NAIC Report: Insurance Producers Rack Up Nearly 42,000 Fines In 2020

Insurance producers accounted for nearly 42,000 fines in 2020, while 1,275 licenses were suspended and another 1,468 licenses were revoked.

The data comes from the 2020 Insurance Department Resources Report published Wednesday by the National Association of Insurance Commissioners. The NAIC produces the annual report to help state insurance departments assess their resource needs by allowing them to compare themselves to other agencies in the U.S.

The report is based on surveys completed by each of the individual insurance departments, the NAIC said.

When it comes to bad behavior, the news appears to be better. State insurance departments received 246,900 official complaints and 1.3 million inquiries. That compares to nearly 290,000 official complaints and more than 1.6 million inquiries in 2018.

Data on fines and license suspensions and revocations in pervious years was unavailable.

Licensed resident producers numbered nearly 2.3 million individuals and 239,585 entities. Nonresident producers consisted of nearly 7.9 million individuals and 506,159 entities. Those numbers are up from the nearly 2.2 million licensed resident producers and 228,393 entities in the 2018 report. Non-resident producers numbered nearly 6.6 million individuals and 456,908 entities in 2018.

Forty-one states had separate criminal fraud investigation units, and 51 jurisdictions had company and producer licensing information available online.

Staff Turnover

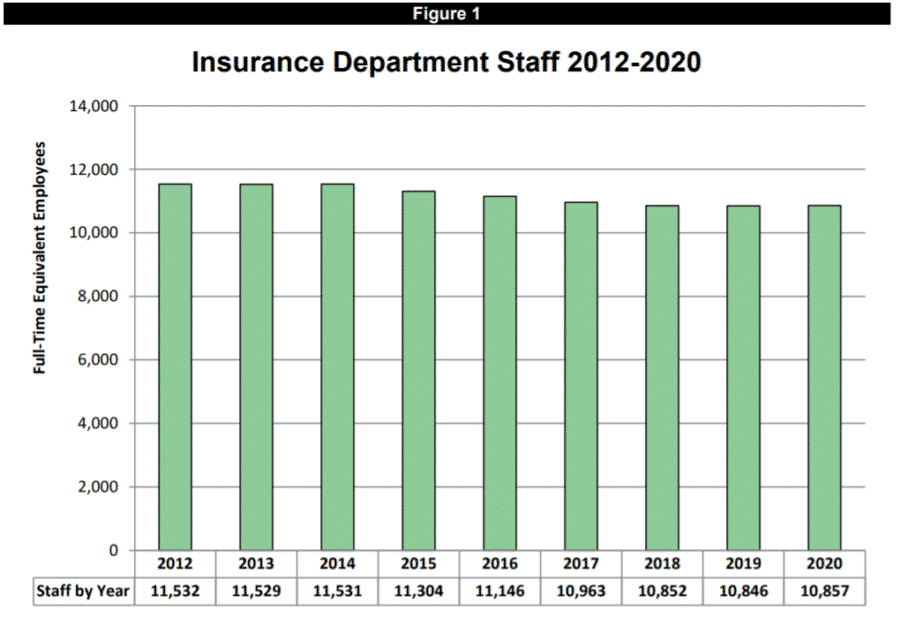

Overall, insurance department full-time equivalent staffing levels increased 0.10% from the 2019 level. Fourteen departments increased staffing, and 20 decreased staff levels. The remaining departments either stayed the same or did not have sufficient data to determine the degree of change.

Staffing nationwide is down about 6% since 2014, NAIC data indicates. The top five departments based on staffing levels in 2020 were: 1) Texas; 2) California; 3) Florida; 4) New York; and 5) North Carolina.

Insurance department contractual staff (those hired for specific tasks but not employees of the insurance departments) decreased by 0.24% from 2019 and was down by 11.53% since 2015.

Budget Concerns

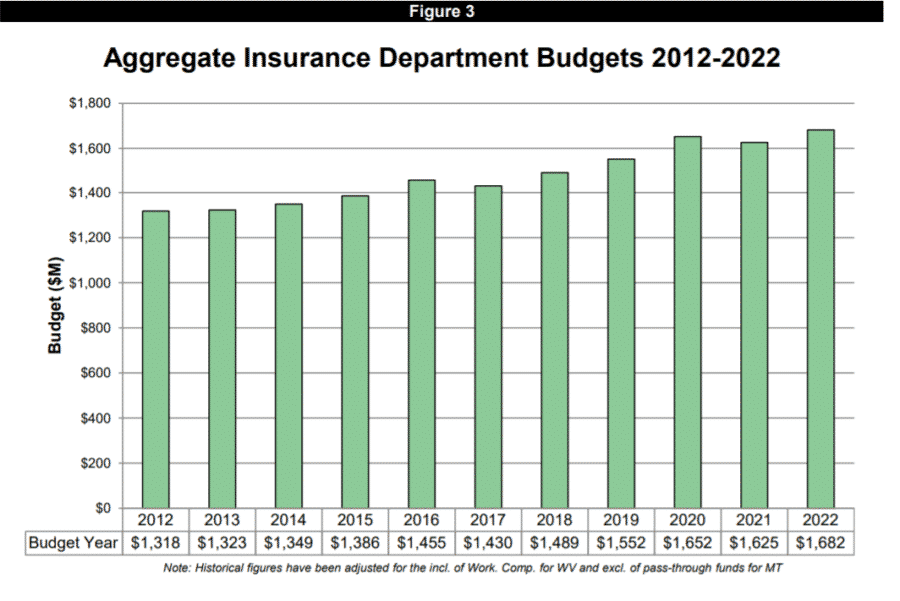

Budget levels for fiscal year 2022 are expected to increase by 3.47% from 2021 amounts and to increase by 12.94% since 2018, the NAIC reported. Total projected fiscal year 2022 budgets are almost $1.7 billion.

California reported the largest 2022 budget, which is $79.6 million greater than the second-largest 2022 budget (New York). Thirty states reported increased 2022 budget amounts from their 2021 reported budgets.

Revenues collected from the insurance industry increased 7.34% from 2019 to $29 billion in 2020. Total taxes collected increased by 6.93%.

Declining Insurer Numbers

The number of U.S. domestic insurers decreased from 5,947 companies in 2019 to 5,929 companies in 2020. This figure does not include captive insurers, which are reported in the second volume of the report due out in a few weeks.

The total number of company examinations completed was 1,588. There were 195 liquidations in progress at year-end, as well as 37 rehabilitations in progress.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Maryland’s FineFix Program Ends With Nearly 20,000 Uninsured Motorists Paying Up

Revolving Credit Balances Reach Pre-Pandemic Levels

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

More Annuity NewsHealth/Employee Benefits News

- $2.67B settlement payout: Blue Cross Blue Shield customers to receive compensation

- Sen. Bernie Moreno has claimed the ACA didn’t save money. But is that true?

- State AG improves access to care for EmblemHealth members

- Arizona ACA enrollment plummets by 66,000 as premium tax credits expire

- HOW A STRONG HEALTH PLAN CAN LEAD TO HIGHER EMPLOYEE RETENTION

More Health/Employee Benefits NewsLife Insurance News