Opinion: Why the DOL’s Retirement Security Rule is the emperor of all public policy mistakes

In creating the new Retirement Security Rule (“RSR”), I believe its authors at the Department of Labor sincerely intended to advance the interest of retirement investors. But will this new regulation accomplish that objective? Or will it surprisingly produce the opposite outcome? I believe it will be the latter, and that the RSR deserves to be vacated as quickly as possible.

One of the tragic outcomes of the RSR is likely to be the disenfranchisement of lower income individuals including many from underserved communities who will find it harder to access the professional financial guidance they desperately need. Here we need to be honest. Most investment advisors and financial planners have zero interest in working with individuals with low (or no) account balances. Historically, it has been the insurance community that has served these individuals. Insurance agents have generated countless financial benefits for less affluent Americans including systematic wealth building through annuities and financial protection for families via life insurance.

Insurance agents have demonstrated their willingness to work with individuals and families whose savings capacity is limited to a relatively modest amount of monthly savings. I’ve seen the benefits of this firsthand. When I began my career as a young insurance agent, I routinely recommended flexible premium annuities to help clients build wealth in a systematic and disciplined fashion. I don’t know of any investment advisors who seek out this type of client.

The RSR is purported to advance the interests of “retirement investors.” Again, I do not question the sincerity or good intentions of the people at the Department of Labor who wrote this rule. What I question is what seems obvious: that they lack an understanding of what constitutes retirement security. Because it is not the accumulation of assets. Yet, it is assets and the costs that the DOL seems intently focused on.

In 2000, a risk averse retiree with $1 million could have purchased 6-month CDs and collected $5,700 per month in interest income. By 2021, that retiree’s interest income had plummeted by 99%, to just $75/mo. It is not about the “assets.” In this example, the assets never changed. Rather, for retirees, it is and always will be about the “income.”

Wrongheaded Thinking About Compensation

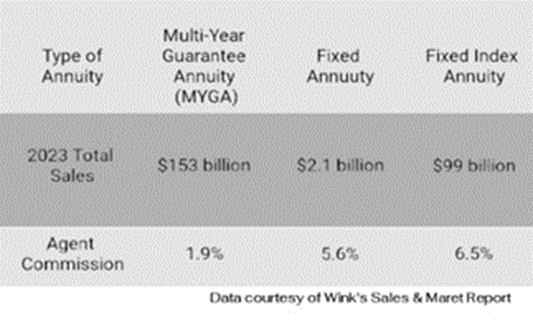

Wink CEO, Sheryl Moore, was kind enough to share annuity sales data with me. In 2023, the largest segment of annuity sales was represented by multi-year guarantee annuities. MYGA sales totaled $153 billion. On those sales, insurance agents received an average commission of 1.9%.

The second largest category was fixed index annuities. FIAs paid agents an average commission of 6.5%. At $2 billion, fixed annuities represented the smallest share of sales, paying agents and average commission of 5.6%. Please keep in mind that these are one-time payments. After reviewing the facts about commissions, the reasonable conclusion is that insurance agents are far from overpaid. This fact did not prevent the DOL from introducing the RSR in dramatic fashion.

On Halloween 2023, Joe Biden delivered a smear of insurance agents that will not soon be forgotten:

“Right now, millions of Americans, especially seniors, are being targeted by financial advisors and insurance brokers selling bad annuities…”

It is fitting that Biden said this on Halloween because his statement was horrific. What bothered me most about it was the three words,” millions of Americans.” In stating this, Biden implied that there is a large-scale effort by insurance agents to foist “bad annuities” on the American public. This was of course an allusion to fixed index annuities. To the extent that the president of the United States taking this stance serves to discourage savers from accessing the benefits of annuities, the outcome induced is truly horrible.

It bothers me that DOL has an adverse view of annuities, especially fixed index annuities. Is there a more compelling value proposition than what lies at the heart of an FIA: “The potential for growth, without the risk of loss?” I cannot think of one that is more valuable to retirees.

What the DOL Does Not Know

I assume that much of DOLs perspectives is due to a lack of understanding of nuanced retirement income planning, the same lack of knowledge that has apparently led to the RSR ignoring the issues that are of the greatest importance to most retirees. Perhaps one day the DOL may find its way to read this article, and maybe even revisit how the RSR is written. I am not optimistic this will happen, but one never knows. But if that did happen, retirement investors would be the winners. Keep reading and I will explain why.

The Commission Canard

Retirement investors’ interests are not served when they pay fees that are higher than they should or could otherwise pay.

