MassMutual To Offer Bitcoin Fund Through NYDIG

MassMutual is pushing deeper into cryptocurrency with a planned investment fund for Bitcoin administered through a tech platform that the carrier has already invested in.

The insurer plans to offer the fund through its broker-dealer MML Investors Services working with NYDIG, a Bitcoin platform in which MassMutual bought a $5 million minority equity stake when the carrier invested $100 million in Bitcoin last year.

“As MassMutual explores ways to integrate cryptocurrency into different areas of its business, MMLIS saw a growing demand from our financial professionals and their clients to gain bitcoin exposure,” Daken Vanderburg, Head of Investments at MML Investors Services, said in announcing the deal. “This offering with NYDIG is yet another step to continue to expand our product shelf with the goal of ensuring our financial professionals and clients have the tools they need to continue to build broadly diversified portfolios.”

Several insurance companies have invested in Bitcoin, some in funds such as Grayscale Bitcoin Trust, but none has been as enthusiastic as MassMutual.

According to a NYDIG survey, many life insurance policyholders are eager to see their carriers ramp up their cryptocurrency investments and offer options for clients. The poll was taken in March of a national sample of 1,050 Americans with at least $50,000 in annual income.

Four in five of the respondents expressed some interest in indirect exposure to digital investments.

More than half of respondents want the option to receive all or some of their insurance payouts in Bitcoin.

The survey showed that 47% of the respondents already own digital assets such as Bitcoin, and half of those who don’t are considering it. Also, about 75% expressed at least some interest in learning more about bitcoin annuities and bitcoin life insurance.

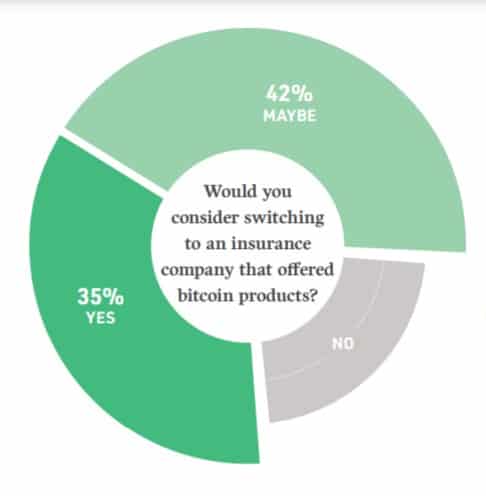

A third of the respondents said they would you consider switching to an insurance company that offered bitcoin products.

NYDIG has been maneuvering into the insurance space with MassMutual’s investment being just one aspect. Earlier this year, the company brought on Matt Carey to focus on “bitcoin-powered solutions for US-based life insurance and annuity providers,” according to the company. Carey was co-founder and CEO of Blueprint Income, an online annuity marketplace acquired by MassMutual from Stone Ridge, which owns NYDIG.

Also earlier this year, New York Life CEO Ted Mathas joined NYDIG’s board of directors. The carrier also has digital asset investments but has not revealed how much.

The company has the property and casualty side covered with a recent appointment of Mike Sapnar, formerly CEO of TransRe, as Global Head of Insurance Solutions to accelerate “bitcoin-driven innovation in the global property and casualty industry.”

In April, NYDIG said it raised another $100 million in growth capital from strategic partners including property and casualty-focused insurers Starr Insurance, Liberty Mutual Insurance and other carriers.

NYDIG is pulling in some big players on the broker side as well, most notably with JP Morgan, whose CEO Jamie Dimon had been a high-profile skeptic of digital assets, according to CoinDesk. The firm began offering an in-house Bitcoin fund to its Private Bank clients last week.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Connecticut Releases Survey On Climate Risk In The Insurance Industry

An ‘Overnight Success’ That Took A Decade

Advisor News

- Help your clients navigate tax regulations

- CFP Board announces CEO leadership transition

- State Street study looks at why AUM in model portfolios is increasing

- Supreme Court to look at ERISA rules in upcoming Cornell case

- FPA announces passing of CEO, succession plan

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Tom Campbell: State Health Plan status quo not acceptable

- Enhanced ACA tax credits in the crosshairs in new Trump term

- Judge lifts deadline for federal workers to accept Trump buyout. How will it impact Arizona?

- Recent Findings from Eli Lilly and Company Highlight Research in Heart Disease (Prevalence of complications and comorbidities associated with obesity: a health insurance claims analysis): Heart Disorders and Diseases – Heart Disease

- UnitedHealth rebuts Justice Department allegations in $3.3B Amedisys deal

More Health/Employee Benefits NewsLife Insurance News

- Sapiens Releases its Latest Underwriting Solution with Innovative Automation and AI for Life & Annuities Insurers

- Overcoming ‘I need to think about it’ in life insurance sales

- 4Q24 Investor Presentation

- 10 reasons we must embrace the Northwestern Life Insurance building in Minneapolis

- AM Best Revises Outlooks to Stable for Lincoln National Corporation and Most of Its Subsidiaries

More Life Insurance News