Life Insurers: COVID-19 Changing How Consumers Apply

Consumers are turning to online life insurance applications as a result of the ongoing COVID-19 pandemic, a new LIMRA survey found.

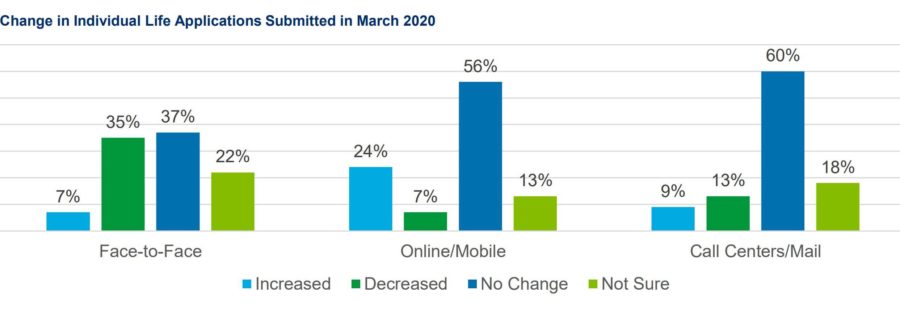

A third of companies reported a decline in face-to-face applications while a quarter reported an increase in online applications in March.

LIMRA surveyed 47 U.S. life insurers and 12 Canadian life insurers to learn what, if any, changes they were making due to the COVID-19 pandemic and the federal and state social distancing guidelines.

Based on the survey results, the most common response was that there was no significant change in overall applications in March. That said, there was a shift in how consumers applied for life insurance.

Twenty-four percent of U.S. companies that accept online/mobile applications experienced an increase, while half saw no change. The majority of companies saw no change in call center/mail applications during the month of March.

In Canada for the same month, the majority of life insurers reported a decline in face-to-face applications. Five in 10 companies that accept online/mobile applications experienced no change; 3 in 10 experienced increases. Of the 1 in 4 Canadian companies accepting applications through call centers/mail, none saw any significant change in applications.

Altering Practices

To make it easier for consumers to apply for a policy under these unusual circumstances, more than a quarter of U.S. life insurers have expanded their automated underwriting practices. One in five U.S. companies have postponed or waived paramedical requirements.

Some companies reported they have added questions on COVID-19 exposure and travel to the underwriting process, are now requiring good health statements, accepting electronic health records, and are allowing historical exam and lab data in place of an exam. A small percentage of carriers are implementing face amount and premium limits for new coverage.

In Canada, many companies have made—or are planning to make—changes to their underwriting practices. Most are waiving paramedical requirements for some cases, and half are postponing exams until they can be conducted.

Canadian life insurers are also extending grace periods, but few are providing other types of relief for customers that have been financially impacted by COVID-19. This may change as several companies say that they are still reviewing possible changes.

Insurers To Pay NY More Than $2M To Settle Annuity Sales Errors

COVID-19 Blamed For 2.2% Decline In March Life Insurance Activity

Advisor News

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

- Different generations are hopeful about their future, despite varied goals

- Geopolitical instability and risk raise fears of Black Swan scenarios

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Wellmark still worries over lowered projections of Iowa tax hike

- Families defend disability services amid health cuts

- RANDALL LEADS 43 DEMOCRATS IN DEMANDING ANSWERS FROM OPM OVER DECISION TO ELIMINATE COVERAGE FOR MEDICALLY NECESSARY TRANS HEALTH CARE

- Trump's Medicaid work mandate could kick thousands of homeless Californians off coverageTrump's Medicaid work mandate could kick thousands of homeless Californians off coverage

- Senator Alvord pushes back on constant cost increases of health insurance with full bipartisan support

More Health/Employee Benefits NewsLife Insurance News

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

More Life Insurance News