Medicare Advantage shows large profit advantage that new CMS rules look to cut

Medicare Advantage plans have a significant advantage over other health insurance – profit.

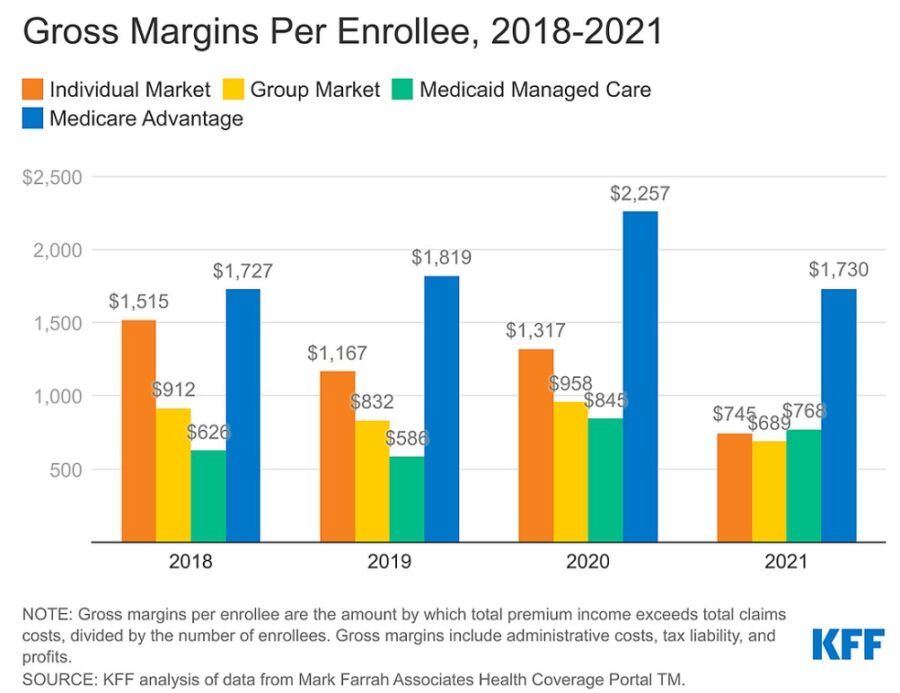

MA carriers have reported profit margins more than double that of insurers in the individual/non-group, the fully insured group/employer and the Medicaid managed care markets, according to an examination by the Kaiser Family Foundation.

The study examined profit margins of carriers in 2021 (the latest full year available) and found the pandemic suppressed the gross margin per enrollee over the previous year, but MA carriers still maintained a healthy margin over the other markets.

The year was a rough one but MA plans regained profitability by the end of the year to pre-pandemic levels while other markets floundered.

“Medicare Advantage plans have both higher average costs and higher premiums (largely paid by the federal government), because Medicare covers an older, sicker population,” according to the report. “So, while Medicare Advantage insurers spend a similar share of their premiums on benefits as other insurers in other markets, the gross margins — which include profits and administrative costs — of Medicare Advantage plans tend to be higher.”

The profit margin has been wide enough for carriers to be worried about their medical loss ratios. If the carriers’ medical costs fall below 85% of premium income, they risk penalties, including termination from the program.

“To avoid such a risk, some Medicare Advantage insurers with loss ratios below 85% may take this opportunity to offer new or more generous extra benefits, such as over-the-counter allowances, meals following hospital stays or transportation, in addition to gym memberships, dental, vision and hearing benefits that are offered nearly universally to help retain and attract new enrollees,” according to the report.