Because this issue is the subject of such intense focus, I want to delve a bit deeper into commissions. Retirement investors’ interests are not served when they pay fees that are higher than they should or could otherwise pay. Insurance agents who have any degree of experience know this. And they wish everyone else did too.

Consider an agent selling a $100,000 fixed index annuity that pays a Commission of 7%. The agent will receive a one-time payment of $7,000. Imagine that the index annuity has a 10-term with a surrender charge of the same duration. If the annuity owner holds the contract for ten years, he or she pays no commission at all. Rather, the insurance company exclusively finances the agent’s commission.

This stands in stark contrast to fee-based advisor compensation. For example, if over the same 10-year period a retiree had invested $100,000 in a fee-based account averaging 6% annual growth, the retiree would pay fees equal to $13,932. But this is only part of the story. The reason is that once the fees are withdrawn from the account, they represent monies that are no longer available to earn investment gains. Therefore, the investor’s actual cost could be considerably higher than $13,932.

The Two Categories of Money

The DOL’s intense focus on advisor compensation is really an illogical and counterproductive waste of energy. Money placed in an annuity is not comparable to money invested in a fee-based account. This is because the two vehicles are funded with incompatible categories of money. This is a nuance that the RSR misses completely.

One category of money can be thought of as risk-based investing. It seeks the highest rate of return and accepts an inherent level of risk to the extent that the entire investment could be lost.

The other category of money can be thought of as protected savings. It is content with a lower rate of return because its chief priority is to be insulated from the risk of loss. I will be the first to acknowledge that most retirees need a measure of both categories of money. The DOL completely misses this important distinction. And in missing it, they also miss an opportunity to advance the interests of millions of retirees.

The Most Important Issue Missed by DOL

There is a large segment of retirees, millions strong, that I call Constrained Investors. These are typically diligent Americans who arrive at retirement with savings. That is a wonderful thing. However, the amount of savings they have accumulated is not high in relation to the level of retirement income they must produce from their savings to fund a minimally acceptable lifestyle. When I say minimally acceptable lifestyle, I mean enough monthly income generated from savings that, when added to Social Security, covers the retiree’s vital expenses, plus a small margin for some expenses that add fulfillment and enjoyment to retirement. To be sure, this does not describe any type of lavish lifestyle. Far from it. It is simply what is minimally acceptable.

In planning income for Constrained Investors, the financial advisor’s first and most important responsibility is to mitigate the risks that can reduce or wipe out the investors’ ability to generate income from savings. This means that the investor’s savings must be arranged in such a manner that protection against longevity and timing risks is created while at the same time allowing for some exposure to risk assets. The proper sequencing of assets accomplishes the needed risk mitigation while also producing secure monthly paychecks.

The Primacy of “Flooring”

Building the appropriate income strategy begins with” flooring,” the designing of a foundation of secure lifetime income. In the same manner that we cannot build a house without first building a solid foundation, we cannot build an effective income plan for Constrained Investors without first building a foundation of lifetime income.

Financially, income is everything to Constrained Investors. This is why to serve the best interests of these millions of retirees, an annuity that pays lifetime income is an absolute requirement for longevity risk management.

As indicated above, another nuance the DOL misses is that in retirement it is your income, not your wealth, which creates your standard of living. Financially, income is everything to Constrained Investors. This is why to serve the best interests of these millions of retirees, an annuity that pays lifetime income is an absolute requirement for longevity risk management.

To be clear, annuities are not required to manage timing risk. But it is also true that a laddering of annuities, a SPIA and MIGA covering the first 10 years of the strategy, nicely manages timing risk while making monthly income certain. This is an efficient and cost-effective way to approach the management of timing risk.

Discrimination is a Practical Outcome

The RSR effectively discriminates against Constrained Investors. This means the RSR is effectively hostile to the financial needs of most “boomer” women investors, most minority investors, and, in fact, most Americans who reach retirement with anything less than an overfunded status.

The DOL did not intend the RSR to discriminate against a large segment of retirement investors. But it does. It is a sad reality that the DOL’s focuses on “costs” and “commissions” while ignoring the nuances of proper income planning including the urgency for risk mitigation. The RSR effectively discriminates against Constrained Investors. This means the RSR is effectively hostile to the financial needs of most “boomer” women investors, most minority investors, and, in fact, most Americans who reach retirement with anything less than an overfunded status.

The Department of Labor’s Unintended Gift to the Insurance Industry

Because the people of the Department of Labor do not understand income planning needs of Constrained Investors, they did not anticipate that the RSR would create a business growth opportunity for insurance professionals that is as significant as it is surprising. This is, perhaps, the ultimate of ironies. But the truth is, “flooring” for risk management is a universal need of Constrained Investors. “Flooring” must come before investing. And “flooring” is the sole and sacred responsibility of life insurance agents.

