Opinion: redefining high-net-worth client service

By Jason L Smith

In our line of work, we see folks from all walks of life. Some clients have worked hard enough or smart enough to be considered high-net-worth (HNW), but how do their financial plans differ from those of other clients?

In my experience, HNW clients are those with assets ranging from $2 million to $30 million. In fact, a recent survey by Charles Schwab found that Americans consider “wealthy” to have accumulated $2.2 million or more of personal net worth.

As the landscape of money changes over time, one thing that stays consistent is the way you handle clients who fall within this HNW range. They expect the best, which means listening more than speaking, and working hard to understand one another as you build a financial plan together. A positive relationship with your HNW clients relies on your ability to seek information and work with when necessary, their pre-established team to achieve their financial goals.

Avoid complex jargon and concepts

Do not assume that your client is well-versed in financial terminology and strategy. Even though they are HNW, they may not know some of the words you would use in conversation with other financial professionals.

To guide your conversation, consider taking the educational route in a way that allows the client to speak to their experiences with the products that you may potentially suggest.

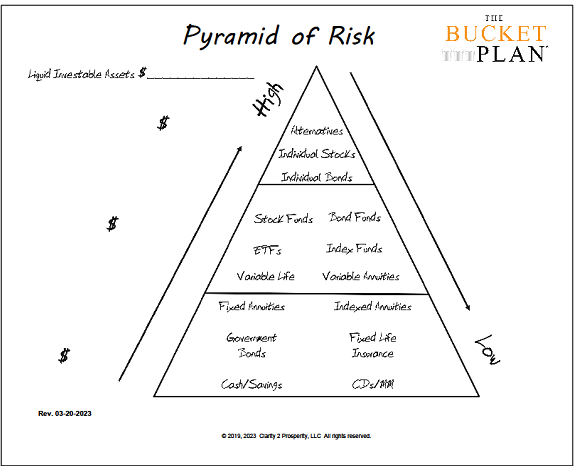

When discussing solutions to build out a financial plan, I will often show clients the ‘Pyramid of Risk’ to guide the conversation. Some products may be familiar, while others may be new. A great first question to ask is if they are familiar with the Pyramid of Risk. You can then go on to facilitate collaborative discussion on the various investment products and strategies.

By walking through these, you can gauge their feelings and clarify any myths or bad advice they have received in the past. For example, they may share that they are wary of using annuities. Knowing this information up-front is much better than learning it later so you can prepare a financial plan that addresses their concerns and helps reach their goals.

Listen more, speak less

The golden rule of financial planning is to let the client do 80% of the talking. This can be easier said than done, but encouraging clients to speak more during meetings is the key to understanding their needs.

You can achieve this by asking the right questions. For example, rather than asking “what insurance policies do you have,” try asking “When was the last time someone did an audit of your insurance policies?”

In this example, rather than putting them on the spot to recall all their insurance policies, you’re able to see what work they may have already done with a previous advisor or insurance broker. Questions like this open the door for the client to lead the meeting and feel taken care of.

Working as a team

For many HNW clients, they already have some sort of team to handle their finances. They could have a tax preparer, an accountant handling their books, an attorney, an estate manager and more.

To earn their trust and respect, make an effort to connect with any of their existing team members that you feel are valuable and (you and they) should continue working with. For example, take a tax professional.

Financial advisors don’t need to do tax preparation but should still understand it. You may not be filing the client’s taxes at the end of the year, but without attention to the role taxes play in the bigger financial picture, you will miss an opportunity at holistic financial wellness. Asking for an introduction to any of those existing team members will show your collaborative and holistic approach and increase their confidence in their decision to work with you.

While many tactics used to help HNW clients meet their financial goals are the same as any other client, it’s good to understand some of the nuances that make these clients different. Meet their high expectations with premier service.

By avoiding complex language, listening more and collaborating with their larger team, you can create a lasting HNW client relationship that ultimately grows your business.

About the Author

Jason L Smith, CEP, BPC, is a speaker, financial planner, best-selling author, coach and entrepreneur. Following in his father’s footsteps as a second-generation advisor, he founded his financial services practice JL Smith in 1995 to provide clients with holistic financial planning services that align investments, insurance, taxes and estate planning into one comprehensive, coordinated plan. After a serious heart diagnosis at the age of 29, Smith made a commitment to transition his personal financial planning firm into a process-driven company so it could continue with or without him. Today, his financial planning practice is self-managing, allowing him to provide focused financial planning services to his clients. Smith is an 18-year MDRT member with 16 Court of the Table and 16 Top of the Table nominations.

Panel weighs possible changes for WA Cares LTCi plan

Cyber insurance market growing with rising cyber threats

Annuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance NewsProperty and Casualty News

- Home insurance costs soar in North Bay

- Enlyte to Acquire PartsTrader, Complementing Mitchell’s Auto Physical Damage Technology Solutions: Enlyte

- TOP DEMOCRATS ON ENVIRONMENT, FINANCE, AND BANKING COMMITTEES LAUNCH INVESTIGATION INTO INSURANCE RATING COMPANY DEMOTECH, EVALUATIONS OF INSURER FINANCIAL STABILITY AMID GROWING CLIMATE RISK

- It’s the most accident-prone time of the year

- PUBLIC INVITED TO REVIEW FLOOD MAPS IN FRANKLIN COUNTY

More Property and Casualty News