Insurers, trade groups seek influence via donations in divisive election

The insurance industry contributed more than $60 million during the current 2023-24 election cycle, according to Open Secrets, a nonprofit organization tracking campaign donations and lobbying.

There are more donations to be counted before the Nov. 5 election, but the insurance industry is well behind the $127 million donated in the 2019-20 election cycle. The off-year 2021-22 election cycle netted $83 million in donations from insurers.

Open Secrets donations figures are based on Federal Election Commission data released on Aug. 21. The nonprofit tracks insurance donations as part of what it terms the FIRE sector [Finance, Insurance, and Real Estate].

The FIRE sector "is far and away the largest source of campaign contributions to federal candidates and parties," Open Secrets notes on its website. "The sector contributed generous sums to both parties until 2010 when donations began to heavily bias Republicans, which likely reflects the finance industry’s interest in overturning the financial regulations from the Dodd-Frank Act."

Insurance contributions in the current cycle benefited Republicans ($30.4 million) over Democrats ($21.2 million).

"I think that insurance is obviously going to have some major companies in it and has some very vested interests in making sure that it has access to the folks who will be regulating in their space," said Sarah Bryner, director of research and strategy for Open Secrets. "I'd say, generally speaking, it's a little bit more conservative than some of the other industries."

Health issues still dominate

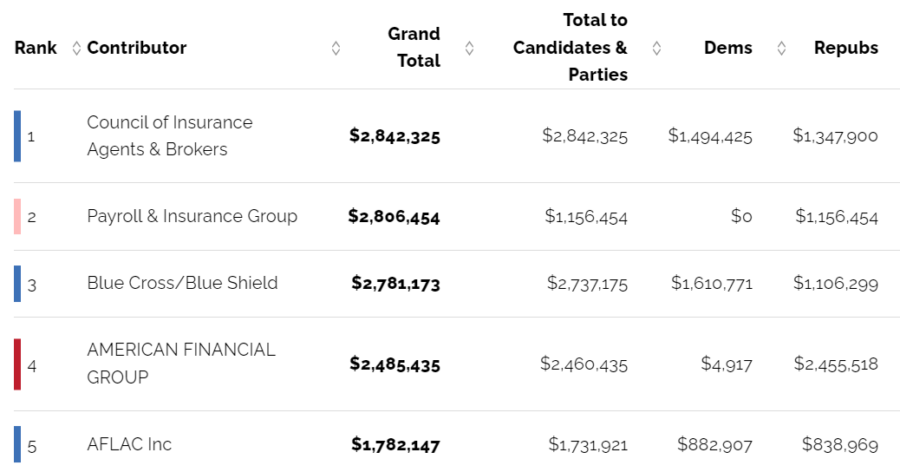

A look at the top political donors reveals representation from all corners of the insurance industry. There are not major issues standing out that would attract large-scale donations, Bryner said, adding that she expects insurance industry giving to fall short of 2020 levels.

"The lobbying by the insurance industry has been actually remarkably flat, very few peaks and valleys since 2009 and it looks like it'll be right on trend this cycle, too," Bryner said. "I don't see anything jumping out that would motivate the industry specifically."

The health insurance industry continues to be on the agenda for many lawmakers in Congress and the current cycle is no different. Bills dealing with drug prices and pharmacy benefit managers are likely to drive lobbying efforts, Bryner said.

The Lower Costs, More Transparency Act passed the House of Representatives and includes measures to increase price transparency for hospitals, insurers, and pharmacy benefit managers. It also requires consistent Medicare payment for physician-administered drugs in hospitals and doctors' offices. The bill remains in the Senate.

The chairman of the Senate Finance Committee wants a pharmacy benefit manager reform bill passed during Congress’ lame-duck session later this year.

At a committee hearing last week, Sen. Ron Wyden, D-Ore., said, “I'm going to do everything I can to get PBM cost containment on medicine. It's good for seniors, good for taxpayers. This committee has shown a lot of support for it and we’re going to do everything we can to get back to some kind of common-sense principles with respect to cost containment."

Proposed reforms include requiring extensive disclosure of business practices to plan sponsors and the government; a ban on “spread pricing;” 100% pass-through of rebates, fees and discounts to plan sponsors; and requirements for PBM and third-party administrators to disclose direct and indirect compensation to plan fiduciaries.

Likewise, the Medicare for All bill remains lurking in the background and generates much enmity from the health insurance industry. It seems unlikely to get serious consideration anytime soon.

Still, these issues and others are generating big bucks for lawmakers on select committees of influence. Blue Cross Blue Shield, Clover Health, and Cigna are all among the top 11 political donors from the insurance industry.

Equal opportunity donations

Kenneth Miller is an assistant professor of political science at the University of Nevada, Las Vegas. He explained why it is important for companies to take part in the political process, and the strategies to go about it.

"You want to ensure access to lawmakers so that you can make the case for your industry, so that you can inform lawmakers who are passing laws or not passing laws that are going to affect your industry," he explained. "Those lawmakers probably don't know as much about your industry as you do, so you need to get that foot in the door so that you can be part of the process."

While Republicans are receiving more donations from the insurance industry, Miller said it makes sense to donate to both sides.

"You're donating to the people who are on the key committees, the committees who are going to have the oversight, the committees who are going to be in that markup process of new bills that are coming through," he said. "And when you're pursuing that strategy, that's going to end up putting you in the position of donating to both parties."

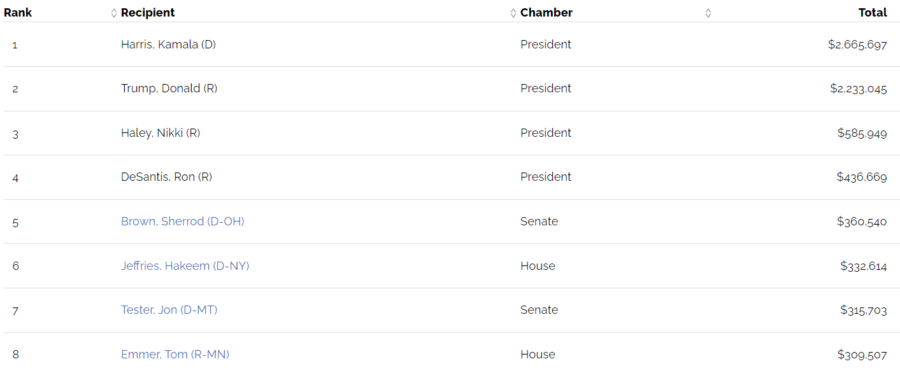

Not surprisingly, the top two recipients of insurance donations are the candidates for president, Kamala Harris and Donald Trump.

Sherrod Brown, D-Ohio, is on the Senate Finance Committee, while Tom Emmer (R-Montana) is the Republican majority whip and serves on the House Financial Services Committee. Jeffries is House minority leader and Jon Tester, D-Montana, sits on the powerful Senate Appropriations Committee.

Open Secrets donation data "are based on contributions from donors (individuals as well as corporations and unions that give directly from their treasuries) to outside groups and from PACs (including super PACs) and individuals giving more than $200 to candidates and party committees. In many cases, the organizations themselves did not donate; rather the money came from the organization's PAC, its individual members or employees or owners, and those individuals' immediate families."

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Poor website design could be hindering Americans’ retirement planning, study finds

‘The court is troubled’: Judge tells Security Benefit, plaintiffs to work faster

Advisor News

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

More Life Insurance News