Life sales surge 8.5% in second quarter, Wink reports

Life insurance sales for the second quarter topped $2.9 billion, up 8.5% compared to the previous quarter and up 2.6% compared to the same period last year, Wink, Inc. reports.

Strong sales of indexed life led the way, said Sheryl Moore, CEO of Wink and Moore Market Intelligence.

“Most of second quarter had a steadily-rising market, which lent well to sales of indexed life," Moore said. “It was the second-best quarter for sales of these index-linked products.”

All life sales include fixed universal life (UL), indexed UL, variable UL, whole life, and term life product sales.

Noteworthy highlights for all life sales in the second quarter included Pacific Life Companies ranking as No. 1 in overall sales for all life sales, with a market share of 5.6%. Transamerica Life’s Financial Foundation IUL II, an indexed universal life product, was the No. 1 selling product for all life sales, for all channels combined, for the quarter.

All universal life sales for the second quarter were over $1.1 billion, up 5.9% compared to the previous quarter and up 4.4% compared to the same period last year. All universal life sales include fixed UL, indexed UL, and variable UL product sales.

Noteworthy highlights for all universal life sales in the second quarter included Pacific Life Companies ranking as No. 1 in overall sales for all universal life sales, with a market share of 11.1%. Transamerica Life’s Financial Foundation IUL II, an indexed universal life product, was the No. 1 selling product for all universal life sales, for all channels combined, for the quarter.

Non-variable universal life sales for the second quarter were $897.5 million, up 5.8% compared to the previous quarter and up 5.9% compared to the same period last year. Non-variable universal life sales include both fixed UL and indexed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the second quarter included National Life Group retaining the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 14.5%. Transamerica Life’s Financial Foundation IUL II, an indexed universal life product, was the No. 1 selling product for non-variable universal life sales, for all channels combined, for the quarter.

Fixed universal life sales for the second quarter were $69.8 million, down 12.7% compared to the previous quarter and down 30.5% compared to the same period last year.

Items of interest in the fixed UL market included Nationwide retaining its No. 1 ranking in fixed universal life sales, with a 20.3% market share; Prudential, Pacific Life Companies, John Hancock, and Thrivent Financial completed the top five, respectively.

Nationwide’s Nationwide CareMatters II was the No. 1 selling fixed universal life insurance product, for all channels combined, for the third consecutive quarter. The top primary pricing objective of no lapse guarantee captured 36.9% of sales. The average fixed UL target premium for the quarter was $7,742, an increase of nearly 15% from the prior quarter.

Indexed life sales for the second quarter were $829.7 million, up 7.7% compared with the previous quarter, and up 11% compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

Items of interest in the indexed life market included National Life Group keeping its No. 1 ranking in indexed life sales, with a 15.6% market share; Transamerica, Pacific Life Companies, Nationwide, and John Hancock rounded out the top five, respectively.

Transamerica Life’s Financial Foundation IUL II was the No. 1 selling indexed life insurance product, for all channels combined, for the second consecutive quarter. The top primary pricing objective for sales in the quarter was Cash Accumulation, capturing 73.3% of sales. The average indexed life target premium for the quarter was $12,917, an increase of more than 8% from the prior quarter.

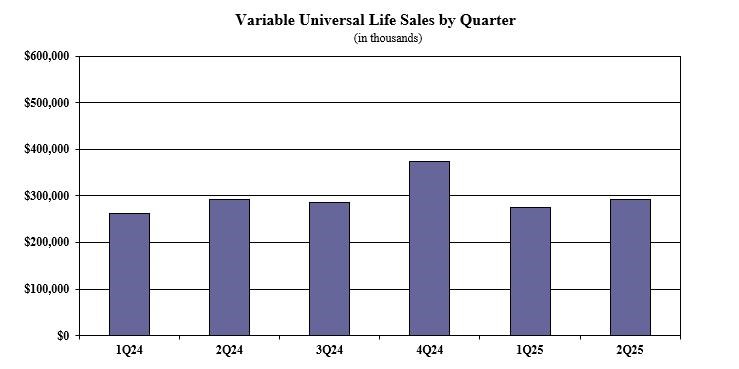

Variable universal life sales for the second quarter were $292.2 million; up 6.4% compared with the previous quarter and up 0.2% compared to the same period last year.

