Most Americans aware of LTC’s importance, but few have started preparing

Many Americans have not taken any steps to prepare long-term care plans despite being keenly aware of its importance, according to the results of a Transamerica study.

Nine out of ten (91%) of Americans believe that long-term care planning is crucial, but just 45% have actually given thought to planning for their long-term care needs, Transamerica's Extended Care Report found.

Cost and accessibility could be major factors causing this, said John Stanley, senior managing director for Employee Benefits at Transamerica.

“With nearly all respondents acknowledging the importance of planning for long-term care, it's clear that awareness is not the issue. The challenge lies in translating this awareness into action,” he said.

This is a key area where advisors can step in to assist, Stanley told InsuranceNewsNet.

Calling the report a “clarion call,” he urged advisors to take away key insights when speaking with clients about long-term care needs.

“Without proper knowledge or understanding, individuals may not prioritize long-term care insurance or may not fully comprehend its benefits,” Stanley said.

“Advisors and those in the long-term care industry should focus on educating individuals about the importance of planning early, addressing cost concerns, and providing options that align with their preferences for care.”

Understanding consumer insights on LTC

Transamerica’s study was undertaken as the issue of affordable extended care for an aging population becomes more urgent across the United States.

It conducted the survey to understand if their workplace benefit customers “were planning for long-term care, if they understood their options and if long-term care could potentially impact their retirement plans.”

“The survey revealed that 91% of respondents agreed that their retirement planning should include their needs for extended care,” Stanley noted.

“Both individuals with and without life insurance recognized the importance of long-term care planning, with 78% of those with life insurance and 70% of those without life insurance agreeing with the need for extended care planning.”

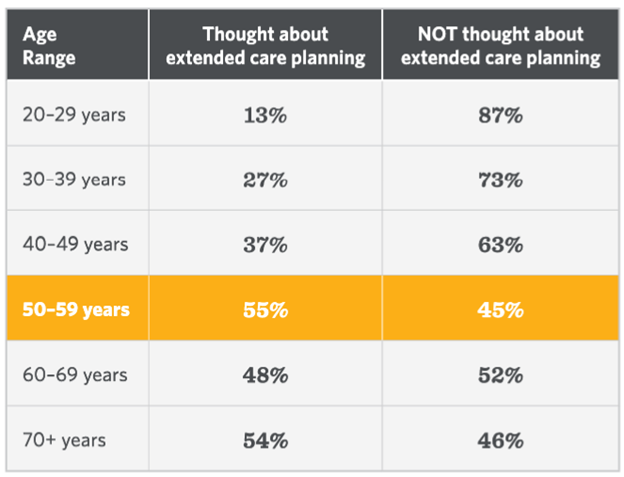

This result was consistent across all age categories, from 18 to over 70 years old. However, late planning was a common theme.

“Fewer than half of participants had thought about extended care needs until they reached the age bracket of 50-59,” according to the report.

“Most haven't taken steps to prepare for possible long-term care needs, but a shift in thinking seems to happen when people reach their 50s.

“At any age, it's important to talk to family and financial planners so questions like ‘who’ are resolved before care is needed.”

Cost the biggest concern

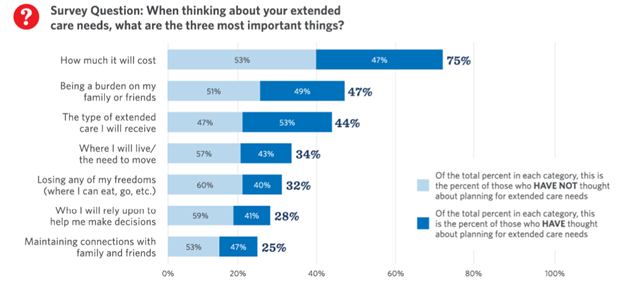

When it comes to LTC, cost was a significant consideration for 75% of survey participants.

“This highlights the need for advisors and industry professionals to provide information and resources on different payment options, including insurance policies, federal programs and personal funds,” Stanley said.

“Educating individuals about the various financial aspects of long-term care can help them make informed decisions and alleviate concerns.”

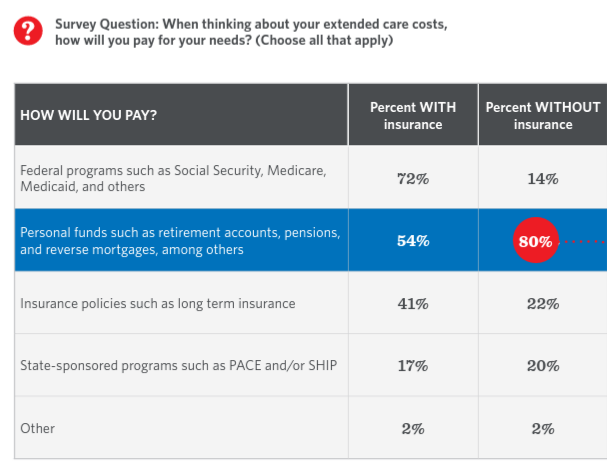

According to Transamerica’s survey, just one in every five respondents felt confident they will have enough money to pay for extended care.

Eighty percent of insured respondents and 54% of uninsured respondents said they plan to use personal funds such as retirement accounts and pensions to fund their long-term care costs.

However, Transamerica found that 37% of respondents who plan to use their own funds have an annual household income under $75,000.

Gaps in LTCi coverage

Around 45% of participants in Transamerica’s survey said they plan to use insurance to pay for extended care, although just 22% said they actually have insurance to cover those costs.

Gaps in long-term insurance coverage is a serious concern across the United States. It’s expected that many aging and uninsured Americans will not be able to afford long-term care.

In July 2023, Washington became the first state to introduce a government-mandated LTCi program meant to address this issue.

Stanley suggested that LTCi gaps may be due not just to high costs but also to lack of accessibility, lack of understanding, belief in alternative funding sources and failure to meet health eligibility requirements.

“Some individuals may find it difficult to access long-term care insurance due to limited availability or lack of access to insurance providers, [especially] in rural areas or those with limited access to insurance resources,” he said.

Additionally, he said some Americans may believe that alternative funding such as personal savings, investments or government programs like Medicaid “will be sufficient or prefer to self-fund their care.”

Stanley acknowledged that these reasons are not exhaustive, as individual circumstances can vary.

Nonetheless, he said that by understanding such consumer insights, “industry professionals can better assist individuals in making informed decisions about their long-term care needs.”

Founded in 1906, Transamerica is a provider of insurance, retirement and investment solutions to millions of Americans. It offers both individual insurance coverage as well as a range of workplace benefits.

Rayne Morgan is a journalist, copywriter, and editor with over 10 years' combined experience in digital content and print media. You can reach her at [email protected].

Washington asks court to block SHIP long-term care rate increases

How captive and independent agents are affected by the DOL rule

Advisor News

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

- Todd Buchanan named president of AmeriLife Wealth

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Trump wants Congress to take up health plan

- Iowa House Democrats roll out affordability plan

- Husted took thousands from company that paid Ohio $88 million to settle Medicaid fraud allegations

- ACA subsidy expiration slams Central Pa. with more than 240% premium increases

- Kaiser affiliates will pay $556M to settle a lawsuit alleging Medicare fraudKaiser affiliates will pay $556M to settle a lawsuit alleging Medicare fraudKaiser Permanente affiliates will pay $556 million to settle a lawsuit that alleged the health care giant committed Medicare fraud and pressured doctors to list incorrect diagnoses on medical records to receive higher reimbursements

More Health/Employee Benefits NewsLife Insurance News