Millennials ‘Unforgiving’ On Tech Expectations, SIR Speaker Says

Emerging technology is great for streamlining delivery of insurance coverage using fewer resources.

But it is also creating a much more demanding customer, said Martha Turner Osborne, chief marketing and sales officer for Teachers Life, a Canadian fraternal benefit society which provides life insurance and disability insurance to members in Alberta, British Columbia and Ontario.

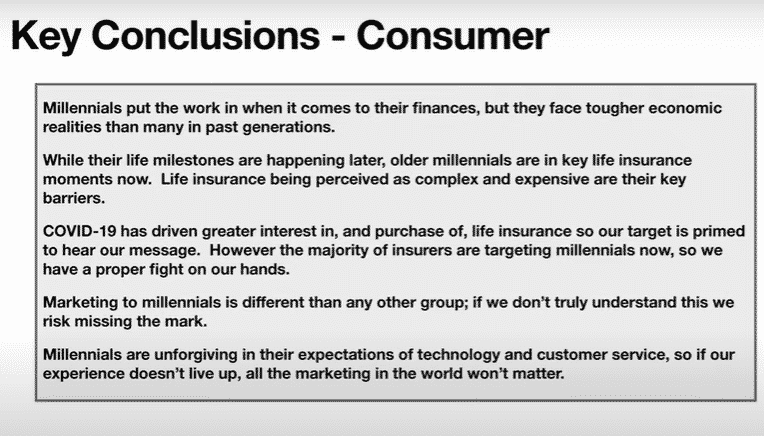

"Marketing to millennials is different than any other group," Osborne said during the Society of Insurance Research annual conference Monday. "If you don't understand this, you're going to miss the mark. They are unforgiving in their expectations of technology and customer service. So if our experience doesn't live up, all the marketing in the world won't make a difference."

It is important to fine-tune marketing efforts to the coveted younger consumer, she explained. And the competition is fierce, since everyone is targeting this group.

"Everybody is marketing to them," Osborne said. "And because of the uptake of people shopping and buying life insurance, and it being front and center because of Covid, that has really accelerated in terms of the dollars being poured into the ads."

And 84% of millennials don't trust traditional advertising, she noted, one of several key takeaways:

Teachers Life is dealing with many of the same difficulties in the Canadian market, Osborne said. Much like the United States, Canada is "a very underinsured country," she explained. Forty percent of Canadians have no life insurance and 77% are dramatically under insured.

Despite the challenges presented by the younger generations, they do want life insurance, surveys show. Life Insurance being perceived as complex and expensive are their key barriers, Osborne noted.

According to the 2021 Insurance Barometer Study by LIMRA, nearly half of millennials surveyed (45%) said they're now more likely to buy life insurance coverage because of the global pandemic. That number exceeds baby boomers and Gen X individuals, 15% and 31%, respectively, who say they would buy life insurance.

There is much work to be done to capitalize on the opportunity, Osborne said.

"Our key conclusions on the consumer is that millennials put the work in when it comes to their finances," she added. "But they face much tougher economic realities than many in previous generations. And while their life milestones are happening later, older millennials are in the key life moments now."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Nationwide, Annexus, Capital Group Launches Target Date Fund Series

Growing Your Expertise Through Advanced Certifications

Advisor News

- The financial advisor’s guide to creating an effective value proposition

- Thrivent survey finds gap between financial fear and action

- Help your clients navigate tax regulations

- CFP Board announces CEO leadership transition

- State Street study looks at why AUM in model portfolios is increasing

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Easy initial Unicam approval for 2nd Jacobson Medicaid bill

- New Texas advocacy group calls for more health insurance transparency

- GOP-led Georgia Senate votes to ban state medical coverage of transgender procedures

- Georgia Senate OKs bill to ban state workers from gender affirming care under state health plan

- Health insurance for millions could vanish as states put Medicaid expansion on chopping block

More Health/Employee Benefits NewsLife Insurance News

- Brighthouse Financial Announces Fourth Quarter and Full Year 2024 Results

- Jackson Recognized for Clear and Compelling Marketing and Communications throughout 2024

- NC yanks incentives for Charlotte-area firms that had pledged $200M investment, 900 jobs

- Symetra Adds New Consumer-Facing Cancer Care Compass (SM) Site During National Cancer Prevention Month

- Trustmark Selects Leading Caregiver Platform Cariloop To Support Customers Facing Long-Term Care Challenges

More Life Insurance News