NuraLogix: How one company is using facial scanning for insurance underwriting

Imagine spending 30 seconds taking a “picture” of your face instead of having to go through lab tests to provide information for life insurance underwriting.

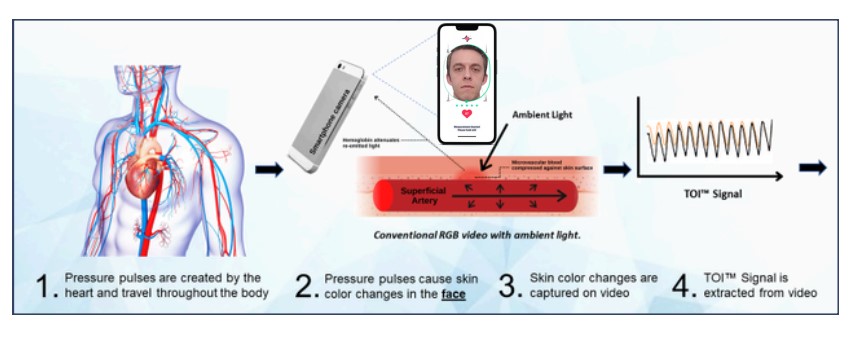

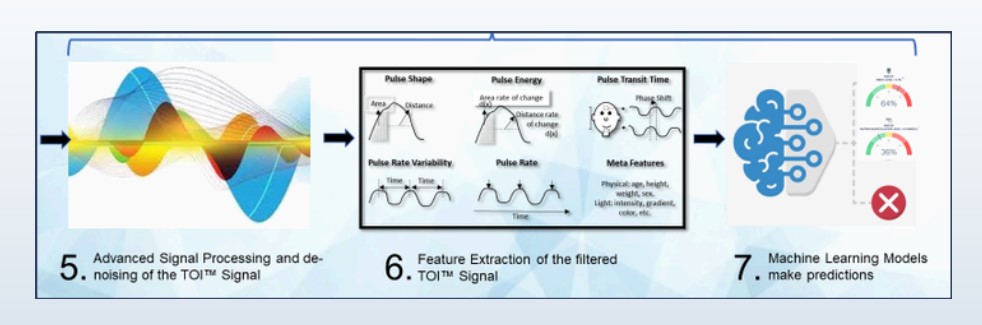

NuraLogix, a Canada-based technology company, developed an artificial intelligence tool that can measure more than 100 health and wellness parameters using a video camera. A patented transdermal optical imaging technique extracts facial blood flow information to predict the likelihood of developing health conditions such as hypertension or diabetes.

Since human skin is translucent, light and its respective wavelengths are reflected at different layers below the skin and can be used to reveal blood flow information in the human face.

The information is captured by and contained in conventional video images. The information is extracted and sent securely into the cloud to be processed.

The company is working with 10-15 U.S. life insurers as part of their underwriting process, said Michael Keefe, NuraLogix vice president of global sales.

Life insurance applicants are directed to a web page where they click on a link and then receive a scanning page on their mobile device or laptop computer, Keefe said. After a 30-second scan, the results are input into the carrier’s actuarial back office. The information is part of the information collected by the applicant’s questionnaire.

This leads to a significant reduction in fraud, Keefe said, as applicants can’t lie about their health conditions on the questionnaire.

“What we provide is a snapshot right now of what your health is with a predictive index in a number of different categories,” he said. “We can predict your cardiovascular disease risks. We can predict the onset of Type 2 diabetes. We can predict your mental health and your propensity to have anxiety and depression as well as mental stress.

But just because you have these conditions doesn’t mean they are lifelong or a life sentence. We’re working with multiple companies in the coaching space that will look at a person and help them through nutrition and fitness.”

The applicant’s face doesn’t appear in the scan, only pixelated images of blood flow, said Dr. Keith Thompson, NuraLogix chief medical officer.

“There is no personal health information stored, so there's no way that we identify anybody. It's processed in the cloud, and those results are sent back. And we don't use any of that customer scanning data to train our models.”

NuraLogix’s app, Anura, measures vital signs such as pulse rate, breathing rate, blood pressure, heart beat and vascular capacity. It also measures body mass index, facial skin age, waste-to-height ratio, body shape index, and mental stress index. Anura can determine the user’s 10-year risk of stroke or heart attack, as well as the user’s risk for Type 2 diabetes, hypertension and fatty liver disease.

The company’s technology also is used in the employee wellness space, Keefe said, with the data collected used to determine health risks that are specific to certain worker populations.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is editor in chief, magazine, for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

How auto insurers are leveraging advanced data scoring to provide more customized rates

Health agents return from Washington summit

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

More Annuity NewsHealth/Employee Benefits News

- Sen. Bernie Moreno has claimed the ACA didn’t save money. But is that true?

- State AG improves access to care for EmblemHealth members

- Arizona ACA enrollment plummets by 66,000 as premium tax credits expire

- HOW A STRONG HEALTH PLAN CAN LEAD TO HIGHER EMPLOYEE RETENTION

- KFF HEALTH NEWS: RED AND BLUE STATES ALIKE WANT TO LIMIT AI IN INSURANCE. TRUMP WANTS TO LIMIT THE STATES.

More Health/Employee Benefits NewsLife Insurance News