More drivers accept telematic tracking for insurance, studies show

More consumers have been accepting the use of data from their driving to lower insurance costs but still only a small percentage of consumers are taking advantage of the technology when it is available, according to recent studies.

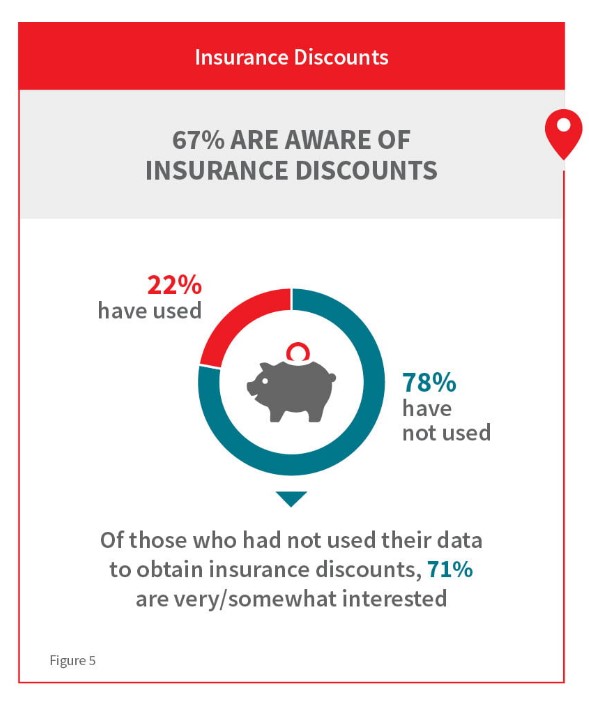

Two-thirds (67%) of drivers were aware that their vehicles can capture and transmit telematic data, according to a recently released LexisNexis study. Only 22% used their data to get insurance discounts, but among those who weren’t using the data for discounts, 71% said that they would be interested in doing that. Telematics connect through consumers’ mobile phones or apps in the vehicle.

LexisNexis researchers said the disconnect is a lost opportunity not just for insurance companies but also for auto companies.

“Insurance is a major contributor to the total cost of vehicle ownership for consumers,” according to the report. “Automakers are looking to improve cost of ownership and the overall customer experience by leveraging vehicle and driving behavior data to enable usage-based insurance (UBI) products, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD). Lower insurance premiums can contribute significantly to making car ownership more affordable, benefiting consumers and automakers.”

The technology is becoming more accessible as the 5G network solidifies across the nation, offering a much wider bandwidth to “unleash a new dynamic for the digital ecosystem,” according to the report.

Technology has become less expensive and more effective, leading to greater adoption, according to the researchers. But now the hard work is in education.

“Educating consumers on how they can leverage their telematics data through your connected services program has the power to help solve the gap between consumer interest and engagement with UBI [usage-based insurance],” the researchers wrote, addressing automakers.

Pandemic taketh and giveth

Although driving decreased dramatically early in the COVID pandemic, the adoption of telematics increased significantly, according to recent J.D. Power survey of U.S. auto insurance customer satisfaction.

Its survey found the largest year-over-year increase in consumers’ adoption of telematics for insurance pricing, with 16% of drivers using UBI, which was double usage over five years. More than a third (34%) in the JD Power survey said they were interested in using telematics for UBI.

When people do use UBI, they like the savings, with price satisfaction among those customers 59 points higher than among customers overall.

A TransUnion survey released in May showed that inflation was driving UBI adoption, with a 33% year-over-year increase in consumers who accepted an offer from their insurance carrier to use telematics.

Compared to the previous survey in November 2021, the number of customers offered a telematics policy to monitor driving and help set rates rose from 32% to 40%, and the number of those who accepted rose from 49% to 65%.

Michelle Jackson, senior director of TransUnion’s personal property and casualty insurance business, attributed the greater acceptance partly to the pressure of inflation.

“It’s clear that high inflation levels are impacting consumer wallets, and many people are now considering new technologies that may help them save money,” Jackson said. “In the insurance industry, more consumers are warming to the idea of using a telematics tool to enhance safe driving while also lowering costs.”

She added that the acceptance might spread to other property and casualty business, such as connected devices in homes monitoring for fire, water leaks and other risks.

How to drive up interest?

The LexisNexis researchers had some advice for automakers to help accelerate telematic and UBI acceptance.

- Create awareness of insurance discount opportunities and educate consumers about the potential benefits of participating.

- Provide a seamless way for customers to engage and opt in through their automaker’s connected services program.

- Engage with a well-managed telematics exchange to create an opportunity for consumers to shop for insurance using their own driving behavior data.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Legislation aims to bring transparency to health care

IRS escalating attacks on some captive insurance companies

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- Major health insurer overspent health insurance funds

- OPINION: Lawmakers should extend state assistance for health care costs

- House Dems roll out affordability plan, take aim at Reynolds' priorities

- Municipal healthcare costs loom as officials look to fiscal 2027 budget

- Free Va. clinics brace for surge

More Health/Employee Benefits NewsLife Insurance News