More Americans say yes to sharing wellness data

Life insurance wellness programs have been around for less than a decade, but more Americans are interested in participating in them, researchers found. An increasing number of Americans say they are willing to share their wellness data in return for saving money on insurance.

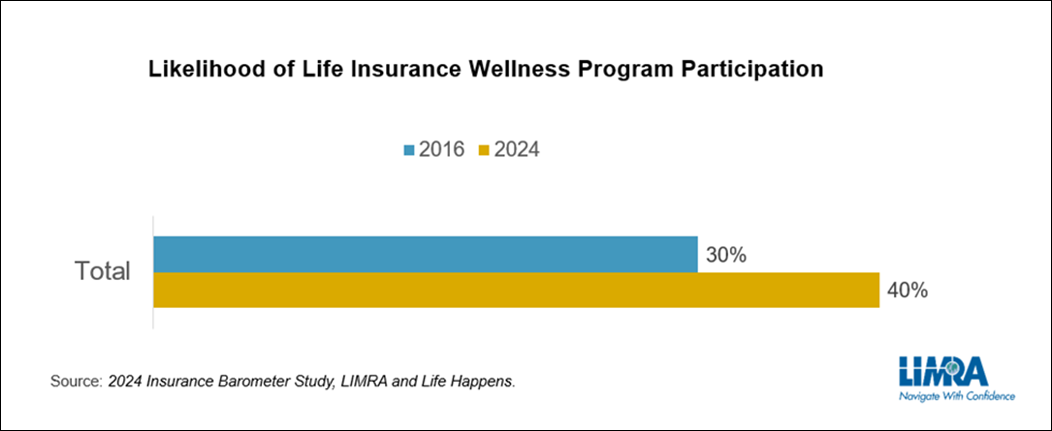

According to the 2024 Insurance Barometer Study by LIMRA and Life Happens, more Americans say they would participate in a life insurance wellness program than in previous years. These programs involve consumers exchanging health or activity data for incentives such discounts on premiums or products. The percentage of willing Americans increased 10 points over the past eight years, from 30% in 2016 to 40% in 2024.

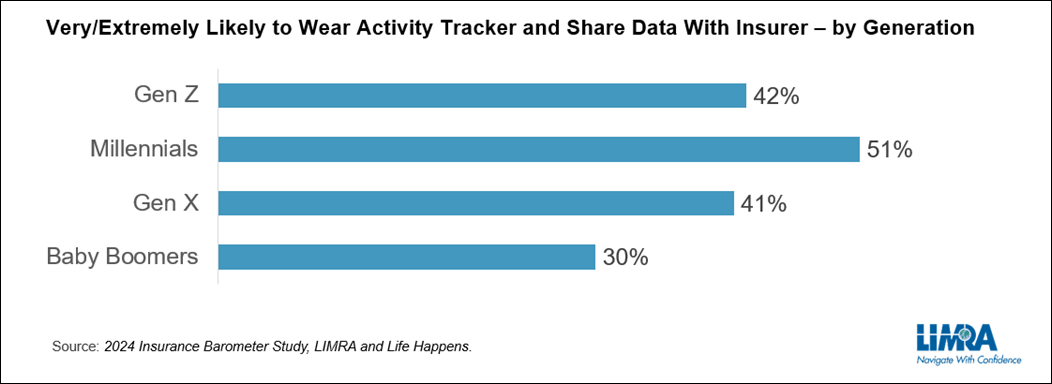

Interest in life insurance wellness programs increased across all demographics. Younger adults, in particular, have more interest than older generations. More than half of millennials and 42% of Generation Z adults say they would be willing to wear an activity tracker and share data with a life insurer compared to 41% of Generation X and 30% of baby boomers.

Almost one-third of Americans are wearing some type of fitness tracker, according to the National Heart, Lung, and Blood Institute. As wearable technology, smart phones and apps become more ingrained in our everyday life, this presents an opportunity for the life insurance industry to continue exploring wellness incentive programs for consumers, the Barometer Study said.

Steve Wood, a member of LIMRA’s markets research time, told InsuranceNewsNet that the popularity of rewards programs and apps offered by nearly every business from coffee shops to pharmacies is making its way into life insurance.

“We’ve all become kind of used to sharing some personal information with companies, but when you’re dealing with life and health insurance, now you’re sharing even more personal information, so that becomes a hurdle in getting more people to participate,” he said.

Gaining trust in the technology, the security of that technology and in the company that is seeking the information will be crucial in getting more consumers to feel confident in sharing their wellness data, he added.

Consumers might say they’re concerned about privacy, but the study shows more Americans are showing a willingness to share their data, Wood said, and that indicates that “as a culture, we've become so immune to data sharing.”

The Barometer Study identified two different types of incentive programs that consumers said they would be interested in. Both involve ways of reporting consumer data back to their insurer.

