Insurers To Pay NY More Than $2M To Settle Annuity Sales Errors

Three insurers agreed to pay more than $2 million in restitution and penalties to New York for annuity replacement transactions that violate the state's new best-interest standard.

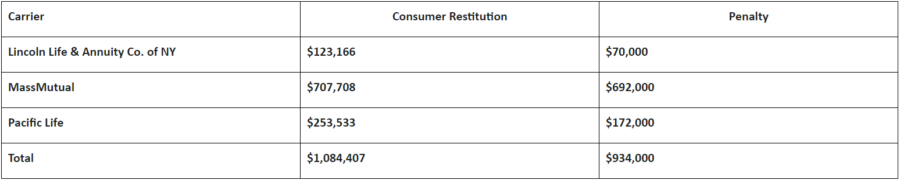

State Department of Financial Services Superintendent Linda A. Lacewell announced the three consent orders with Lincoln Life & Annuity Company of New York, MassMutual Life Insurance Company, and Pacific Life & Annuity Company. The insurers, collectively, will pay $1,084,407 in restitution to New York State consumers, plus $934,000 in penalties.

“The Department is committed to protecting the families of New York, especially our vulnerable seniors, from being misled as they seek a safe and stable retirement income,” Lacewell said. “Today’s settlements provide a measure of monetary restitution, especially important during the COVID-19 pandemic, and are a reminder that all New York’s life insurers must comply with DFS regulations and act in the consumer’s best interest.”

DFS' investigation found that the three carriers failed to properly disclose to consumers income comparisons and suitability information, causing consumers to exchange more financially favorable deferred annuities with immediate annuities, DFS said in a news release.

Many New York consumers received "incomplete information regarding the replacement annuities, resulting in less income for identical or substantially similar payout options," the department added.

DFS issued Regulation 187 in 2018 to ensure that recommendations related to life insurance and annuities "are in the best interest of the consumer and appropriately address the insurance needs and financial objectives of the consumer at the time of the transaction," the DFS said.

That regulation went into effect Aug. 1, 2019 for annuity sales and Feb. 1, 2020 for life insurance.

The recent settlements are the result of DFS’ ongoing industry-wide investigation into deferred to immediate annuity replacement practices in New York State, the department said. To date, the investigation has resulted in settlements with ten carriers, totaling $3,275,483 in restitution and $1,847,000 in penalties.

Below are the estimated consumer restitution and penalty amounts for each carrier:

As a result of the settlements, "many New York consumers will receive additional restitution going forward in the form of higher monthly payout amounts for the remainder of their contract terms," DFS said.

The consent order outlined five ways that the insurer and agents failed to adhere to the best-interest standard while selling Lincoln products:

- Lincoln failed to make reasonable efforts to obtain contract holders’ complete suitability information, which would have included information about existing assets, such as the amount of guaranteed income available if the existing deferred annuity contracts were annuitized, prior to the recommendation of a Replacement Contract;

- In some instances, Lincoln failed to properly consider whether proposed Replacement Contracts were suitable for consumers, including whether the consumers would lose existing benefits available through annuitization options in the existing deferred annuities;

- Lincoln issued Replacement Contracts to consumers without reasonable bases to believe the annuities at issue were suitable in some instances, and without providing consumers with the required Annuitization information for replaced deferred annuities;

- Lincoln did not establish a supervisory system reasonably designed to achieve compliance with Regulation 187; and

- Lincoln failed to ensure that every producer recommending Lincoln’s immediate annuities to consumers was adequately trained to make those recommendations.

The insurers have agreed to take corrective actions, including revising their disclosure statements to include side-by-side monthly income comparison information and revising their disclosure, suitability, and training procedures to comply with regulations, the release said.

Investigations into additional life insurance carriers licensed by the department remain ongoing, the release said.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

What COVID-19 Could Mean For The Insurance Sector

Life Insurers: COVID-19 Changing How Consumers Apply

Advisor News

- Bessent confirmed as Treasury secretary

Former hedge fund guru to oversee Trump's tax cuts, deregulation and trade changes

- Jackson National study: vast underestimate of health care, LTC costs for retirement

- EDITORIAL: Home insurance, tax increases harm county’s housing options

- Nationwide Financial Services President John Carter to retire at year end

- FINRA, FBI warn about generative AI and finances

More Advisor NewsAnnuity News

- MetLife Among the World’s Most Admired Companies by Fortune Magazine

- Aspida and WealthVest Announce a Suite of New and Enhanced Indices for Their WealthLock® Accumulator Product

- Brighthouse Financial Inc. (NASDAQ: BHF) Sees Notable Increase in Tuesday Morning Market Activity

- Hexure Integrates with DTCC’s Producer Authorization, Providing Real-Time Can-Sell Check within FireLight

- LIMRA: 2024 retail annuity sales set $432B record, but how does 2025 look?

More Annuity NewsHealth/Employee Benefits News

- Open house set at Rural Behavioral Health Clinic

- Taxing premiums would hurt everyone

Cathie Adams: Millions of Texans face higher costs for worse health insurance if Congress gets its way

- Cigna to ‘listen to the public narrative,’ promises pharmacy benefit reforms

- NC bill would limit insurers' prior authorizations

- Sermo Barometer Finds 78% of US Physicians Think Health Insurance Companies Have Too Much Influence Over Patient Care Plans; 52% Globally

More Health/Employee Benefits NewsLife Insurance News

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of Solidarity Bahrain B.S.C.

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of First Insurance Company

- AM Best Maintains Under Review With Developing Implications Status for Credit Ratings of Bahrain National Insurance Company B.S.C. (c)

- 2024 life insurance new premium tops $16B, sets new record, LIMRA says

- New York Life Announces Planned Leadership Transition within New York Life Real Estate Investors

More Life Insurance News