Items of interest in the variable universal life market included Prudential retaining the No. 1 ranking in variable universal life sales, with a 28.9% market share; Pacific Life Companies, John Hancock, Nationwide, and RiverSource Life completed the top five, respectively.

Pruco Life’s VUL Protector was the No. 1 selling variable universal life product, for all channels combined for the sixth consecutive quarter. The top primary pricing objective for sales this quarter was cash accumulation, capturing 59.3% of sales. The average variable universal life target premium for the quarter was $27,661, an increase of nearly 14% from the prior quarter.

"Like indexed life, the market’s performance supported increasing sales of VUL," Moore said. "We are anticipating an increase in sales for third quarter as well."

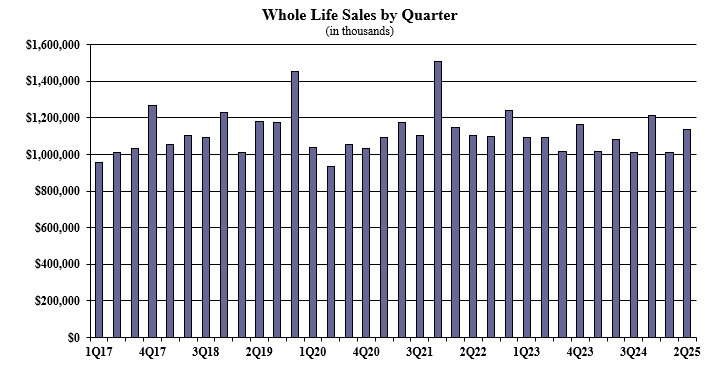

Whole life second quarter sales were $1.1 billion, up 11.9% compared with the previous quarter, and up 4.8% compared to the same period last year.

Items of interest in the whole life market included the top primary pricing objective of final expense, capturing 76.5% of sales. The average premium per whole life policy for the quarter was $5,086, an increase of more than 7% from the prior quarter.

Term life second quarter sales were $622.9 million, up 7.7% compared with the previous quarter and down 4.3% compared to the same period last year.

Items of interest in the term life market included Prudential ranking as No. 1 in term life sales, with a 5.9% market share. Pacific Life Companies, Protective Life Companies, Corebridge Financial and National Life Group completed the top five, respectively.

Pruco Life’s Term Essential 10 was the No. 1 selling term life insurance product, for all channels combined, for the quarter. The average annual term life premium per policy reported for the quarter was $2,498, an increase of more than 17% from the previous quarter.

Wink now reports sales on all annuity lines of business, as well as all life insurance product lines, Moore noted.

Retirees fear tariffs, inflation costs will outpace Social Security benefits

HHS appeals ruling that stalls major Obamacare marketplace changes

Advisor News

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

- Todd Buchanan named president of AmeriLife Wealth

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Husted took thousands from company that paid Ohio $88 million to settle Medicaid fraud allegations

- ACA subsidy expiration slams Central Pa. with more than 240% premium increases

- Kaiser affiliates will pay $556M to settle a lawsuit alleging Medicare fraudKaiser affiliates will pay $556M to settle a lawsuit alleging Medicare fraudKaiser Permanente affiliates will pay $556 million to settle a lawsuit that alleged the health care giant committed Medicare fraud and pressured doctors to list incorrect diagnoses on medical records to receive higher reimbursements

- Changes to NY's Essential Plan still pending

- CATHOLIC HEALTH ASSOCIATION'S STATEMENT ON THE ADMINISTRATION'S HEALTH PLAN

More Health/Employee Benefits NewsLife Insurance News