More Than Money: What Clients Want To Discuss

The advisor of the future must be willing and able to discuss topics that are not purely financial, according to a new study by AIG Life and Retirement and the Massachusetts Institute of Technology AgeLab.

The study, “The Future of Client-Advisor Relationships,” found that as clients’ needs evolve, the model of a financial professional also must evolve.

Clients want to broaden the scope of their conversations with their advisors to have highly satisfying relationships, the study found. Clients who said they are satisfied with their advisor relationships said they still want to discuss their financial plans for retirement and how they manage their money. But they also want to discuss topics such as their careers, their future goals and aspirations, their potential long-term care expenses, and even their family members’ finances,” said Kevin Hogan, CEO of AIG Life and Retirement.

“Clients are expressing interest in discussing topics beyond traditional conversation boundaries in favor of wider-ranging, deeper conversation,” Hogan said. “Although financial planning, portfolio performance and financial expertise remain important drivers of satisfaction, advisors are now being asked to consider broader topics and act as a resource connector. In this role, a financial advisor uses their broader network to help clients find the right expertise and services to address their needs.”

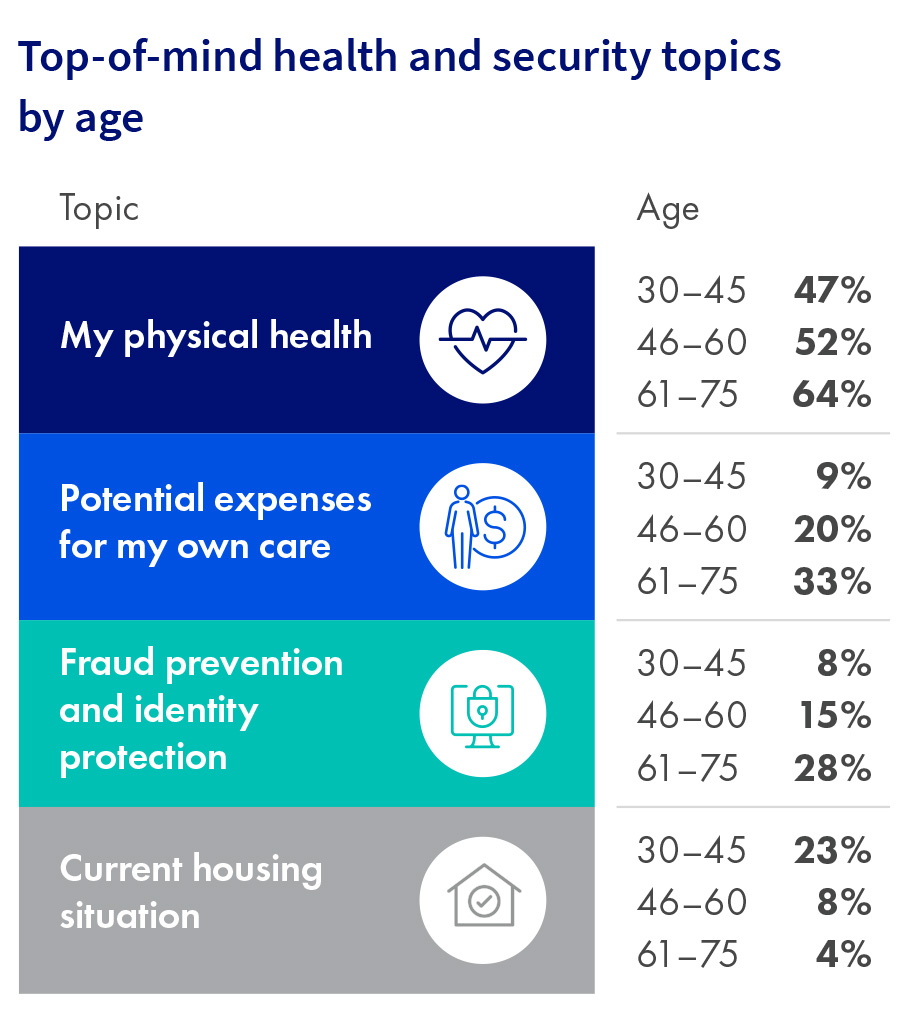

The nonfinancial topics that clients want to discuss include identity theft, fraud prevention, their physical health and their housing situation, the study found. The chief topic across the age groups polled (30-45 years old, 46-60 years old and 61-75 years old) was their own physical health, not their financial standing, Hogan said. The threats of identity theft and fraud prevention are also top of mind; 97% who already have discussed this with their advisor want to continue the conversation, and 80% who have yet to discuss this topic are eager to do so.

Hogan said he was surprised at the amount of importance clients placed on the topics of identity theft and fraud prevention, especially among older clients. However, this older age group was also the least likely to have already had a related conversation with their advisor, with only 30% of them saying they had discussed the subject. “This represents a clear opportunity,” he said.

