Now is a ‘perfect time’ for preretirees to consider FIAs, expert says

The current market environment “could not be a more perfect time” for those who are in the “retirement red zone” to add a fixed indexed annuity to their portfolio. That was the word from Igor Zamkovsky, head of indexed annuities and insurance with Blackrock’s Retirement Insurance Group. Zamkovsky made the case for adding FIAs in the accumulation phase of a client’s retirement portfolio at a webinar presented by the National Association for Fixed Annuities.

The retirement red zone refers to the time period of roughly five years before retirement or five years after retiring.

“If you happen to be retiring in 2022 and your portfolio is down 20% and your’re not overfunded, something has to give,” Zamkovsky said.

With so many investment classes down, “having protected retirement solutions is more important than ever,” he said. “We’re in an incredibly dynamic market environment. But the overall concepts surrounding the value of FIAs are still true.”

The classic portfolio of 60% stocks and 40% bonds is under pressure in today’s environment, Zamkovsky said. The quarter ending Sept. 30 marked the third consecutive quarter of both stock and bond losses. This is the first time this occurred since 1931. Although stock volatility and valuations are elevated, bonds are less equipped to provide protection. Bond indexes have only lost money in four consecutive quarters once – in 1954 – and in three consecutive quarters three times – in 1931, 1980 and 2022. Stock indexes have lost money in six consecutive quarters twice – in 1969-70 and 2008-09 – in five consecutive quarters only in 1931 and in four consecutive quarters twice – in 1937-38 and 1974-75.

“If you happen to be retiring in 2022 and your portfolio is down 20% and your’re not overfunded, something has to give."Igor Zamkovsky, head of indexed annuities and insurance, Blackrock’s Retirement Insurance Group

Meanwhile, bonds are on pace for the lowest returns since the 1960s, Zamkovksy said. As for equity funds, they have become riskier in the past 10 years, which may increase the risk of losses.

Clients want to “play it safe” with their portfolios, he said, but that strategy carries its own risks. Much like it reduces the value of money in the future, inflation also affects the true return on our investments after we take it into account. If an investment’s return is less than the inflation rate, then a return that appears positive on paper could actually be negative in real-value terms. In particular, Zamkovsky noted bond returns are at a negative 0.1% return over the past 10 years when adjusted for inflation, while bank certificates of deposit are at a negative 1.75% return and cash is at a negative 2.3% return.

“We believe liquidity is incredibly important but too many people have too much cash on the sidelines,” he said. “Inflation is eating away at purchasing power.”

Blackrock’s research suggests that FIAs can allow for consistent equity exposure in the retirement red zone to help capture upside potential while also mitigating downside sequence-of-return risk.

Zamkovsky provided a case study showing how an FIA can be added to the portfolio of someone entering the retirement red zone.

A retirement case study

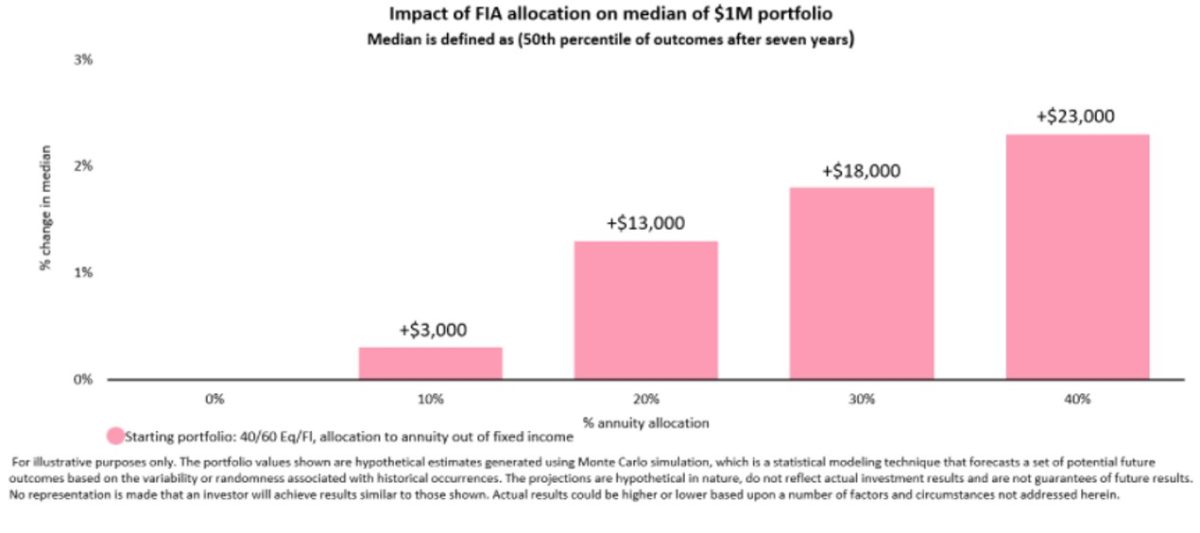

Zamkovsky said Blackrock analyzed the benefits and tradeoffs of adding partial portfolio allocations to an FIA. In its case study, Blackrock looked at a hypothetical preretiree with a 60/40 retirement portfolio.

The preretiree is 58 years old, planning to retire at age 65 and has an initial portfolio of $1 million. Blackrock ran Monte Carlo simulations with 5,000 return paths.

