McKinsey To Insurance: Get Younger, Get Digital And Get Flexible

The insurance industry is going to have to get younger, more digitally savvy and come up with more versatile products. Oh, and employees will probably not be coming back to the office.

Otherwise, it should be business as usual for the next decade.

Training its viewfinder on 2030, McKinsey & Co. analysts see these changes as core focus points for the insurance industry and those who wish to remain competitive along the distribution chain.

A pair of McKinsey analysts briefed members of the National Association of Independent Life Brokerage Agencies last week during the trade association's virtual NAILBA 39 Engage event.

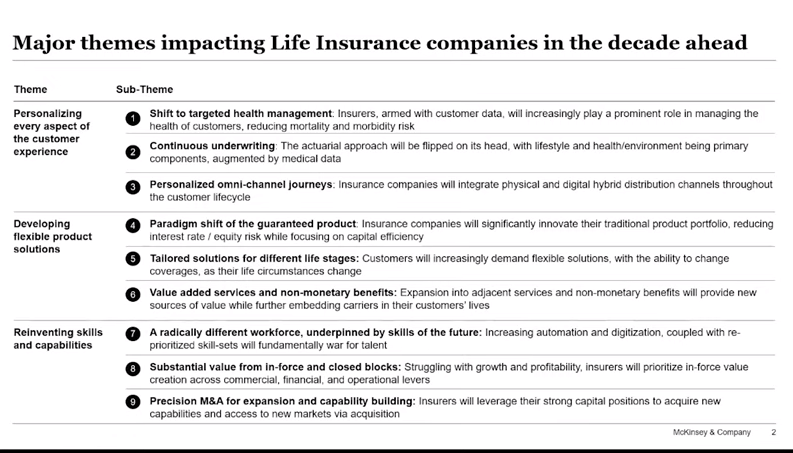

Jonathan Godsall, partner at McKinsey, co-authored a report on the future of the insurance industry with Andrew Reich, associate partner. They settled on three main themes impacting the industry, further broken down into three sub-themes each:

Customer Experience

Insurers could be well on the way to a "more proscribe and prevent" attitude toward policyholder management by 2030, Reich explained. Some of these ideas are already in practice as insurers like John Hancock track client health behaviors and offer discounts for targets met.

The readily available data on "lifestyle" and "health and environment" choices makes for a "continuous underwriting" experience, Reich said. In the future, medical records will actually be the least important part of the underwriting paradigm, the McKinsey analysts said.

“Given the fact that we’re going to have tons more data, more connectivity, more personalization with our customer base, more continuous feedback loop, we actually anticipate that when we look back at the decades behind us in 2030, we will see this fundamental shift in underwriting and in our actuarial approach," Reich said. "All of a sudden we’re learning more about our customers than ever before, we’re getting information in real time, we’re looking to intervene and in some cases, prevent certain outcomes.”

Flexible Products

Asian insurers are having success with interesting policies that shake up the traditional life insurance policy outcomes, Reich said. U.S. insurers have an added incentive to pursue similar strategies with interest rates hovering near zero, he added.

From the customer standpoint, major lifestyle changes are demanding more flexible products. The researchers shared data showing that the number of single-adult U.S. households increased from 13% in 1960 to 28% in 2015, a trend that is seen around the globe.

In China, insurers are having success pairing in-kind benefits with life insurance policies, Reich said.

"Rather than offering clients a monetary payout, the value of the policy is actually in providing guaranteed residence in retirement communities that have skilled nursing, assisted living. If an insured person’s considerations are around 'How am I going to live in my retirement years?'" these policy benefits make sense, Reich said.

Digital Skills

Reich shared how one insurance executive characterized the COVID-19 lockdown impact in a recent comment to him: "an accelerator on a one-way time machine to the future."

In other words, a rapid-fire conversion to virtual meetings, accelerated underwriting tools and a work-from-home workforce. There have been plenty of growing pains throughout this forced digital conversion.

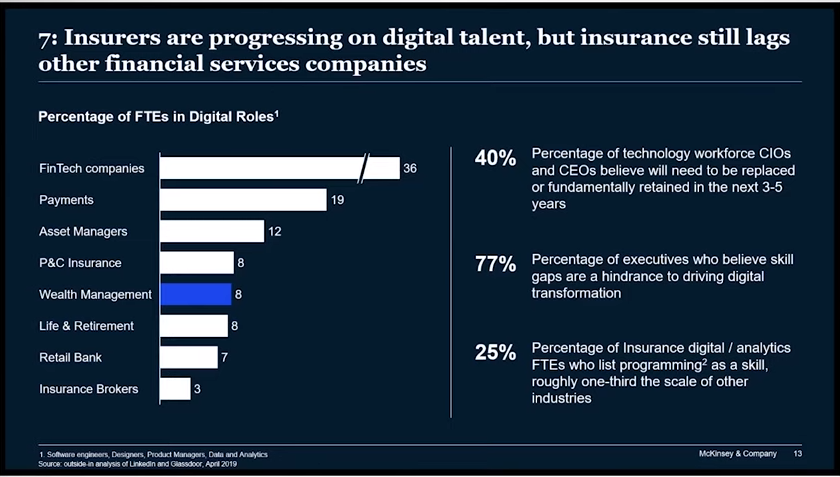

The shotgun marriage to digital laid bare the industry's shortcomings, Reich noted. Simply put, insurance is plagued by an aging workforce that isn't very digitally savvy:

This is a critical issue for the industry, Reich said. Insurers are going to need to incorporate digital into a new customer relationship paradigm that dictates how service is provided at every step, he explained.

“The real winners in the decade ahead will be those that solve this gap between the aging talent and really catering to that next generation that is skilled in the roles that we foresee will be critical for the industry," he said.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

Will The Biden Stimulus Package Be Enough To Save The Economy?

New York Life Launches IndexFlex VA

Advisor News

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

More Advisor NewsAnnuity News

- Edward Wilson Joins SEDA, Bringing Deep Expertise in Risk Management, Derivatives Trading and Institutional Prime Brokerage

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

More Annuity NewsHealth/Employee Benefits News

- Red and blue states alike want to limit AI in insurance. Trump wants to limit the states.

- CT hospital, health insurer battle over contract, with patients caught in middle. Where it stands.

- $2.67B settlement payout: Blue Cross Blue Shield customers to receive compensation

- Sen. Bernie Moreno has claimed the ACA didn’t save money. But is that true?

- State AG improves access to care for EmblemHealth members

More Health/Employee Benefits NewsLife Insurance News