Investment advisers do not have the license that permits them to address this most critical of needs. This is a key reason why they almost always opt for a purely markets-based approach to retirement income distribution. Perhaps this helps explain why the RSR is written as it is.

Life Agents in the Central Role

Because the income planning needs of Constrained Investors demand that careful attention is paid to risk mitigation, it turns out that life insurance agents must play a central role in the post-RSR marketplace. But caution is in order. Agents will have to operate carefully and strategically, and that means focusing narrowly on “flooring.” If they are wise, agents will follow my advice and become experts at a “flooring” process.

Sales Must Be Secondary to Process

Agents should also be aware that insurers have a stake, an incredibly significant stake, in the agent’s use of a consumer-oriented process that rationalizes and validates the client’s need for annuities. Because insurers face substantial financial liability potential in the context of their duty to supervise the sales of their own annuities, it is going to be in the insurers best interests to understand the process that the agent is using to consummate annuity sales.

Importantly, insurers are required to conduct a retrospective review of the agent’s rollover sales at least annually. This review must be reasonably designed to prevent violations and achieve compliance with:

- The impartial conduct standards,

- The terms of the exemption, and,

- The policies and procedures governing compliance with the exemption.

The retrospective review is required to evaluate the effectiveness of the supervision system, identify any noncompliance discovered in connection with the review, and stipulate that corrective actions be taken, if needed.

The retrospective review must also include a review of independent producers’ rollover recommendations and the required rollover disclosure. As part of the retrospective review, the insurer must:

- Prudently determine whether to continue to permit individual producers to sell the insurers annuity contract to retirement investors,

- Update the policies and procedures as business, regulatory, and legislative changes and events dictate, and to ensure they remain prudently designed, effective, and compliant with the exemption.

Your role, to protect yourself, is to think strategically and narrowly, focusing on “flooring,” which, again, is the sole and sacred responsibility of the life insurance agent.

If the insurer fails to adhere to these requirements, they face what is being described as the death penalty, the inability to rely on PTE 84-24, an outcome that would essentially shut them down.

I think one of the primary outcomes of the RSR will be to bring about a closer partnership between insurer and independent agent than ever before.

The penalties for violating fiduciary duty under ERISA are so draconian that agents must choose a process that allows them to operate safely as ERISA investment advice fiduciaries. The overwhelming majority of retirees need annuities. Your role, to protect yourself, is to think strategically and narrowly, focusing on “flooring,” which, again, is the sole and sacred responsibility of the life insurance agent. Recognize that there are millions of Constrained Investors and serve their best interests by building the vital foundation of lifetime income that is the cornerstone of their retirement security.

The founder and CEO of Wealth2K, David Macchia created “Women & Income,” the first retirement income solution expressly developed for female investors. Macchia also led the team that developed the widely used retirement income planning solution called The Income for Life Model. He is also an author, entrepreneur, and public speaker.

David Macchia, MBA, RMA, CBBF, is founder, Wealth2k. Contact him at [email protected].

Riches beyond income: Why high earnings don’t always equal wealth

NAIFA members discuss financial security at the Capitol

Advisor News

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

- Structured Note Investors Recover $1.28M FINRA Award Against Fidelity

- Market reports turn economic trends into a strategic edge for advisors

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- CONSUMER ALERT: TDCI, AG'S OFFICE WARN CONSUMERS ABOUT PURCHASING INSURANCE POLICIES FROM LIFEX RESEARCH CORPORATION

- REP. LAUREN BOEBERT INTRODUCES THE NO FEDERAL TAXPAYER DOLLARS FOR ILLEGAL ALIENS HEALTH INSURANCE ACT

- Thomas Brodmerkel Honored as a Professional of the Year for 2026 by Strathmore's Who's Who Worldwide Publication

- New Antibiotics Study Results Reported from Tehran University of Medical Sciences [Antibiotic consumption and medication cost in diabetic patients: Insights from Iran health insurance organization (IHIO) claims data]: Drugs and Therapies – Antibiotics

- Study Data from Humana Healthcare Research Update Knowledge of Type 2 Diabetes [Trends in use of continuous glucose monitors among individuals with type 2 diabetes enrolled in Medicare Advantage (2021-2023)]: Nutritional and Metabolic Diseases and Conditions – Type 2 Diabetes

More Health/Employee Benefits NewsLife Insurance News

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

- NAIFA and Brokers Ireland launch global partnership

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- Reimagining life insurance to close the coverage gap

More Life Insurance News