Medicare Buy-In May Leave Sickest And Costliest In Employer Plans

The record-high unemployment rates resulting from the COVID-19 pandemic have resulted in millions of Americans losing their employer-based health insurance.

The pandemic may lead to a political landscape that moves away from the employer-based health insurance model and toward a Medicare buy-in, or a form of public option, said Paul Fronstin, director of health research and education for the Employee Benefit Research Institute.

But would workers jump ship from their existing plans to a Medicare buy-in? And what about costs?

EBRI sponsored a webinar Tuesday to discuss many of the angles in the impact of a Medicare buy-in, which has been proposed in Washington for a number of years.

A Medicare buy-in doesn’t address the fundamental problem of health care costs, said Bill Kramer, executive director for health care policy, Pacific Business Group on Health.

“The primary effect is to shift to who is paying for health coverage between the government, employers and individuals,” he said. “There is no incentive for providers to be more efficient. There is a day of reckoning for everyone in the health care industry. We need to find a way to come together and tackle the issue of health care costs.”

A Medicare buy-in would allow older workers to enroll in Medicare before they reach age 65. Similar policy proposals have been kicking around Washington for decades, said Jake Spiegel, EBRI research associate. Previously, he said, such policies were targeted toward expanding coverage, but now the Medicare buy-in has a dual goal of expanding coverage and reducing costs.

But who might switch to a Medicare buy-in? Spiegel described those most likely to switch.

- Higher spenders might switch. They might be less money out of pocket, given that Medicare reimburses providers at a lower rate. If higher spenders switch to Medicare, then the amount of spending shifted from employers could be significant.

- Lower spenders might switch. Only workers who are unconcerned with bumping up against an out-of-pocket maximum would be tempted to switch. If lower spenders switch to Medicare, then the amount of spending shifted from employers will be marginal.

Spiegel built two models to measure the impact of a Medicare buy-in on employers.

The first model, which he described as the naïve model, examines the impact of switching if only higher (and lower) spenders switch. First, he calculated how much the top 10%, 20% and 50% of eligible workers spend; this would represent the scenario in which only systematically high spenders switch. Next, he calculated how much the bottom 10%, 20% and 50% of eligible workers spend; this would represent the scenario in which only systematically low spenders switch.

The second model, which he called the switching model, simulates health care spending based on administrative data, and workers choose the option that minimizes their health care expenses.

In the naïve model, Spiegel said he found the implications on employer spending vary greatly dramatically depending on who switches. He found the top 10% of spenders in the 50- to 64-year-old age group accounted for 19.3% of total employer-sponsored health care spending; the bottom 10% accounted for less than 0.01%. As a result, a Medicare buy-in could end up transferring a significant sum of health care spending to the public rolls, or it could end up transferring very little to the public rolls. This analysis emphasizes that who switches is really the crux of the issue.

In the switching model, Spiegel said he simulated health care expenditures over the course of a year, and eligible workers chose the option that minimized their health care expenditures. This method allowed him to examine the attraction of the buy-in option compared with employer-sponsored insurance. He conducted several analyses in which he varied employer-sponsored insurance’s deductible, out-of-pocket maximums and premiums. The model reported the reduction in total health care spending experienced in firms with 1,000, 500 and 100 workers.

Spiegel said he assumed the employer-sponsored plan featured a $1,000 deductible, $4,000 out-of-pocket maximum and the same worker-paid premiums as the buy-in option. For a firm with 1,000 workers with median health care spending, switchers account for 19.5% of the firm’s health care spending for the 50- to 64-year-old age group.

He also ran a model in which he varied the generosity of the employer-sponsored plan; comparing the health care savings realized by firms with plans that feature a $2,000 deductible and a $500 deductible, with the same out-of-pocket and premiums as before. He saw that firms with lower deductibles saw smaller decreases in health care spending, indicating that lower deductibles encourage more workers to stay on the employer-sponsored plan.

Continuing to tweak the generosity of the employer-sponsored plan in his model, Spiegel showed that firms whose plans have lower out-of-pocket maximums also encourage more workers to stay on the employer-sponsored plan.

Finally, he said, if the Medicare buy-in plan has lower premiums than the employer-sponsored plan, more workers will switch.

