Older Americans richer than previously thought, Census says

Older Americans may be doing better financially than the U.S. Census thought they were, according to a new analysis the agency recently released.

The Census Bureau found that the population overall had higher income and slightly less poverty than previously thought, thanks to a new analysis project, the National Experimental Wellbeing Statistics, or NEWS. The bureau is correcting survey data for a more accurate measure by linking the survey, decennial census and commercial data to remove errors and bias in income and poverty estimates.

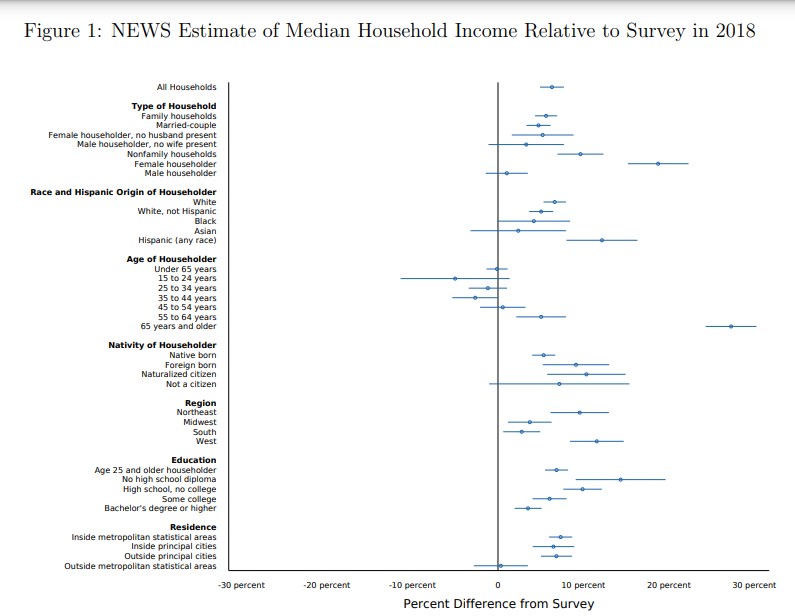

The project found that in 2018, median household income was 6.3% higher than in survey estimates, and poverty was 1.1 percentage points lower.

But older Americans were faring far better. For those 65 and older, household income was 27.5% higher and poverty was 3.3% lower.

This chart shows the adjustments to different subsets.

The previous estimates were spot on for those under 65, with median household income showing a slight difference of -0.1% in the corrected data. But for the 65-and-older group, household income was $55,610 vs. $43,700, a 27.3% difference.

The next age group down fared better as well. For those 55-64, the correction showed $72,430 vs. $68,950, a 5% difference. The change below that was statistically insignificant.

Poverty and income equality

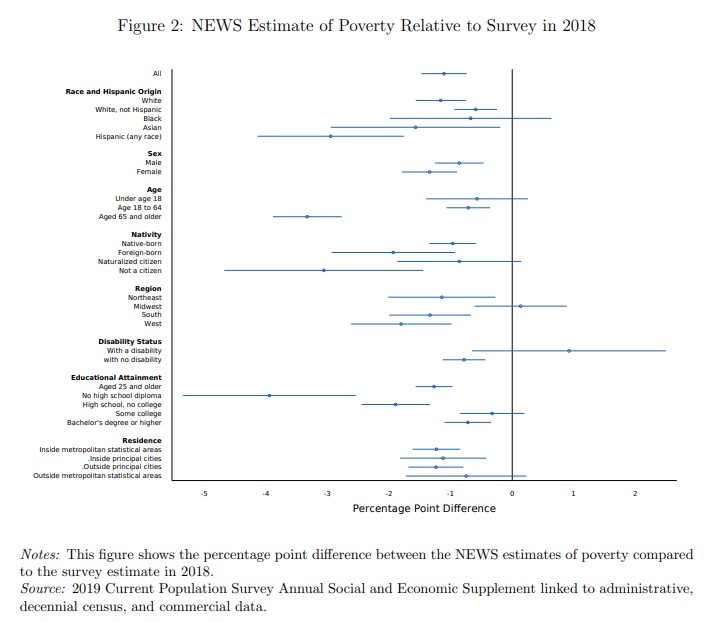

Older people were less impoverished as well. For all ages overall, the poverty rate was 1.1% lower. That might not sound like much but it represents a 9.4% decrease in the number of people in poverty.

For people over 64, poverty was much lower, with a 3.3% decrease in the poverty rate, representing a 34.1% drop in the number of people in poverty.

There was no decline for Black people, disabled people, children, those with some college education, and Midwest and rural residents.

