This happens when NFTs are presold but then never minted. In this scenario, being proactive is essential, and we will probably see proactive, third-party verifications of NFT marketplaces in the future.

In the meantime, there is nothing stopping an insurance company — or anyone else — from guaranteeing the completion of a contract. Indeed, that’s the idea behind completion bonds and escrow apps such as PayPal, both of which are used by millions of companies every day.

Royalties

Another common type of guarantee that could be applied to NFTs is contract insurance. NFTs are essentially contracts — or licenses, more specifically — that give the owner certain rights, usually digital ownership of a unique piece of IP. Some NFTs, like some licenses, generate royalties. This makes the NFT indistinguishable from a financial instrument such as a bond.

Of course, financial instruments are insured regularly, sometimes as a condition of issuance. As long as the NFT creates a fairly predictable revenue stream, an insurance company would theoretically be able to insure it, although there is not yet enough history — or volume — to generate interest from major insurance companies. This will change, and sooner than most of us think.

In the meantime, the security industry will continue to focus on preventing hacks. Coincover.com, for example, offers a “hack checker,” as well as biometric identity verification and multi-wallet protection for crypto owners. It then insures the efficacy of its technology, and by extension, its clients’ NFTs. This makes Coincover.com more like a LifeLock or LoJack than a real insurance company, although the outcome is very similar, if not identical.

In the coming years, increased adoption of NFTs will make them insurable. This is because enough data will exist to produce actuarial tables, and also because their values will be much easier to calculate — and far less dynamic, i.e., volatile.

Who knows? Maybe we’ll even see an agency like the Federal Deposit Insurance Corp. emerge that guarantees a minimum amount of crypto and NFTs against loss in the event of a major hack or exchange event.

Position A Portfolio: Finding Certainty In The Midst Of Uncertainty

The Positives And Negatives Of Fixed Annuities

Advisor News

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- Advisor gives students a lesson in financial reality

- NC Senate budget would set future tax cuts, cut state positions, raise teacher pay

- Americans believe they will need $1.26M to retire comfortably

- Digitize your estate plan for peace of mind

More Advisor NewsAnnuity News

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- GBU Life introduces Defined Benefit Annuity

- EXL named a Leader and a Star Performer in Everest Group's 2025 Life and Annuities Insurance BPS and TPA PEAK Matrix® Assessment

- Michal Wilson "Mike" Perrine

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

More Annuity NewsHealth/Employee Benefits News

- Editorial | Why Medicaid funding crisis matters here

- Recent Findings in Liver Cancer Described by Researchers from Kaohsiung Chang Gung Memorial Hospital (Comparing Health Insurance-reimbursed Lenvatinib and Self-paid Atezolizumab Plus Bevacizumab In Patients With Unresectable Hepatocellular …): Oncology – Liver Cancer

- Missouri Farm Bureau wants to offer health insurance alternatives for members

- Don’t let Texas move Fort Worth-area kids off health plans their families prefer | Opinion

- CT health system’s contract with insurer has expired. What patients need to know about their coverage.

More Health/Employee Benefits NewsLife Insurance News

- AFBA and 5Star Life Insurance Company Name Erica L. Jenkins Senior Vice President, General Counsel, and Corporate Secretary

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- Empathy Collaboration with Voya Financial Brings Industry-First Legacy Planning to Millions

- Federated celebrates record year despite industry challenges at 121st annual meeting

- Proxy Statement (Form DEF 14A)

More Life Insurance News