Blackrock’s simulation looked at adding an FIA funded from equities and fixed income or adding an FIA funded from fixed income. The simulation found that allocating funds to an FIA offers greater upside in the “median” scenario when suitably funded. It also found that adding an FIA reduced extreme bad outcomes in balanced portfolios. FIAs improved worst and median outcomes for conservative and cash-heavy portfolios, assuming liquidity needs had been met. Finally, the simulation found incorporating an FIA with an underlying volatility-controlled index can help provide more certainty around future portfolio values.

What impact does an FIA have on a retirement portfolio in bull markets and in bear markets? If markets keep going up, allocating some of the portfolio to an FIA “can actually decrease median value a little bit,” Zamkovsky said. But what if markets are down?

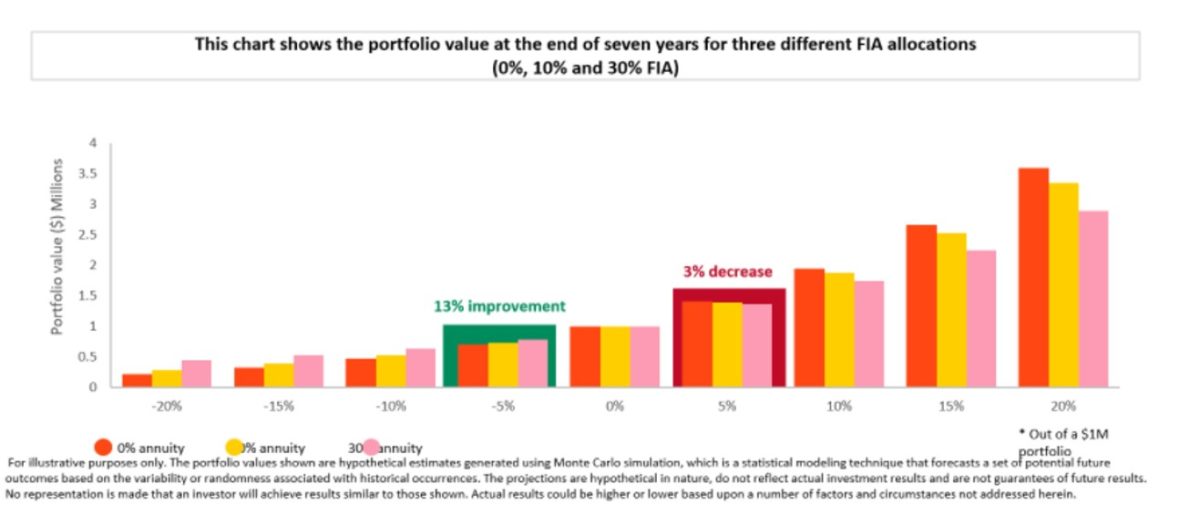

Blackrock’s analysis looked at the portfolio value at the end of seven years for three different FIA allocations: 0%, 10% and 30%. It found that in consistently positive markets (up 5% annually for seven years), a 30% allocation to an FIA led to an overall portfolio value after seven years of $1.36 million versus $1.4 million in a portfolio with no FIA allocation – a 3% decrease. Meanwhile, in consistently negative markets (down 5% annually for seven years), a 30% allocation to an FIA led to an overall portfolio value of $790,000 after seven years versus $700,000 in a portfolio with no FIA allocation – a 13% improvement.

The Blackstone simulation also looked at how to fund the FIA for the hypothetical preretiree’s portfolio.

Sourcing from fixed income: In the situation of the client’s concern that their current portfolio will not provide the upside potential needed for an adequate retirement portfolio, the challenge is that allocating 60% of the portfolio to fixed income is unable to generate the return potential the client needs to grow the portfolio. The solution is to have the client consider allocating a portion of their fixed income to an FIA to potentially provide more upside.

Sourcing from equities and fixed income: For the client who is focused on avoiding extreme downside market scenarios and is less focused on growth, the challenge is that equity funds today are riskier today than they historically have been. The solution is for the client to consider allocating funds from both fixed income and equities to an FIA to provide more protection in an extreme downside scenario.

Sourcing from cash: For a client who is conservative and holds a large amount of cash and fixed income inside their portfolio, the challenge is that inflation and low bank rates could eat into the value of their assets. The solution is for the client to consider including an FIA sourced from cash and fixed income to improve the worst and the median expected outcomes.

Key takeaways for financial professionals

Zamkovksy said choosing between FIA crediting strategies and benchmarks requires an active discussion between the advisor and the client. These conversations can consider product design, index design, current cap and participation rates, median outcome expectations and desired confidence around target outcomes.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Break the auto insurance buying cycle with telematics solutions

An insured American’s lifetime health care expenses may top $700K

Advisor News

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

More Advisor NewsAnnuity News

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

More Annuity NewsHealth/Employee Benefits News

- OID announces state-based health insurance exchange

- Cigna plans to lay off 2,000 employees worldwide

- Insurer ends coverage of Medicare Advantage Plan

- NM House approves fund to pay for expired federal health care tax credits

- Lawmakers advance Reynolds’ proposal for submitting state-based health insurance waiver

More Health/Employee Benefits NewsLife Insurance News