‘Active sharing’ programs

The first type of incentive program is known as “active sharing.” As the name suggests, active sharing programs require the participant to report activities and behaviors to their insurance company. Examples include gym visits, vaccinations, physical exams and test results.

Sixty-six percent of consumers who are interested in this type of wellness program cite savings and discounts as the top reason. Conversely, 46% of consumers with little to no interest mentioned privacy concerns as the main reason. Millennials had the most interest in this program (50%) compared to 39% of Gen X and Gen Z adults and only 30% of baby boomers.

Millennials are more likely to feel confident about their health and gym attendance. They are also more comfortable with data sharing and rewards programs, having grown up with the advent of smartphones, apps, and social media. Therefore, millennials may not feel the same sense of intrusion as older adults. Researchers said they expect Gen Zers to share similar feelings as they mature.

‘Passive sharing’ programs

In a “passive sharing” incentive program, reporting involves passively sharing data on activity completed per day. Examples include heart rate, calories burned, hours slept, miles walked, etc. The idea is that an activity tracker worn on the wrist or chest would track a participant’s daily movement and share that data with the insurer.

Nearly 7 in 10 consumers (65%) say participating in this kind of program would help them establish activity goals and make healthier choices. Similar to active sharing programs, 46% of uninterested consumers believe they would be sharing too much information.

Protecting personal data is a priority

Historically, convincing consumers to share personal health information and daily activities has had mixed results. Even though smartphones and wearables are an increasing part of our lives, consumers still have concerns about how their data will be used — especially older Americans.

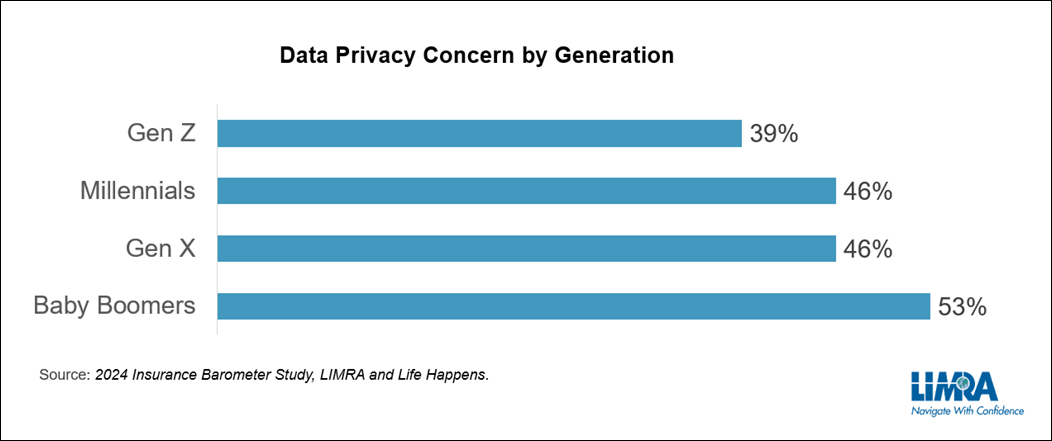

More than half (53%) of baby boomers are very concerned about data privacy. Forty-six percent of Gen X and millennial adults share similar levels of concern, followed by nearly 4 in 10 (39%) Gen Z consumers. This should be a strong reminder to the insurance industry to keep trust at the forefront of their business practices.

More than 100 million American adults say they need (or need more) life insurance, the Barometer Survey revealed. A consistent theme over the past several years is the need for more education and awareness in the life insurance industry. Life insurers who can balance offering rewards for access to consumer health data while giving those consumers the confidence that their data is protected could realize successful business outcomes.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Why insurers must maintain a personal touch in a technology-driven era

Medicare costs lowered for 10 drugs in latest round of price negotiations

Advisor News

- CFP Board announces CEO leadership transition

- State Street study looks at why AUM in model portfolios is increasing

- Supreme Court to look at ERISA rules in upcoming Cornell case

- FPA announces passing of CEO, succession plan

- Study: Do most affluent investors prefer a single financial services provider?

More Advisor NewsAnnuity News

Health/Employee Benefits News

- State Comptroller's audit reveals $16.2 million in improper Medicaid claim payments

- Premiums expected to match hike

- McLeod, 12 other counties might form own health plan

- Researchers at Nationwide Children’s Hospital Target Appendicitis (Accountable Care Organizations, Child Opportunity Index, and Complicated Appendicitis In Children): Digestive System Diseases and Conditions – Appendicitis

- Report: If Medicaid expansion ends, be prepared to pay more for private insurance

More Health/Employee Benefits NewsProperty and Casualty News

- Recent storms are wakeup call about flood insurance

- Dems snub medical malpractice reform

- DJ Bettencourt: Weathering An Evolving Insurance Landscape

- How AI improves interactions between insurers and auto body shops

- Top 8 trends that will impact insurance in 2025

More Property and Casualty News