But not every topic is up for discussion with advisors, the study said. Half of clients ages 46-75 said they do not want to discuss a family member’s health with their advisor.

Deepening The Relationship

Discussing those nontraditional topics leads to deepening the advisor-client relationship, the study showed.

The study revealed that clients who reported the highest levels of satisfaction with their advisor had discussed nontraditional topics with them. More than eight in 10 highly satisfied clients said they discussed future goals and aspirations — 77% discussed job transitions, new careers or retirement; 72% discussed their own care; and 62% discussed their family members’ finances.

The data also showed how crucial an advisor’s ability to personally connect is to client satisfaction; one of the top reasons for ending an advisor relationship is attributed to a lack of personal connection, with 25% saying it was the cause of terminating their relationship.

Clients’ interest in talking to their advisors on topics not directly involving money “is broadening the client/advisor relationship and presenting an opportunity for a more transparent, holistic approach to financial and future planning,” Hogan said. “While no one expects financial advisors to be an expert on all topics, they have the opportunity to help their clients identify areas of concern and then connect them into broader networks of expertise.”

The study also looked into the ways and frequency in which clients communicate with their advisor. One takeaway was that 40% of younger clients — those ages 30-45 — said they communicate with their advisor once a month. In addition, more than one-third of those in that age group said they view their ideal advisor as a life coach or even as their friend. A financial advisor’s professional network and personality were also key drivers of client satisfaction for respondents ages 30-45.

‘You Get Me’

The MIT AgeLab has spent the past several years conducting research to understand what characteristics clients believe are the most important factors for an advisor to have. Not surprisingly, clients expect their advisors to have professional knowledge and expertise. But clients want something more, said Joe Coughlin, director of the MIT AgeLab.

“The characteristic that makes a real difference in attracting and retaining clients is demonstrating that ‘you get me,’” he said. The AIG study “provides more evidence that this element of a financial professional’s engagement with a client, truly knowing them, provides a differentiated value that goes well beyond expertise, product fit and knowing the numbers alone. Clients want you to know them before being given permission to serve them.”

Coughlin said the research makes it clear that all clients are changing and that there is a “new generation gap out there that is all about expectations.”

Younger consumers, he said, have always had a wealth of information and advice — from teachers to SAT prep tutors to career coaches to having access to an online world that provides them with opinion and direction on nearly every aspect of their lives.

“They are now expecting that the professionals they work with to ensure their financial security know them much like a friend and, like a friend, to have their back guiding them throughout their life course, not just at periodic financial decision points,” he said.

The Human Factor

The MIT AgeLab has been conducting research on robo advice for several years, Coughlin said. The results of the AIG/MIT study showed that “human advice and client relationships are not going away.”

“The fact is, algorithms make terrible conversations,” Coughlin said. “Robots are not good at understanding what keeps a client up at night, nor can they engage in a conversation reassuring a client that things will be OK or why a change of plans might be necessary.”

Clients of all ages still want to talk to a human, Coughlin said. He added that the study shows that algorithms will not replace humans, but “they will help financial professionals spend less time working on calculations and more time having conversations with their clients.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Putting His Money Where His Hope Is

Be Better Than Yourself!

Advisor News

- Nationwide Financial Services President John Carter to retire at year end

- FINRA, FBI warn about generative AI and finances

- Prudential study: Babies born today will likely need nearly $2M to retire

- Economy performing better than expected, Morningstar says

- Advisors have more optimism post-election

More Advisor NewsAnnuity News

- Prudential Financial to Reinsure $7B Japanese Whole Life Block with Prismic Life

- Nationwide Financial Services President John Carter to retire at year end

- Pension Rights Center: PRT deals could lead to ‘nationwide catastrophe’ regulated

- Allianz Life Retirement Solutions Now Available Through Morgan Stanley

- Midland Advisory Focused on Growing Registered Investment Advisor Channel Presence

More Annuity NewsHealth/Employee Benefits News

- CVS Health to cut another 13 jobs connected to its offices in Hartford

- Findings from Icahn School of Medicine at Mount Sinai Broaden Understanding of Dementia (Self-funded Personal Care Is Common And Costly For People With Dementia Across The Income Spectrum): Neurodegenerative Diseases and Conditions – Dementia

- Health care impacted by cybersecurity, regulation and AI in 2025

- MNsure sets record as more than 167,000 Minnesotans sign up for health insurance

- Indiana Black Legislative Caucus Unveils 2025 Legislative Agenda

More Health/Employee Benefits NewsLife Insurance News

- Exemption Application under Investment Company Act (Form 40-APP/A)

- Prudential Financial to Reinsure $7B Japanese Whole Life Block with Prismic Life

- Nationwide Financial Services President John Carter to retire at year end

- PHL Variable policyholders: moratorium on policy benefits ‘inequitable’

- How to identify ideal prospects for long-term-care insurance

More Life Insurance News