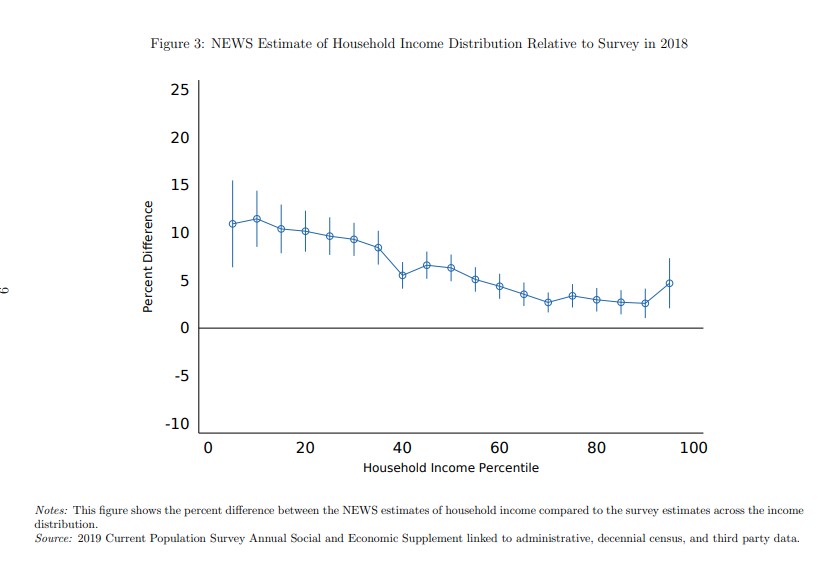

The rich were even richer than estimated in the share of income, but only at the very top, which by now seems familiar for the modern American economy. The top 5% fared better but the groups directly below did not see a similar lift.

Those at the poorest end of the spectrum showed a higher share of income in the new analysis.

The report focused on a single year as a proof of concept. The Census Bureau is planning on scoping out other years and drilling down to smaller geographies, such as counties and states.

The Bureau also plans to include other factors such as the impact of in-kind benefits, taxes and credits on wellbeing.

Elderly poverty still a problem

The Census Bureau has reported that the poverty rate increased since the 2020 survey, rising from 9.5% in 2020 up to 10.7% in 2021. It was not clear if the new wellbeing analysis would change that figure.

The bureau attributed the recent rise in elderly poverty to the COVID pandemic because older people were not eligible for as many pandemic benefits as they left the labor force with dim hopes of returning to work. Inflation has also had a disproportionally larger effect on seniors’ lower income.

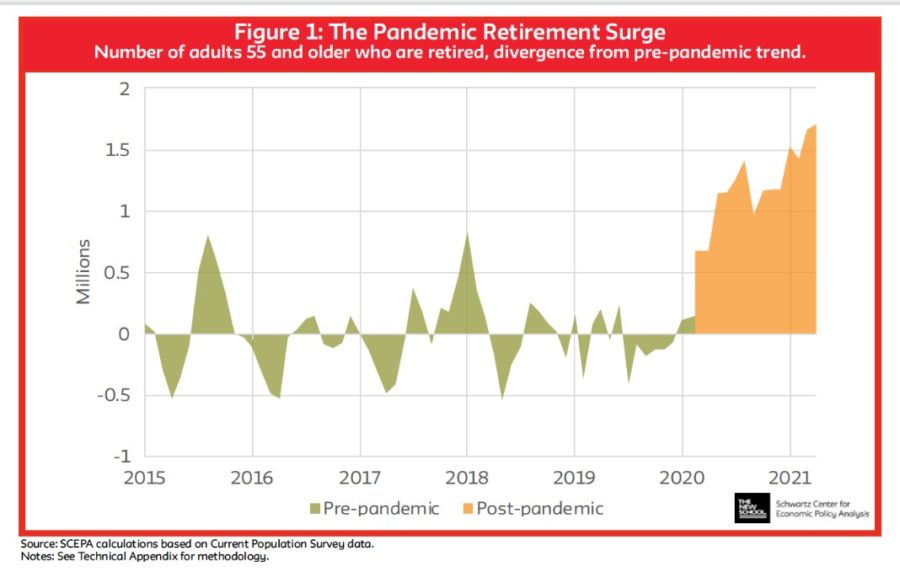

Even if seniors were doing better than expected in 2018, they had a tough time during the pandemic. Teresa Ghilarducci, an economics professor at the New School who studies retirement policy, said the skyrocketing rate of early retirement will set older Americans back economically, especially poorer people with fewer resources.

The retirees were disproportionally those without college degrees, according to a report that Ghilarducci cowrote.

https://www.economicpolicyresearch.org/images/Retirement_Project/status_of_older_workers_reports/Q2_OWAG_2021_V6.pdf

“Although older adults without college degrees retired in greater numbers, the typical worker in this group was not financially prepared for retirement before the pandemic,” according to the report. “Older workers without a college degree had median household retirement savings of only $9,000 in 2019, compared to $167,000 for older working households with a college degree.”

Those with a college degree were less likely to retire early because of the pandemic, but they likely did lose some income.

Even putting aside the pandemic effect, more Americans were facing increased difficulty in retirement, largely because of the shift from pensions starting in the 1980s. Ghilarducci told The New York Times that the trend of elderly poverty is more than the pandemic effect.

“We’re getting more and more older people who lived through this experiment with do-it-yourself pensions, and they’re coming into this age group without the same kind of incomes that older people have,” she said. “I don’t think it’s a blip.”

Her study recommended expanding Social Security benefits by $200 per month and increasing the Special Minimum Benefit up to 125% of poverty levels. It also said the Medicare eligibility age should be lowered to 50 and Medicare should be the first payer.

As Congress grapples with an expected Social Security shortfall, Republican legislators are looking at raising the full retirement age, which is now 67 for those born 1960 and later.

The Republican Study Committee released an alternative 2023 budget that includes a proposal to ratchet the full retirement age to 70 eventually for people born in 1978 or later. The plan would also raise the qualifying age for Medicare.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Northwestern Mutual revenue reaches all-time high at $35B

FPA makes Elder Planning Specialist Program available to members

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

- Jackson Awards $730,000 in Grants to Nonprofits Across Lansing, Nashville and Chicago

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

More Life Insurance News