Morgan Stanley’s GenAI Debrief tool ‘revolutionizes’ day-to-day for financial advisors

Multinational investment firm Morgan Stanley Wealth Management believes they have set a new benchmark for the use of artificial intelligence in the American financial services industry with the launch of AI @ Morgan Stanley Debrief, an automated note-taking tool that will save advisors time and streamline their day-to-day.

Morgan Stanley's Debrief automatically generates notes, a list of action items and a follow-up email on a financial advisor’s behalf after a client meeting.

“The rollout of AI @ Morgan Stanley Debrief is a substantial moment in our innovation journey as it capitalizes on some of the most impressive features of GenAI, taking the administrative work out of meetings so advisors can spend more of their valuable time focusing on clients,” Vince Lumia, head of Wealth Management Client Segments for Morgan Stanley, said.

He also noted what the potential could mean for further technological developments in other lines of business.

“We are thrilled by this technology’s potential to revolutionize an advisor’s day-to-day, and we look forward to additional iterations down the road,” he said. “Further, while advisors remain the center of our universe, we are more than excited to unlock the potential of this technology across all our wealth management channels.”

“AI @ Morgan Stanley is a developing ecosystem that over time will likely have implications for numerous applications at our firm, as well as break down silos to allow more seamless internal exchange, streamline processes, and produce beneficial outcomes for our clients,” Koren Picariello, MSWM head of Generative AI and Execution, added.

AI-powered efficiency

The new AI @ Morgan Stanley Debrief tool is powered by OpenAI — the same research company behind ChatGPT, the popular generative AI chatbot that has been making headlines around the world.

It works by transcribing a meeting between a client and an advisor after the fact, using an audio recording and only with the client’s consent. It then generates a summary of the meeting, including key points and a list of action items. From there, the Debrief tool generates a draft email the advisor can review, edit and send out.

The key working behind this tool is, arguably, the most vital component of anything that uses generative AI: a prompt.

“The summaries are generated based on our instruction or prompt to the model, whereby we instruct the model to identify, highlight and summarize the key discussion points and actionable items,” Picariello explained.

Despite the apparently effortless success, this process actually took months to get right, he said.

“As a core GenAI team, we spent months iterating on the prompt, with live FA feedback, to produce desired outputs,” he added. “We believe AI @ MS is going to be an interaction layer that sits between the users, clients and advisors and the complexity of our platform, and just makes everything more seamless by using just a command prompt.”

Improved advisor and client experiences

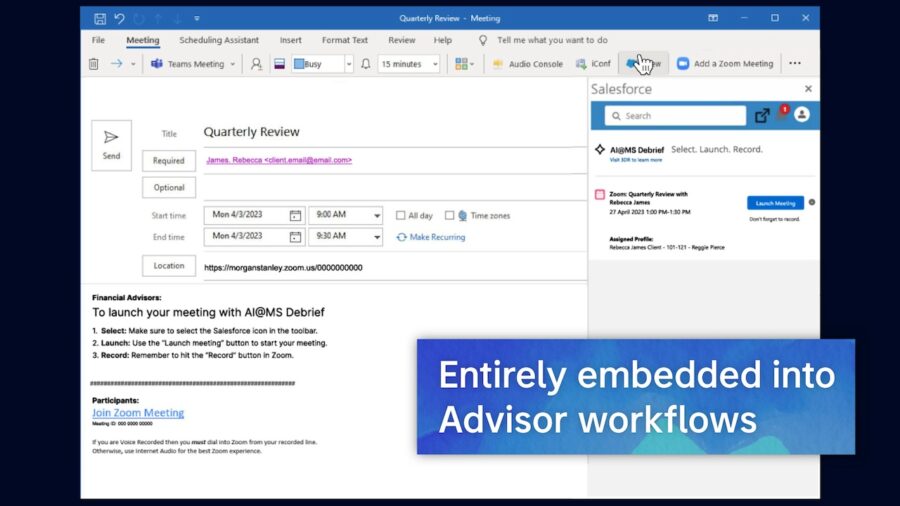

AI @ MS Debrief is integrated with many tools financial advisors already commonly use, including Outlook, Zoom and Salesforce, improving ease of use.

“What sets this technology apart is in how it’s the first to be seamlessly embedded right into advisor workflows, so there’s no toggling between screens — a common advisor pain point,” Lumia noted. “All client interactions, with their consent, are captured and logged in our CRM with ease.”

Picariello added that advisors remain “squarely in the driver’s seat,” as they can review and edit GenAI draft outputs prior to use. Meanwhile, clients can benefit in several ways too.

“Clients are excited to be a part of this groundbreaking technology, and they like the follow-up aspect because it helps hold them accountable as well,” he said. “Because we’re getting to the follow-up steps more quickly, we receive things from clients much quicker, allowing us to execute more efficiently and arrive at solutions sooner.”

An integrated future

Picariello suggested the AI @ MS Debrief is still just the beginning of tech developments at MSWM, which has steadily been developing new solutions with OpenAI since their formal partnership in early 2023.

“We’re still in early innings when it comes to the technology’s evolution,” Picariello noted. “Our financial advisors are the center of our wealth management universe, so we tend to focus on them for our primary use cases, but we aim to bring this functionality to our entire employee base, subject to appropriate oversight and controls.”

However, he emphasized that the firm doesn’t see AI as a replacement for critical human capital, but rather as a tool to better empower them.

“AI is the latest in a decades-long line of technological advancements — including computers, the internet and robo-advisors — that were predicted to render financial advisors redundant,” he noted. “But none of those technological leaps replaced financial advisors. Trust-based relationships will always have a role as clients seek professionals who understand which solutions are the right fit for each of their needs.”

Morgan Stanley Wealth Management is an American investment bank and financial services company founded in 1585. It has over 75,000 employees and offices in 41 countries.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Rayne Morgan is a journalist, copywriter, and editor with over 10 years' combined experience in digital content and print media. You can reach her at [email protected].

Judge to decide if whistleblower can proceed with Globe Life lawsuit

Content that connects: A pathway to business growth

Annuity News

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- Obamacare sign-ups drop

- NJ DEPARTMENT OF BANKING AND INSURANCE PROVIDES GET COVERED NEW JERSEY OPEN ENROLLMENT UPDATE

- Mystic resident attends State of Union to highlight healthcare cost increases

- Findings from University of Connecticut School of Medicine Provides New Data about Managed Care (Nursing Home Ratings and Characteristics Predict Hospice Use Among Decedents With Serious Illnesses): Managed Care

- Missouri, Kansas families pay nearly 10% of their income on employer-provided health insurance

More Health/Employee Benefits NewsLife Insurance News

Property and Casualty News

- Jeff Landry asks state-created insurer to pay for fortified roofs. Here’s why.

- Could AI claims settlement without a lawyer become the new norm?

- Nancy Guthrie abduction puts focus on 'kidnap and ransom' insurance

- U.S. insurers optimistic despite increased headwinds

- Bowhead Specialty Holdings Inc. Reports Fourth Quarter and Full Year 2025 Results

More Property and Casualty News