Most insurance AI patents come from just 3 U.S. insurers, study finds

Artificial intelligence patenting in insurance is becoming a high-stakes, highly concentrated race dominated by a handful of U.S. property and casualty carriers, even as overall activity remains 30% below its 2020 peak.

Evident, an AI benchmarking and intelligence platform focused on financial services, has released new data from its Insurance AI Patent Tracker, providing a sector-wide view of how insurers are protecting AI innovation.

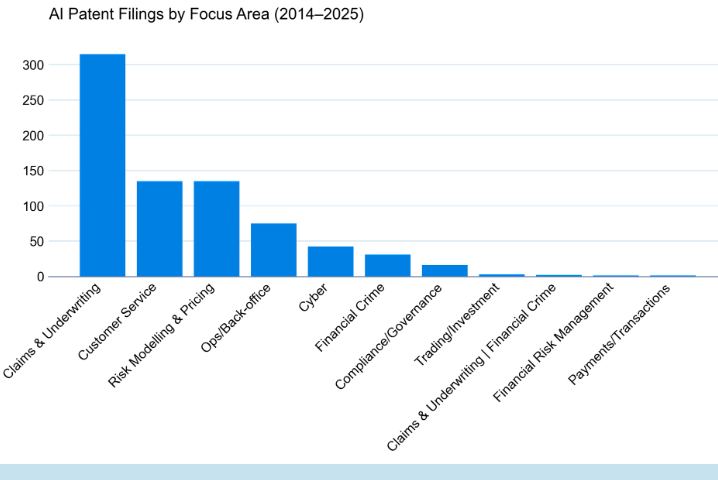

The analysis shows that 166 AI-related patents have been filed by 30 major insurers in North America and Europe since January 2023. Filings are heavily clustered among a small group of U.S. carriers, with State Farm, USAA and Allstate alone accounting for 77% of all AI patents filed by insurers over the past decade. P&C insurers dominate overall, responsible for 89% of AI patents, reflecting their advantage in telematics, IoT-driven risk monitoring, and other sensor-based systems that more easily satisfy patentability standards in the U.S. and Europe.

“Patents offer a rare window into where insurers are placing their biggest bets on AI,” said Alexandra Mousavizadeh, Co-founder and CEO of Evident. “This data shows that innovation is overwhelmingly being driven by a handful of US firms, especially in P&C. While the volume of filings remains modest compared to banking, we’re seeing a sharp uptick in generative and agentic capabilities. The IP landscape is shifting from protecting past systems to enabling future ones.”

GenAI and agents rising

Despite growing interest and investment in generative AI, patent volumes have not returned to their 2020 high. Evident reports that aggregate AI patent activity across insurance is currently about 30% below that peak, suggesting a more selective or strategic approach to filing in the post-2020 period. Within those filings, however, there has been a sharp shift toward generative AI: these patents have climbed from 4% of insurer AI filings to 31% in 2023, with most focused on customer service and claims automation use cases.

Agentic AI—systems that can take autonomous actions on behalf of users—is beginning to appear in the portfolio but remains rare, with only three insurers having filed agentic AI patents to date, led by USAA.

Where insurers are applying AI today

The patent data offers a detailed look at how leading insurers are embedding AI throughout the value chain. Examples highlighted in Evident’s analysis include USAA’s use of generative AI to clarify aerial imagery for property damage assessment, and State Farm’s work on machine learning–based claims triage and autonomous vehicle fault analysis.

Allstate has pursued patents around an in-vehicle AI assistant aimed at automating elements of the claims process and enabling behavior-based discounts, while Swiss Re has focused on predictive analytics for medical data and anomaly detection. Other filings point to MassMutual’s efforts in interpretable underwriting and AI-driven document tagging, Liberty Mutual’s deployment of generative AI for engineering release notes, and Zurich Insurance Group’s systems for transforming user-entered addresses into clean, structured datasets.

Strategic implications

Evident positions this patent landscape as a strategic crossroads for the sector. On one path, AI patents remain the preserve of a small group of frontrunners, particularly in U.S. P&C, who use IP to lock in technical and data advantages around telematics, automation and advanced analytics. On the other, patent filings could become a broader signal of competitive intent as more carriers move from experimentation to production-scale AI.

The data underscores a shift from protecting legacy systems toward securing the next generation of AI capabilities, especially in generative and agentic technologies that touch underwriting, claims, customer interaction and internal operations.

“The insurance sector is at a crossroads,” added Mousavizadeh. “Either patents remain the domain of a few frontrunners, or they become merely a signal of broader competitive intent. As generative and agentic AI reshape the value chain, insurers will need to decide whether to build IP defensively or lead from the front.”

What your homeowners insurance doesn’t cover anymore

Health plan approved drug lists more complex, challenging consumers

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- After loss of tax credits, WA sees a drop in insurance coverage

- My Spin: The healthcare election

- COLUMN: Working to lower the cost of care for Kentucky families

- Is cost of health care top election issue?

- Indiana to bid $68 billion in Medicaid contracts this summer

More Health/Employee Benefits NewsLife Insurance News