Poor website design could be hindering Americans’ retirement planning, study finds

Poor navigation design and ease of use on retirement planning websites could be hindering American consumers from accessing key financial tools, according to new insights from data analytics firm J.D. Power.

A recent survey conducted by the firm found around one in five retirement plan websites and mobile apps do not meet clients’ expectations. This is lower than the satisfaction rate experienced in other financial industries.

Craig Martin, executive managing director and head of wealth and lending intelligence at J.D. Power, suggested it could point to a larger issue.

“Financial wellness or well-being is a big focus today, and a lot of time and resources are dedicated to this topic. The challenge for many firms is that a lot of the potential value to clients of financial wellness tools and education has not been realized due to shortfalls in the digital experience,” he said.

Martin noted that retirement plan digital experiences are “reasonably successful” when it comes to meeting basic client experiences. However, he said challenges with ease of use and navigation tend to be “fairly common” complaints.

“It’s vital to understand both what tools or insights clients want, but also why they may not be accessing what’s available today to ensure the maximum benefit is achieved from investments,” he said.

Failed digital experience expectations

J.D. Power’s 2024 U.S. Retirement Plan Digital Experience Study assessed retirement plan digital satisfaction based on three performance indicators: foundational, functional and valuable experiences.

Foundational experiences relate to basic website/mobile app design, security and key information access. Functional experiences relate to ease of use and website navigation. Valuable experiences relate to personalization and level of proactiveness.

The study found 21% of customers’ digital experiences failed to meet basic expectations. Interestingly, only 21% of respondents said they had digital experiences they would classify as valuable.

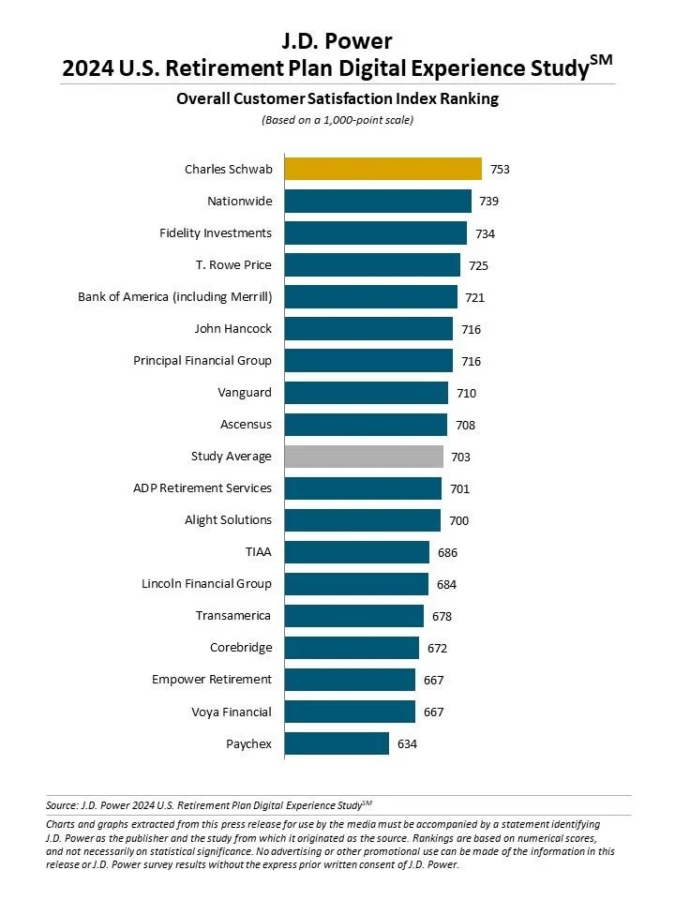

J.D. Power ranked individual companies and overall client digital satisfaction out of 1,000 possible points. They found that overall satisfaction with retirement websites/apps increased to 703 in 2024, up 18 points from last year.

However, this is still lagging behind website/app satisfaction in other industries such as insurance, automotive finance, utilities and banking.

“Comparing and contrasting retirement versus other industries, a key area that other industries tend to be stronger in is designing for ease of use and effectiveness of navigation,” Martin said.

Larger implications

Website design and ease of use are particularly crucial for retirement plan providers considering most client interactions in this sector are digital, Martin said.

“By its nature, retirement plan relationships have very limited engagement opportunities,” he said. “The vast majority of client interactions are digital in nature, which means the level of success on the two critical metrics — assets under administration and cost to service — is heavily impacted by how effective a firm is digitally.”

Poor user experience can affect a business’ bottom line. According to data from J.D. Power, a top-tier digital experience increases the likelihood of asset retention by as much as 97%.

On the other hand, a poor digital experience could translate to added expenses and resources for a company, as clients may opt to call in instead of going online, hesitate to go paperless and become more unwilling to interact digitally on the whole.

Digital experience improvements

Martin emphasized that providers must understand that digital satisfaction is about understanding how their website/app’s navigation, speed, visual appeal and information/content impact client experience.

“Digital is all about getting the end user to what they want in the easiest and most efficient way,” he said.

This is something Tom Armstrong, VP, Customer Analytics & Insight, Voya, acknowledged. Voya scored 667 out of 1,000 points in J.D. Power’s digital satisfaction survey. In comparison, the top-rated company, Charles Schwab, scored 753.

Armstrong said Voya’s focus is on developing technology such as fingerprint and face ID scans to improve ease of use and security. Additionally, they have introduced a “gamified” experience to help clients understand the impact of saving at different ages.

“We are consistently focused on aligning our new products and processes to meet and exceed our customer expectations and even as we get there with new experiences,” he said.

Martin added that providers should first understand the basics before investing in more advanced capabilities.

“To start, it’s critical to understand that digital satisfaction for clients is heavily impacted by having needs met efficiently and effectively… Those advanced options may be impressive, but if the consumer doesn’t ever see them because they can’t locate them on the site, then there is no value in having them,” Martin said.

The J.D. Power U.S. Retirement Plan Digital Experience Study was conducted between May and July 2024. It surveyed 5,638 retirement plan participants.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Rayne Morgan is a journalist, copywriter, and editor with over 10 years' combined experience in digital content and print media. You can reach her at [email protected].

Judge grants government $1.5M forfeiture from Greg Lindberg

Insurers, trade groups seek influence via donations in divisive election

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- Recent Studies from University of Tennessee Add New Data to COVID-19 (Uncovering Gaps in Childhood Vaccine Coverage: A Post-COVID-19 Analysis of Vaccine Disparities in Tennessee): Coronavirus – COVID-19

- AM Best Affirms Credit Ratings of Prudential Financial, Inc. and Its Life/Health Subsidiaries

- TrumpRx is here. What you should know

- Report: Health insurers denied one in five claims in 2024

- Tom Campbell: Is the cost of healthcare top election issue?

More Health/Employee Benefits NewsLife Insurance News