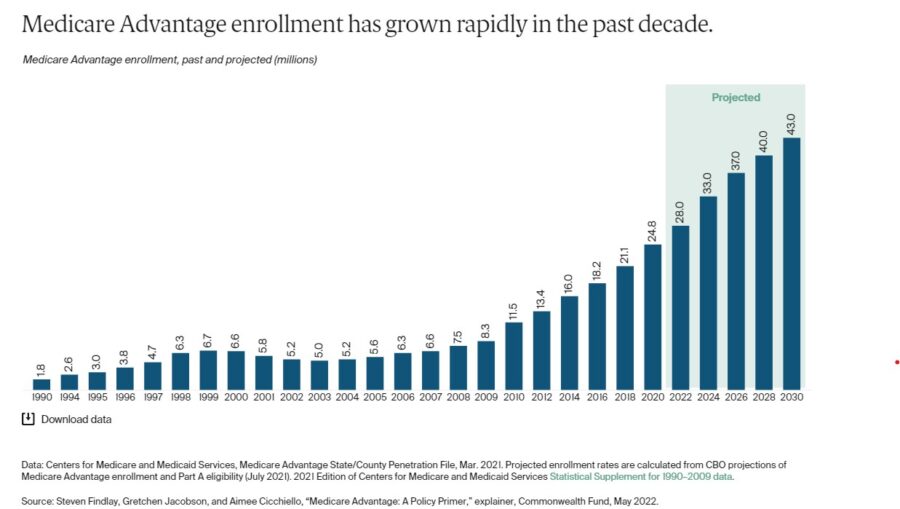

MA is popular and becoming more so with enrollment expected to exceed 50% of all enrollees this year, with two carriers leading the way, UnitedHealth Group and Humana.

CMS to audit MA coding

MA pays private carriers a set rate per enrollee for Medicare-covered benefits, while Medicare pays per service. Insurers use networks to keep costs contained. Carriers say the networks and prior authorizations provide efficiency and allow for more perks but critics say the system encourages denial of some essential services.

The Biden administration and lawmakers are looking at ways to curtail Medicare spending, partly by controlling MA funding.

The Centers for Medicare and Medicaid Services imposed new rate changes and rules for next year, including changes in MA risk adjustment data validation (RADV) audits.

A key issue is “upcoding,” when carriers rate an enrollee sicker than they actually are to get a higher payment. Carriers have said that what looks like upcoding is actually an assessment of enrollees for their likely declining health and the services they will likely need.

Under the new rule, “CMS will extrapolate error rates in the audit sample to the full contract – a practice common to other audits, but not previously included in the RADV program,” according to a KFF report, which said CMS expects the audits to save $4.5 billion over the next decade. MA spending overall is expected to exceed $7 trillion during that time.

Overall, CMS estimates MA payments per enrollee will be 1% higher in 2024, according to KFF, but carriers say that rate changes and RADV audits are taking away from a system that serves not only senior but a diverse set of the population, including disabled people.

In response to the CMS changes, the health carriers’ association, AHIP, reminded everyone about MA popularity and diversity.

“More than 30 million of America’s seniors and people with disabilities choose MA because it delivers better services, better access to care, and better value,” AHIP CEO Matt Eyles said in a press release. “MA also covers more racially diverse populations than original Medicare. As demonstrated by a letter signed by over 60 Senators, MA enjoys strong bipartisan support and is a prime example of the government and free market working together successfully.”

AHIP said it will assess the changes’ potential adverse effects and submit comment. AHIP had also previously laid out its case in a 79-page comment letter last year.

Critics have said the changes don’t go far enough. In an article in Health Affairs, several experts said CMS decided to use data extrapolated starting from 2018 rather than 2011, as first proposed, which they said will leave billions of dollars in the hands of MA carriers. Although carriers are complaining about the rule, it already was a compromise, according to the article.

“The agency’s half-measure seems at least partially motivated by a desire to dissuade legal challenges, an effort that seems poised to fail,” according to the article. “Notwithstanding CMS’s huge gift to MA insurers by declining to apply extrapolation to RADV audits starting with PY 2011, insurer lawsuits challenging the final rule are expected.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Fortified Home standard growing popular as insurance costs rise

AmeriLife shakes up distribution leadership to grow annuity sales

Advisor News

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News