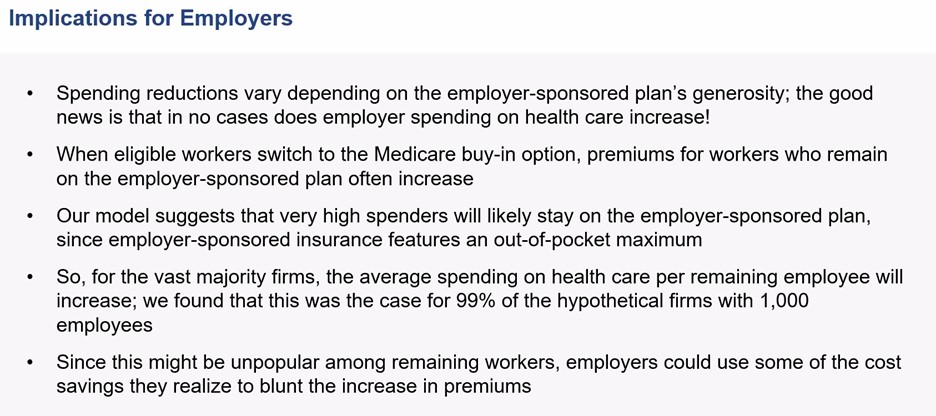

Offering workers a Medicare buy-in has several implications for employers, Spiegel said.

Good, Bad And Ugly

Discussions of a Medicare buy-in on employers can be divided into three categories: good, bad and ugly. That was the word from Katie Mahoney, vice president for health policy with the U.S. Chamber of Commerce.

The good, she said, is the strength of employer-sponsored insurance. Employer-sponsored coverage is the backbone of the nation’s health insurance system, covering about 180 million Americans. It is a powerful employee retention tool and a highly valued workplace benefit, with 55% of workers naming health insurance as their most important benefit and 86% saying they are satisfied with their employer-sponsored insurance.

The bad, Mahoney said, is the consequences of a Medicare buy-in. Its impact on employer-sponsored insurance will depend on which employees switch to the Medicare plan. The choice to switch, she said, will depend on how generous the benefits are and how much the employee will pay. If employer-sponsored coverage is more generous, sicker employees will stick with it. If Medicare is more generous, sicker employees will leave.

The ugly, she said, would be a downward spiral on coverage and quality if a Medicare buy-in becomes reality. Supporters of the buy-in believe it would move older workers to another source of coverage and improve an employer’s risk pool, she said. But, she contended, healthy workers would be likely to migrate to Medicare, and the sick would be likely to stay on the employer-based plan. The result would be increasing premiums and a less-healthy risk pool.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

Study Reveals Perceptions About Life Insurance Ownership Around World

Trends In Financial Services: Where Do We Go From Here?

Advisor News

- Economy performing better than expected, Morningstar says

- Advisors have more optimism post-election

- How to get people to share personal information

- Trump pick for Treasury: extending tax cuts the ‘most important’ issue

- Treasury Secretary nominee Scott Bessent says Trump tax cuts should not expire

More Advisor NewsAnnuity News

- Midland Advisory Focused on Growing Registered Investment Advisor Channel Presence

- Delaware Life Announces Suite of Innovative Fixed Index Annuities

- Allianz Life moves to strengthen annuity operations with own reinsurer

- Global Atlantic Announces New Registered Index-Linked Annuity

- AM Best Affirms Credit Ratings of Reinsurance Group of America, Incorporated and Subsidiaries

More Annuity NewsHealth/Employee Benefits News

- Study Data from Women’s Center Update Understanding of Managed Care (Defining Midwifery-led Care In the United States Using Concept Analysis): Managed Care

- Research from University of Connecticut Yields New Study Findings on Delirium (Emergency Department And Hospital Use Among Cognitively Vulnerable Medicare Advantage Enrollees): Nervous System Diseases and Conditions – Delirium

- UnitedHealth Group CEO acknowledges frustrations with US health care system

- How to find free or discounted health care at Minnesota hospitals

- State heallth agency issues first report on high-cost drugs, treatment

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of Prudential Financial, Inc. and Its Life/Health Subsidiaries

- Symetra reaches $32.5 million settlement over cost-of-insurance charges

- Registration Statement – Specified Transactions (Form S-3)

- Symetra Names Christine Carlson Vice President, Stop Loss Claims

- Best’s Market Segment Report: AM Best Maintains Stable Outlook on India’s Non-Life Insurance Segment

More Life Insurance News